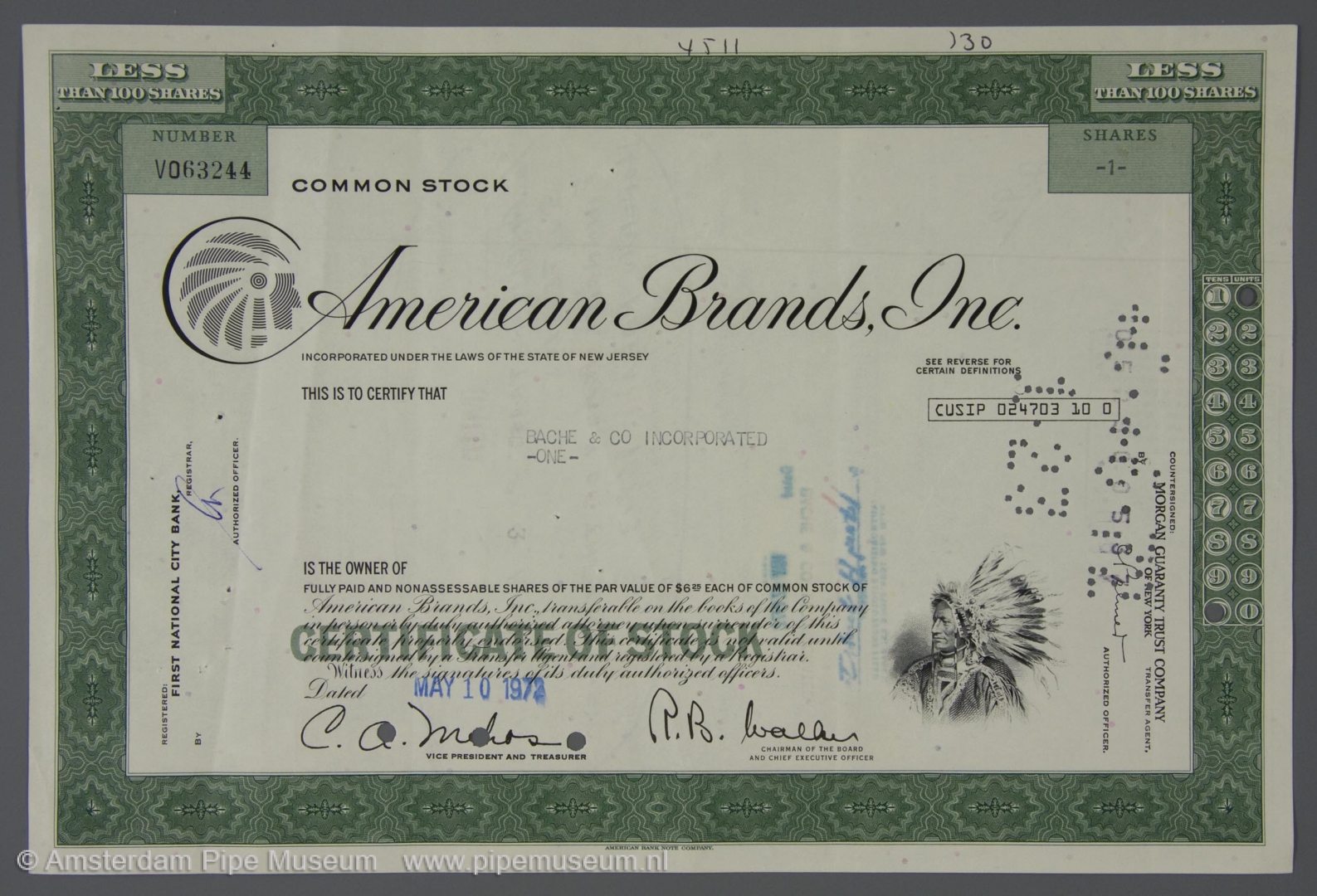

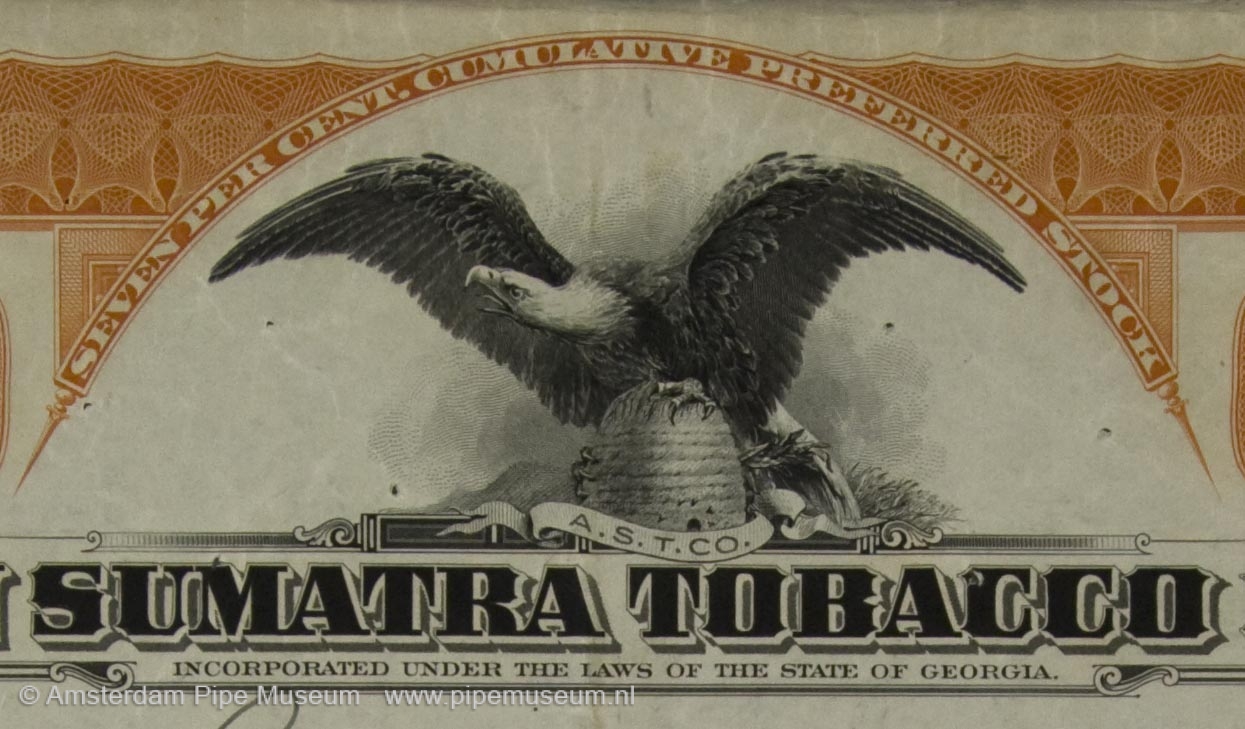

Stocks and bonds

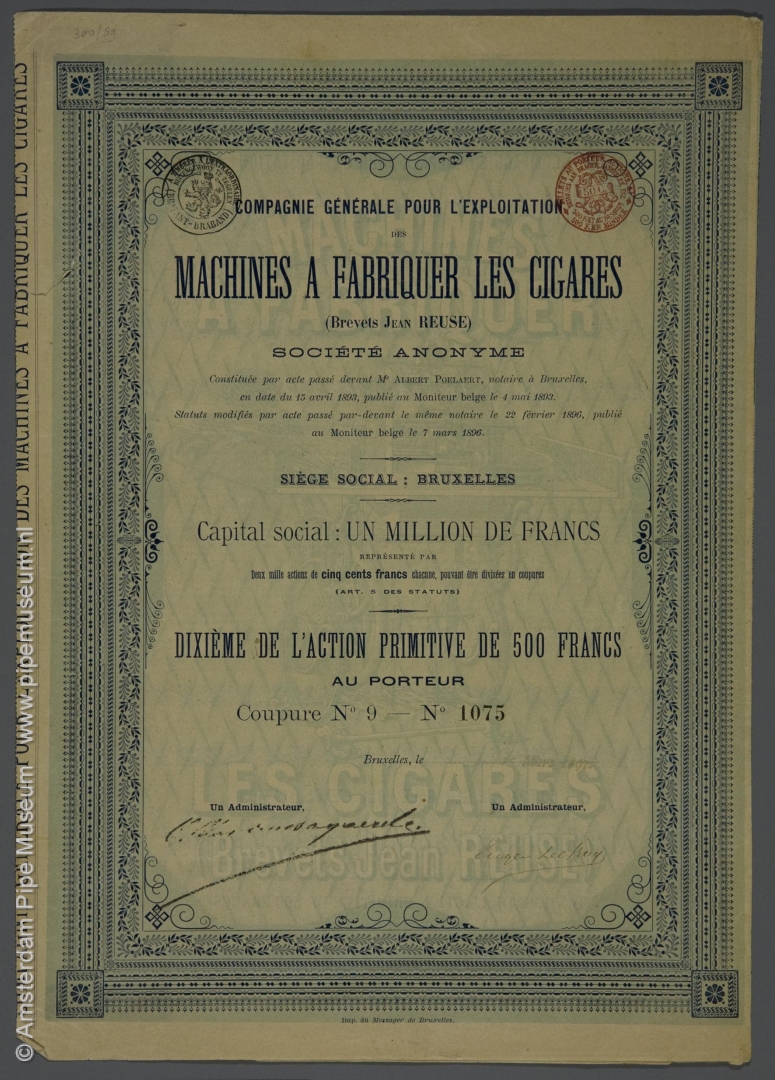

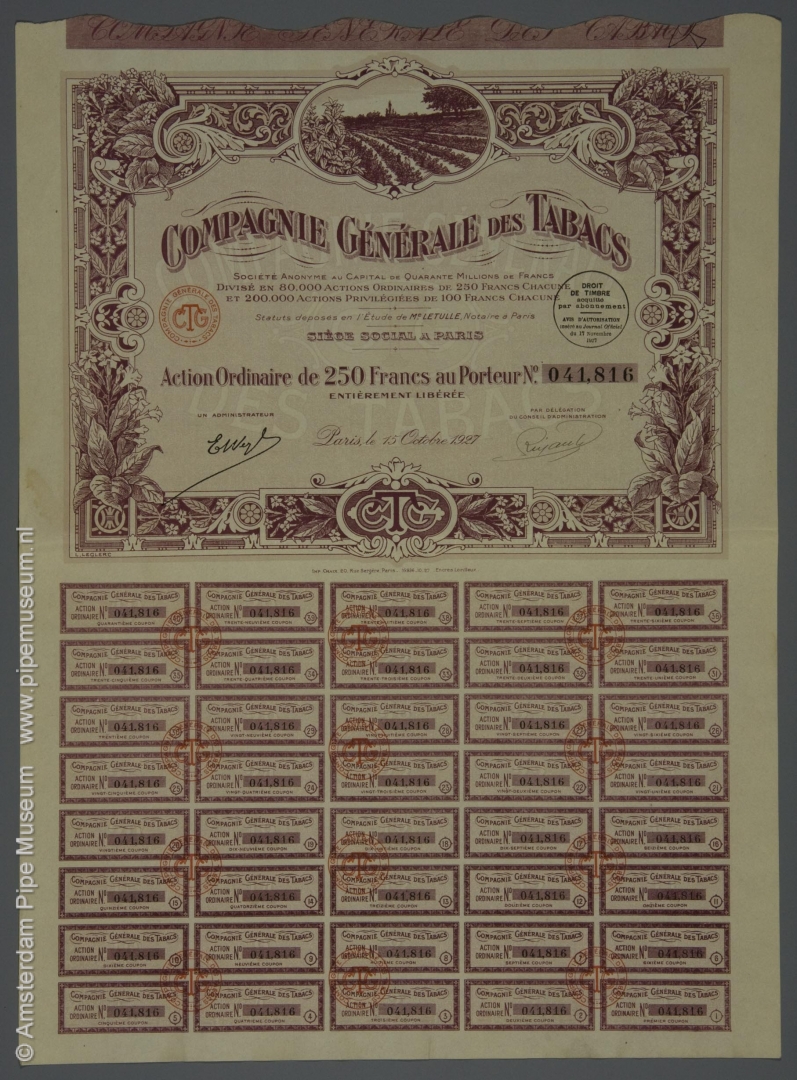

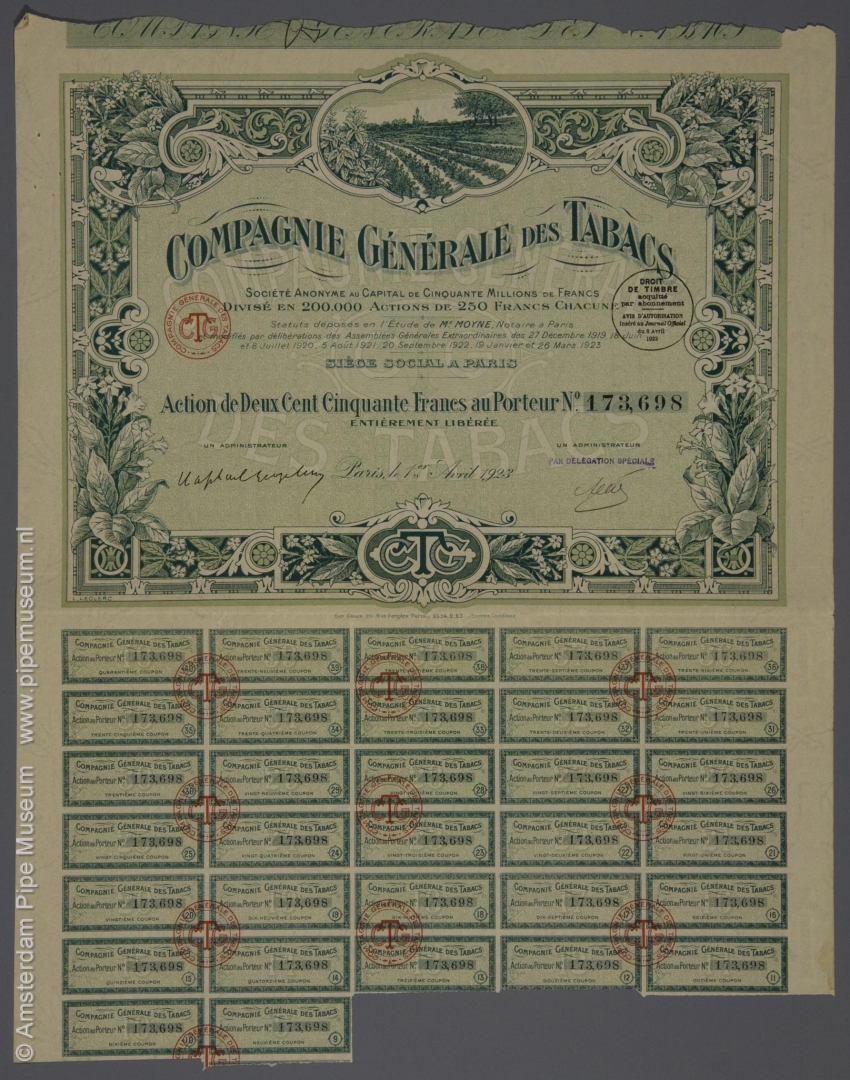

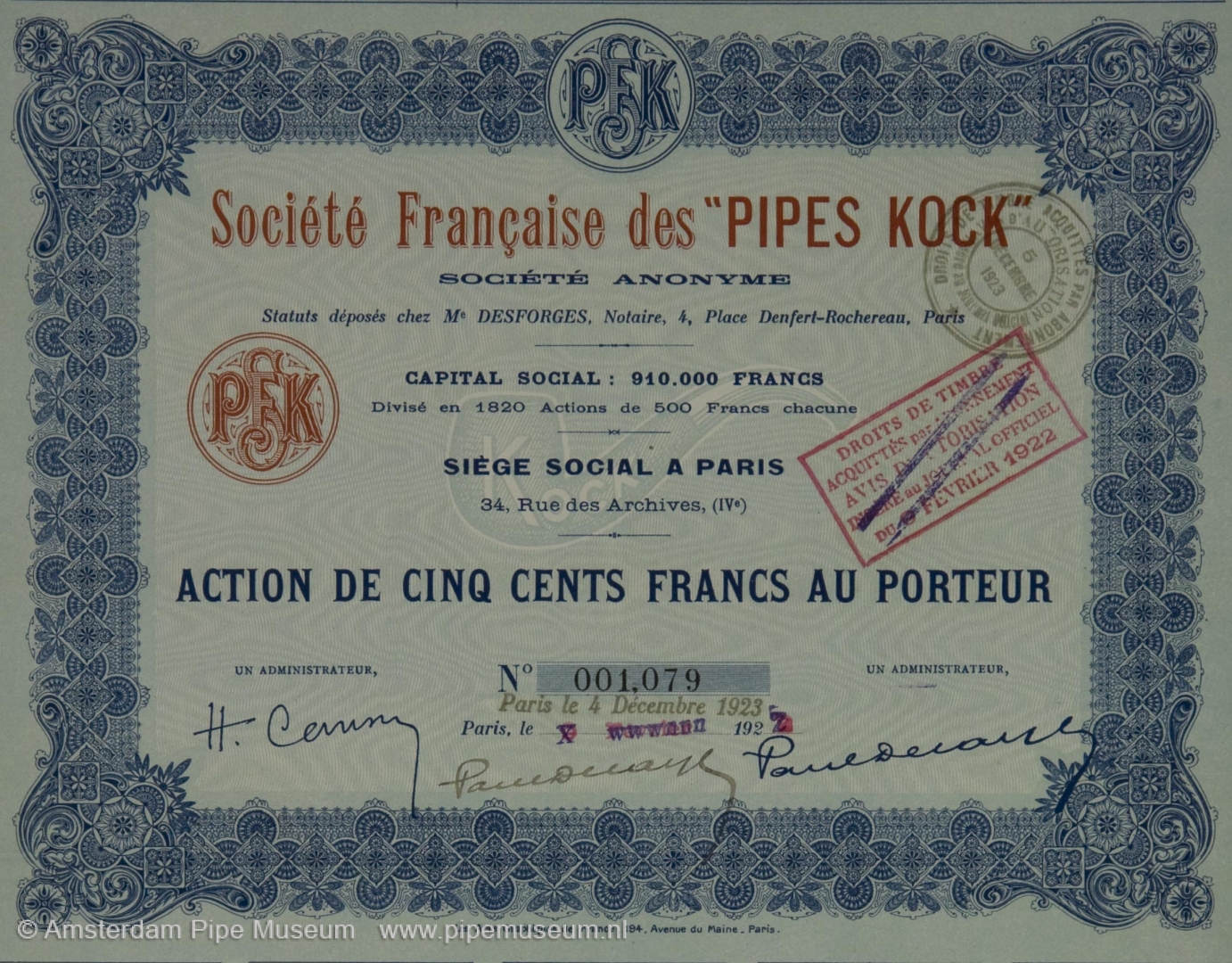

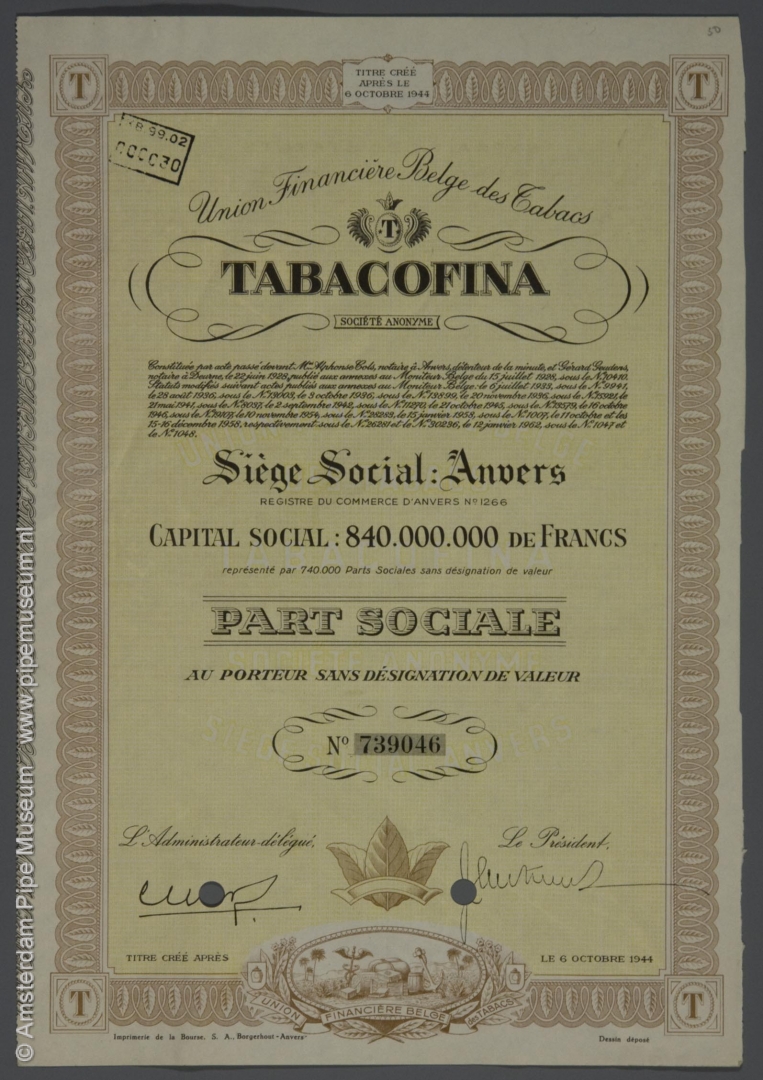

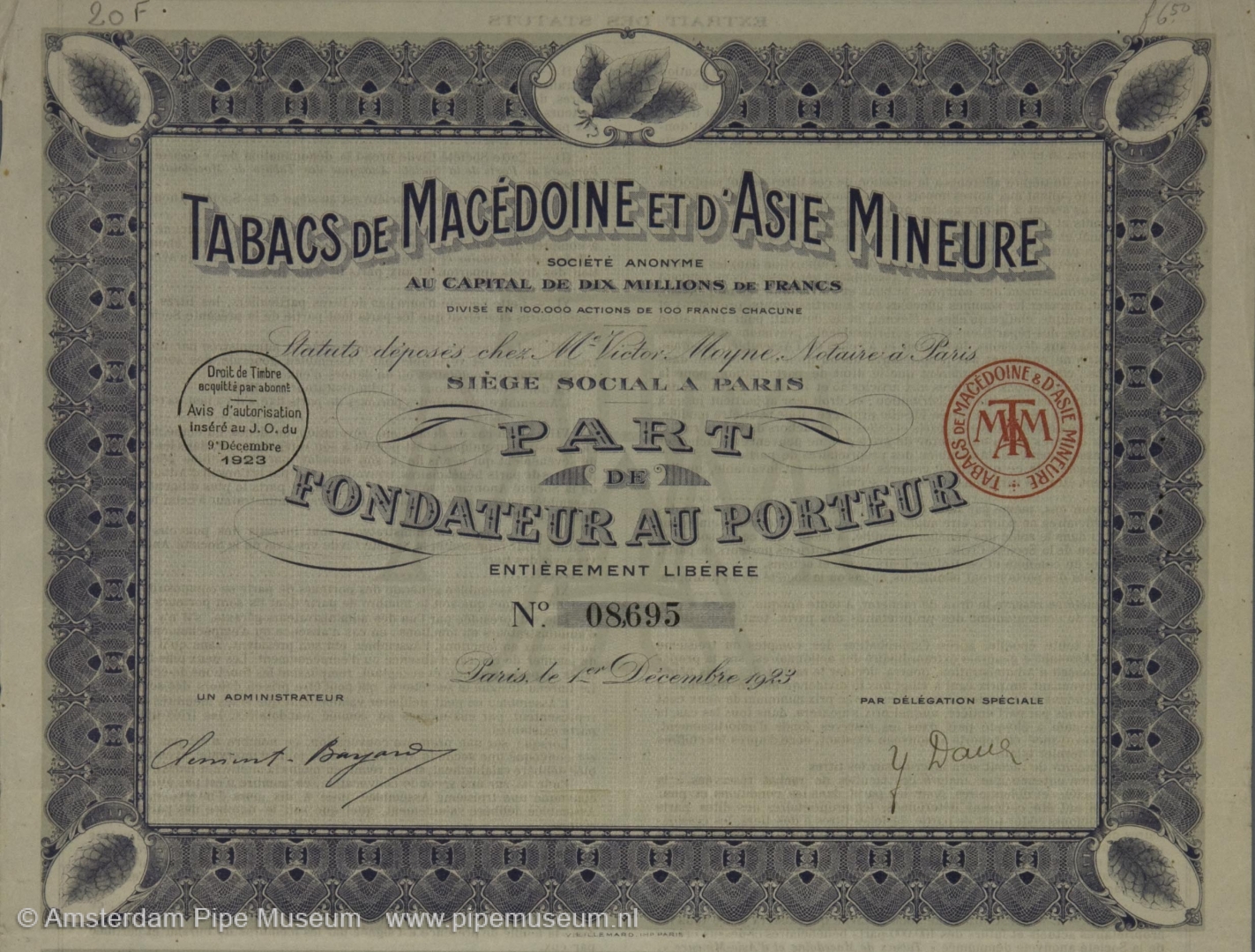

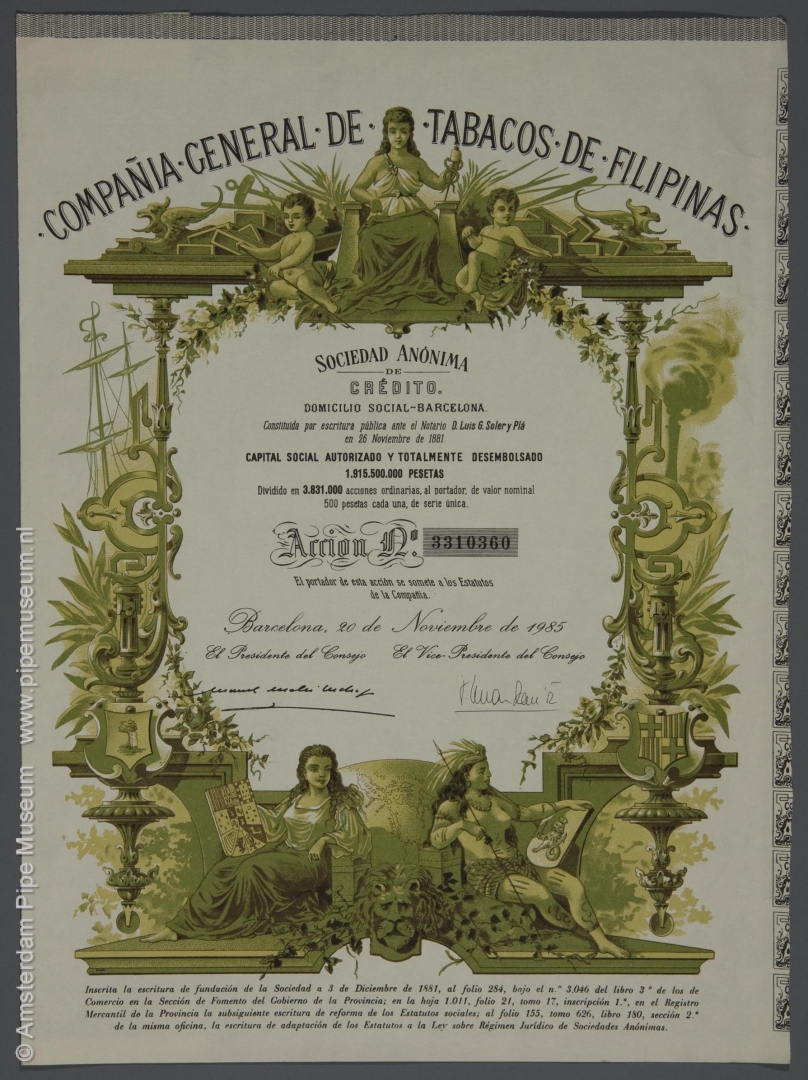

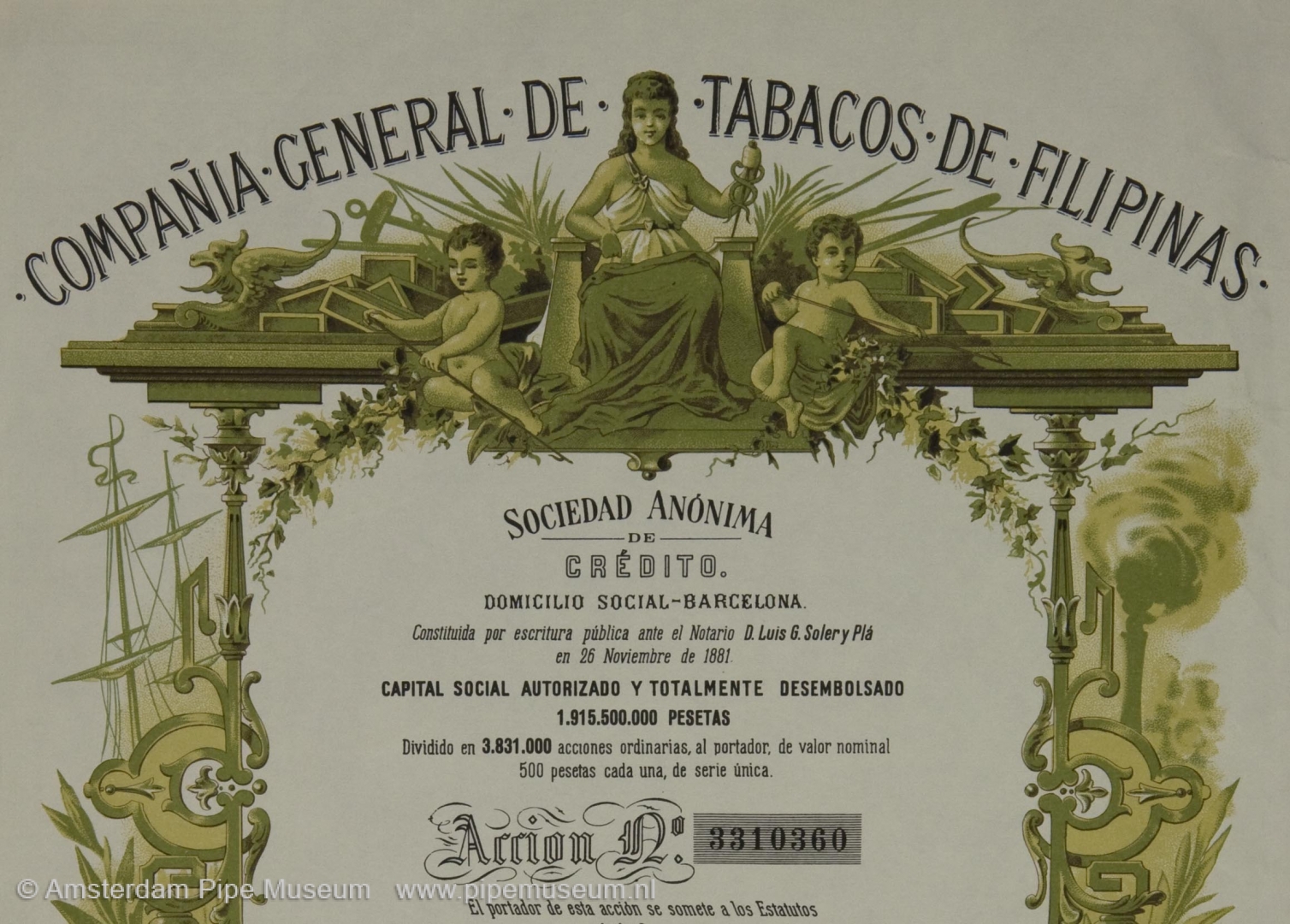

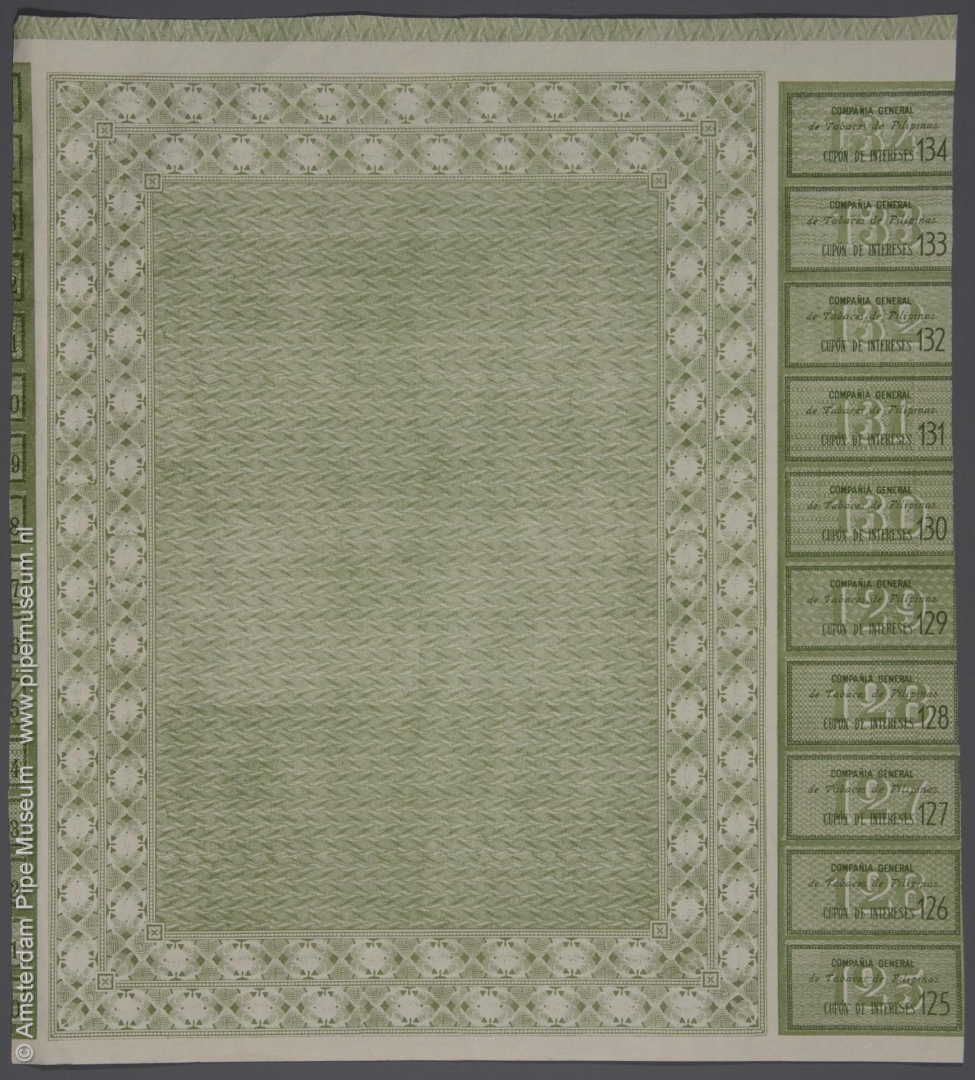

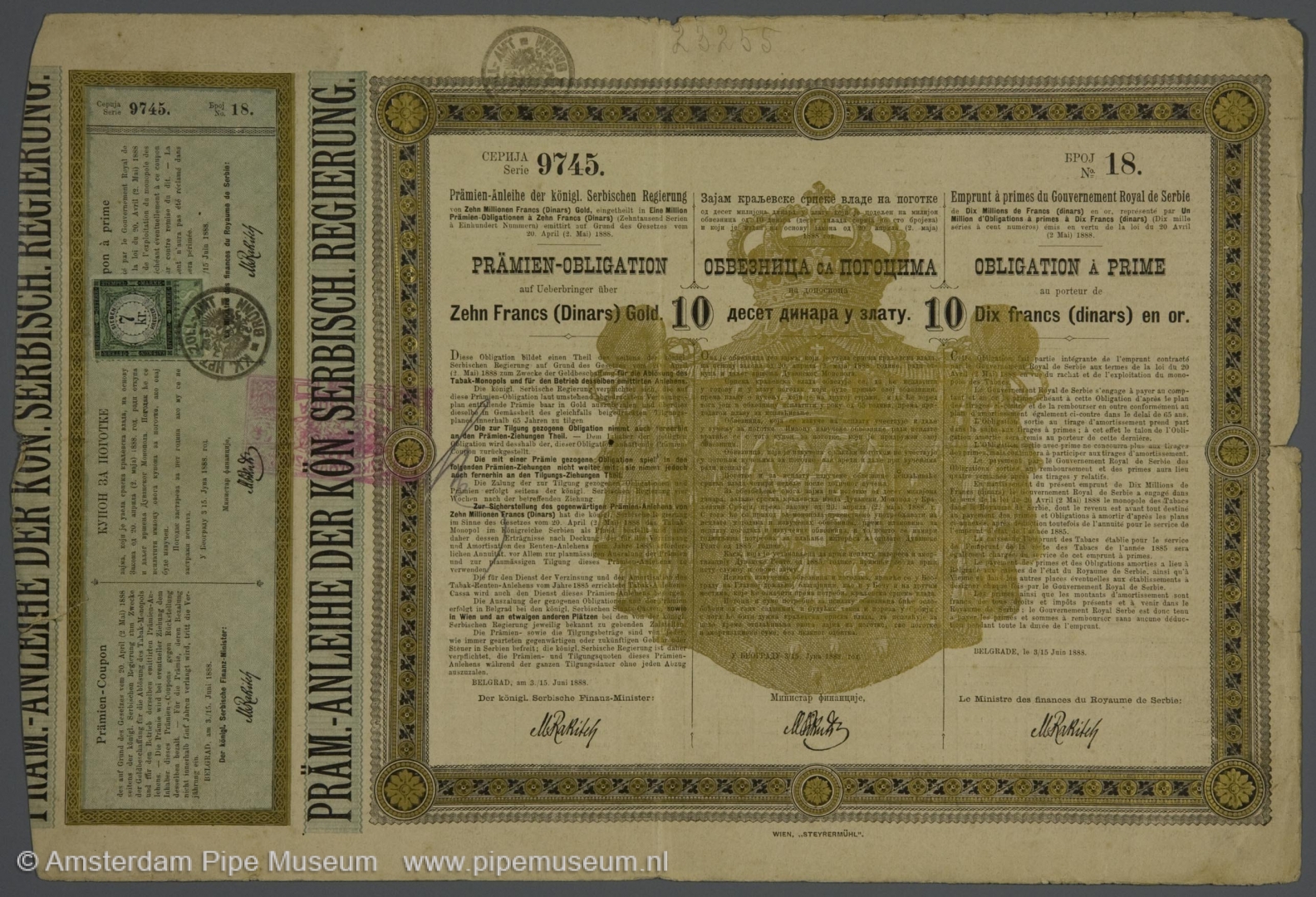

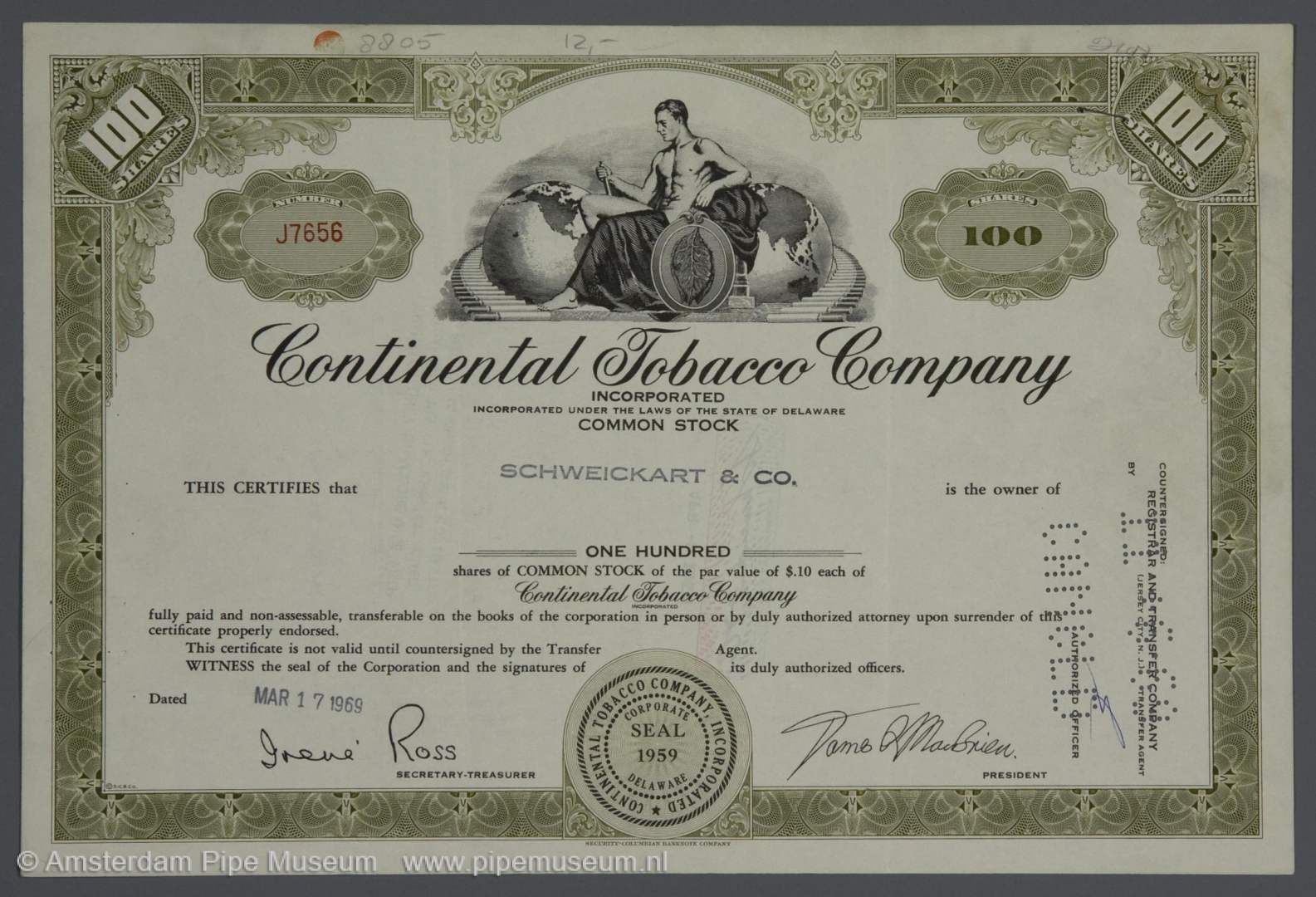

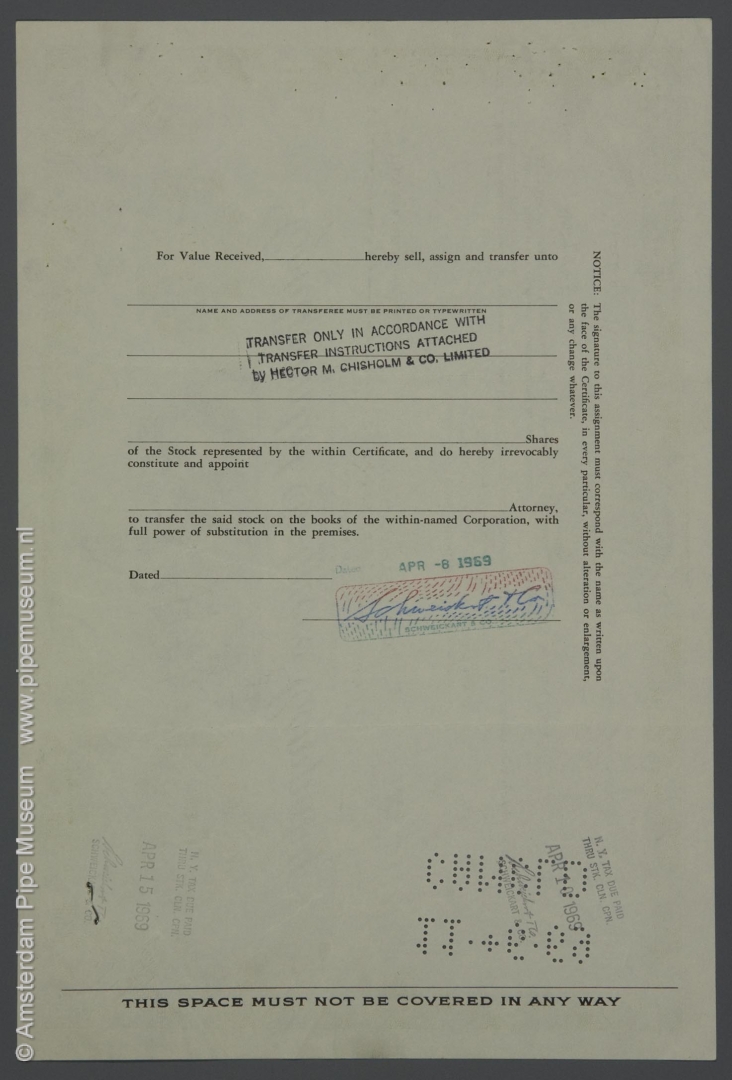

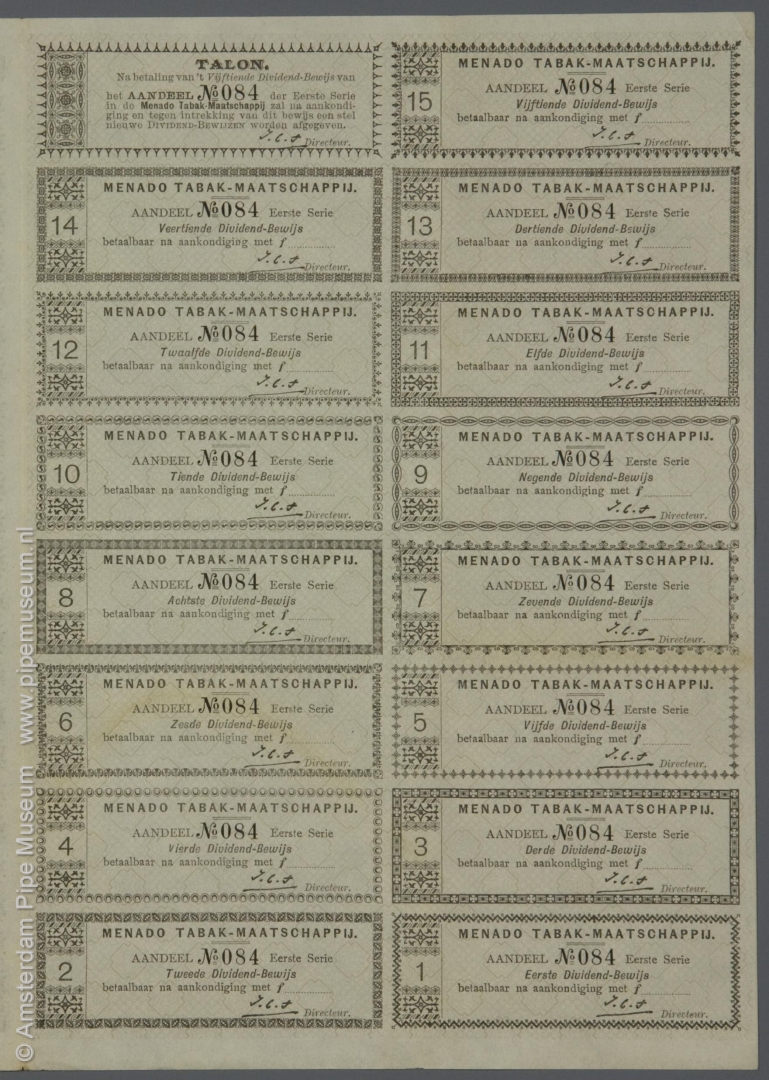

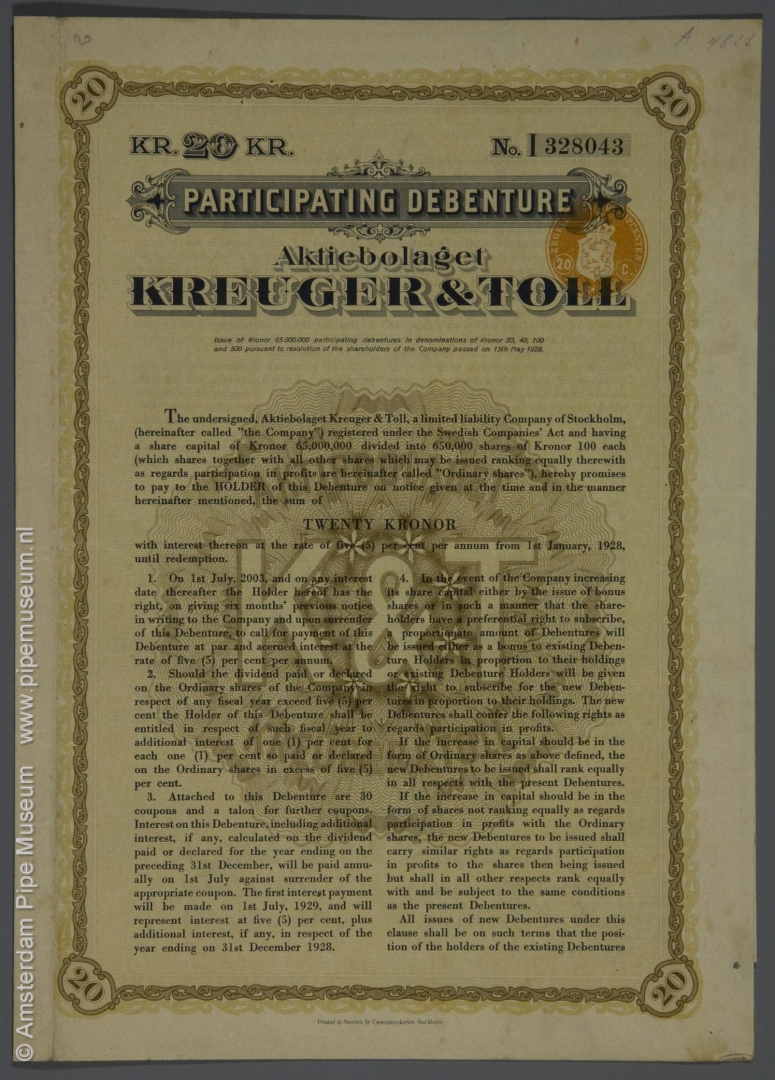

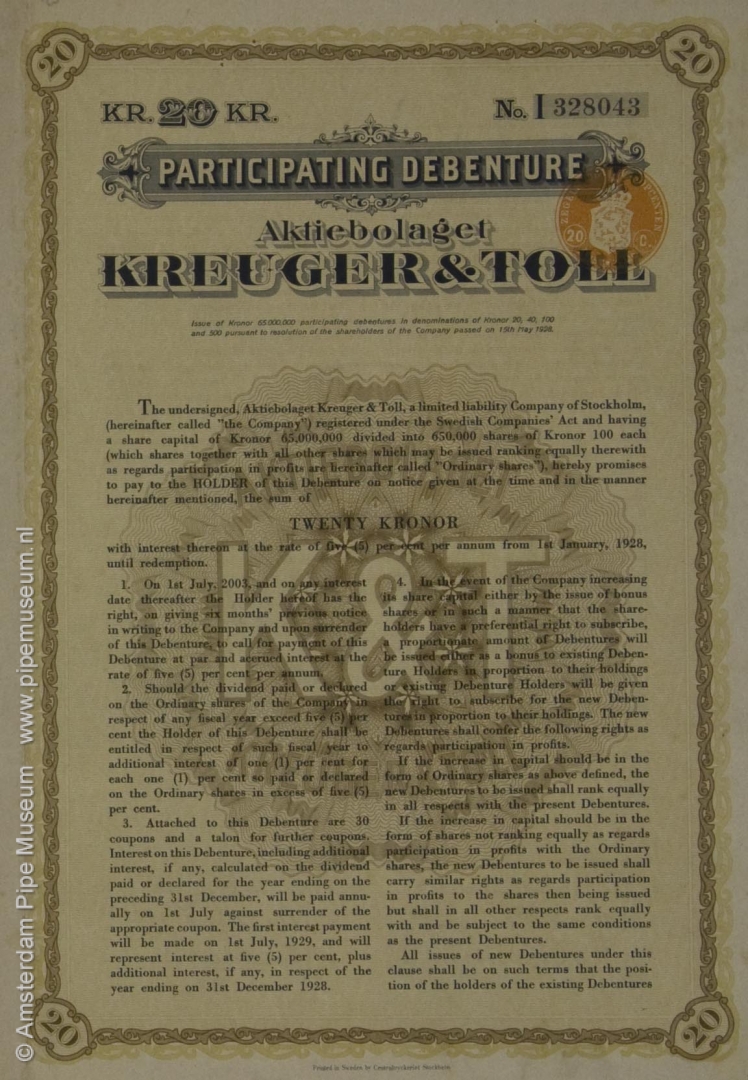

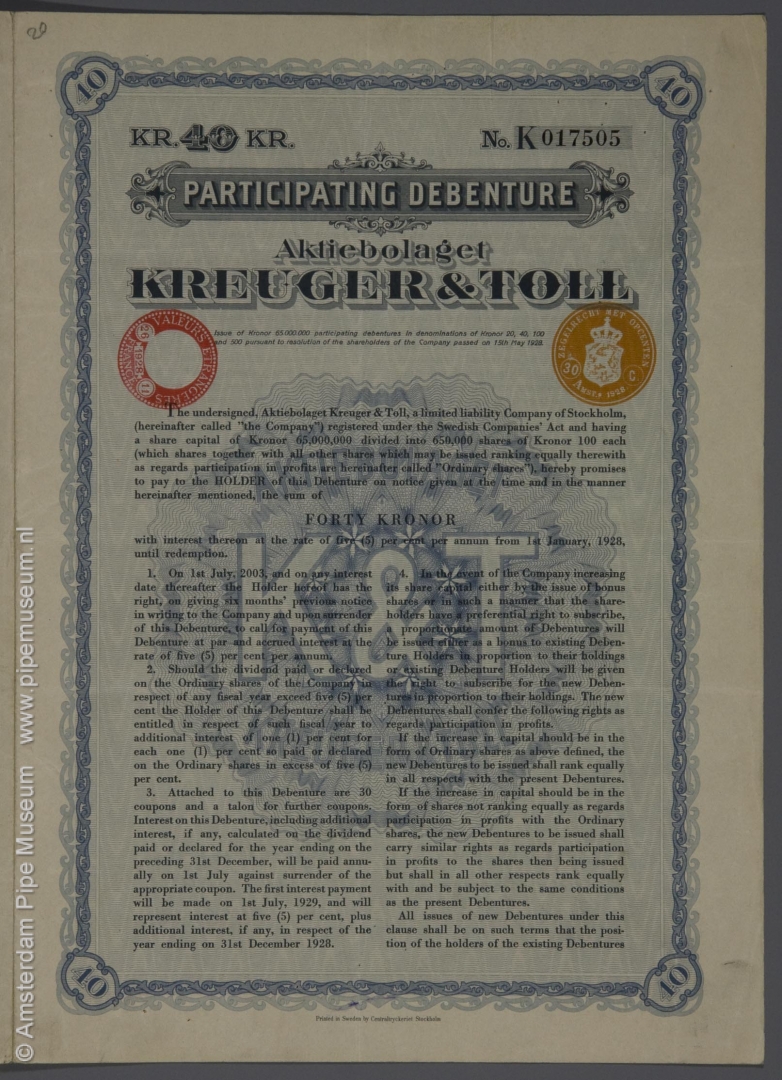

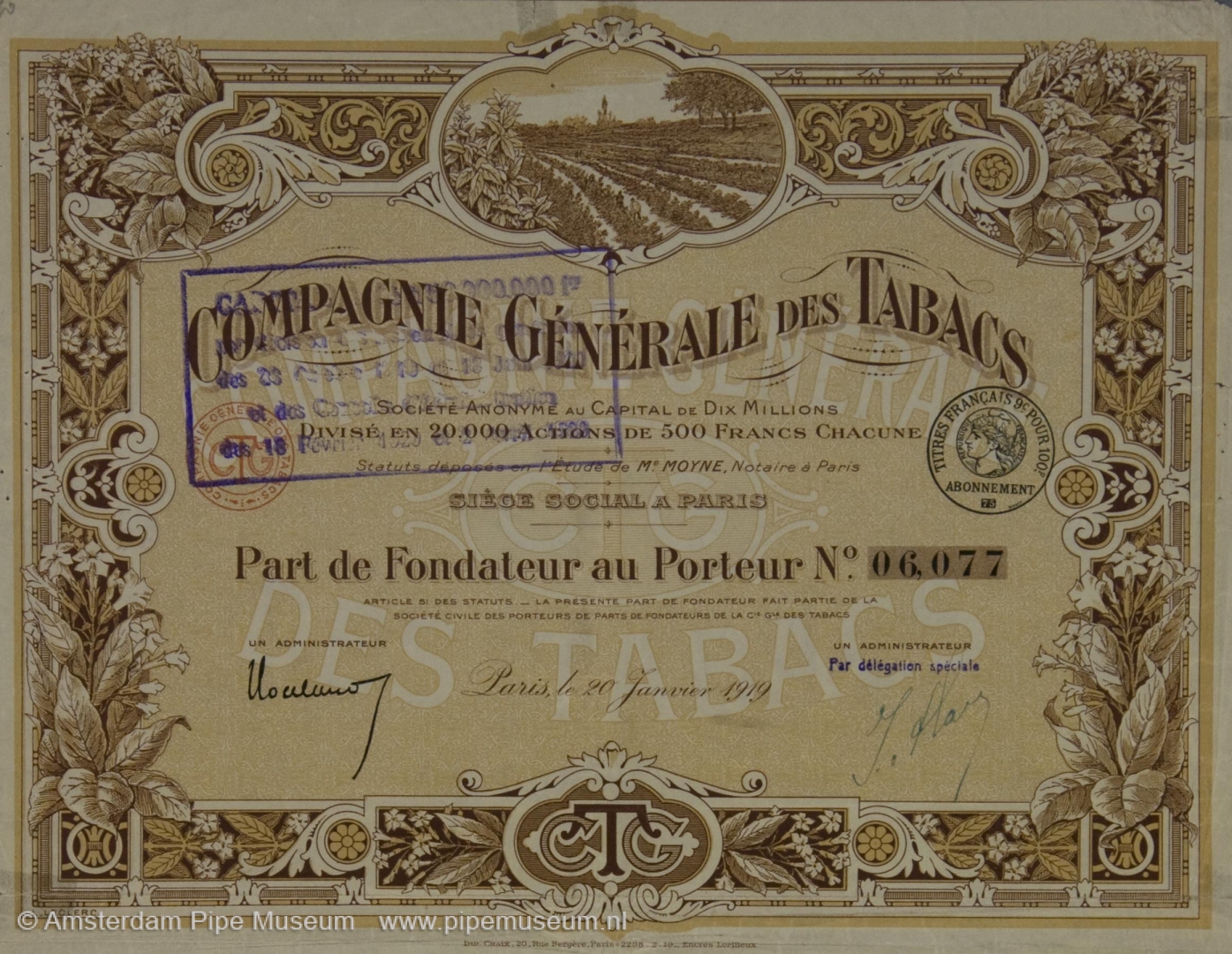

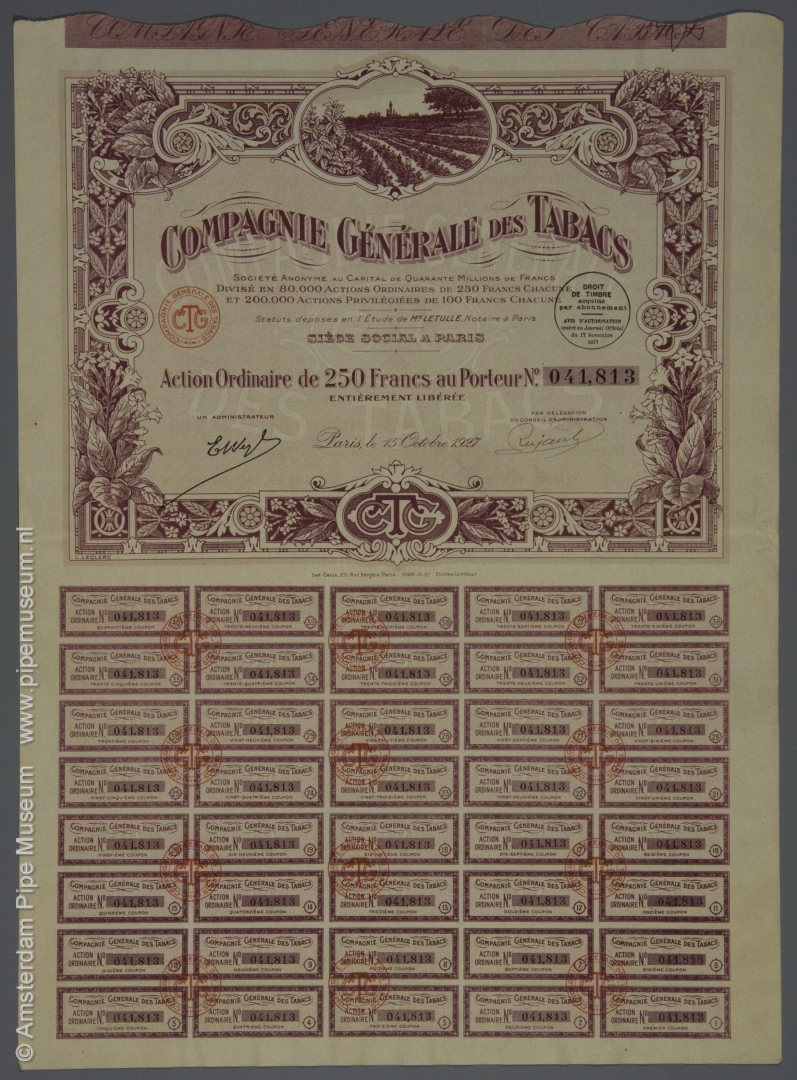

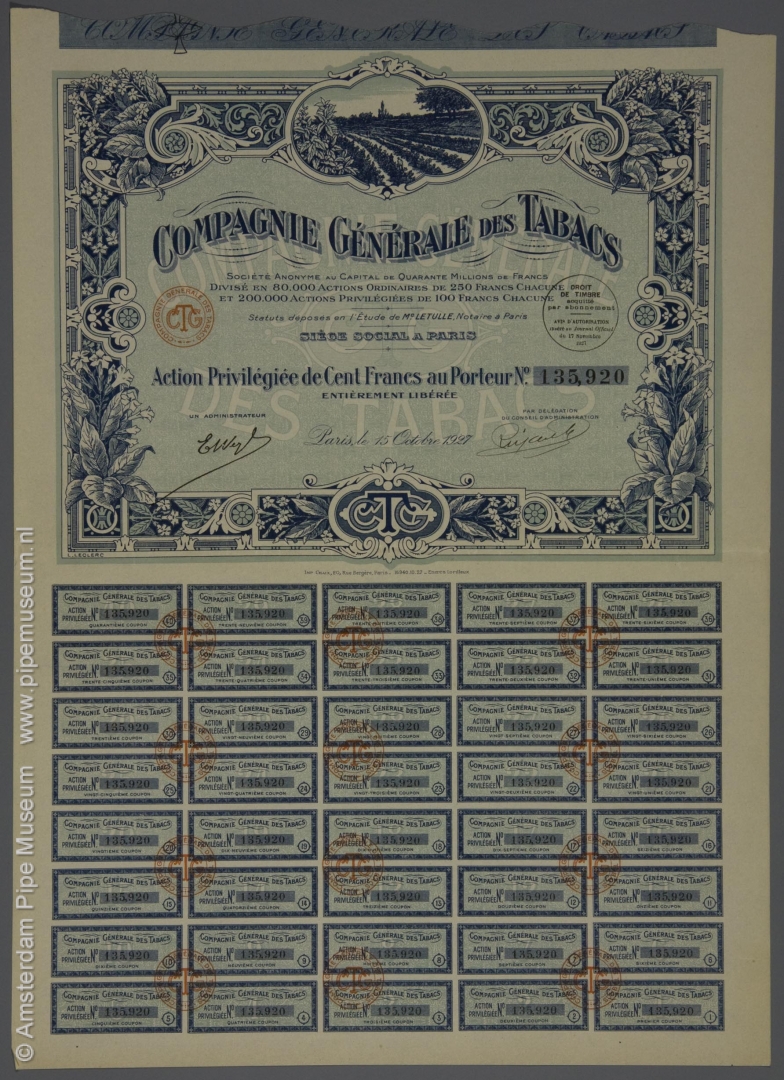

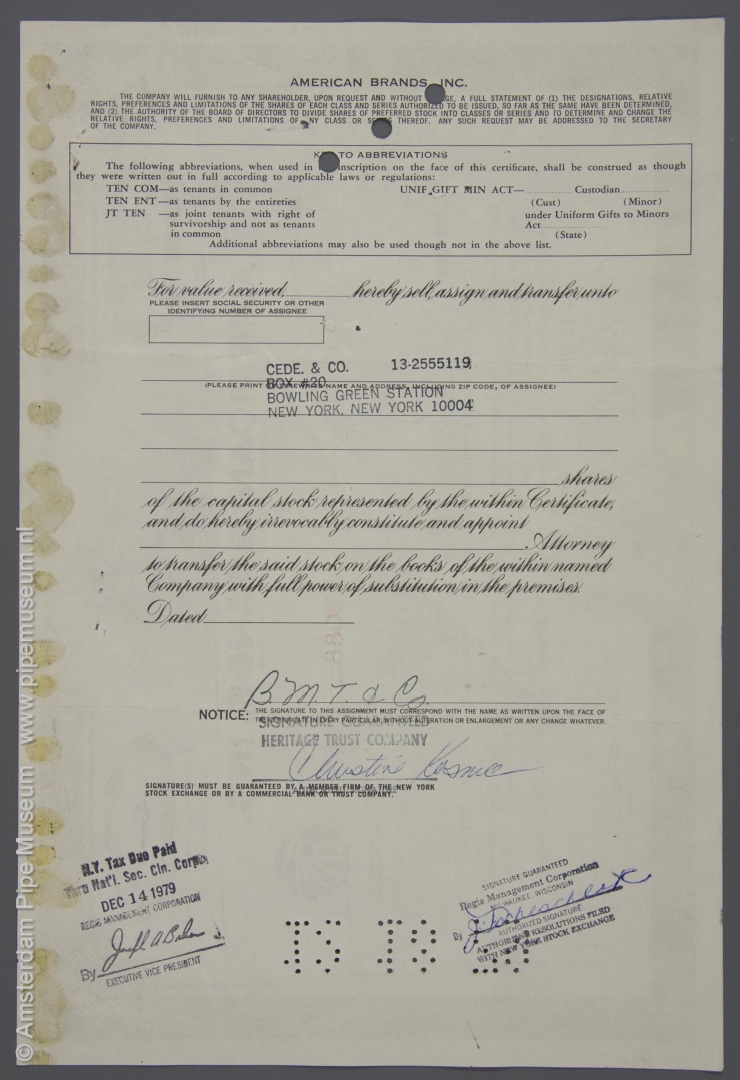

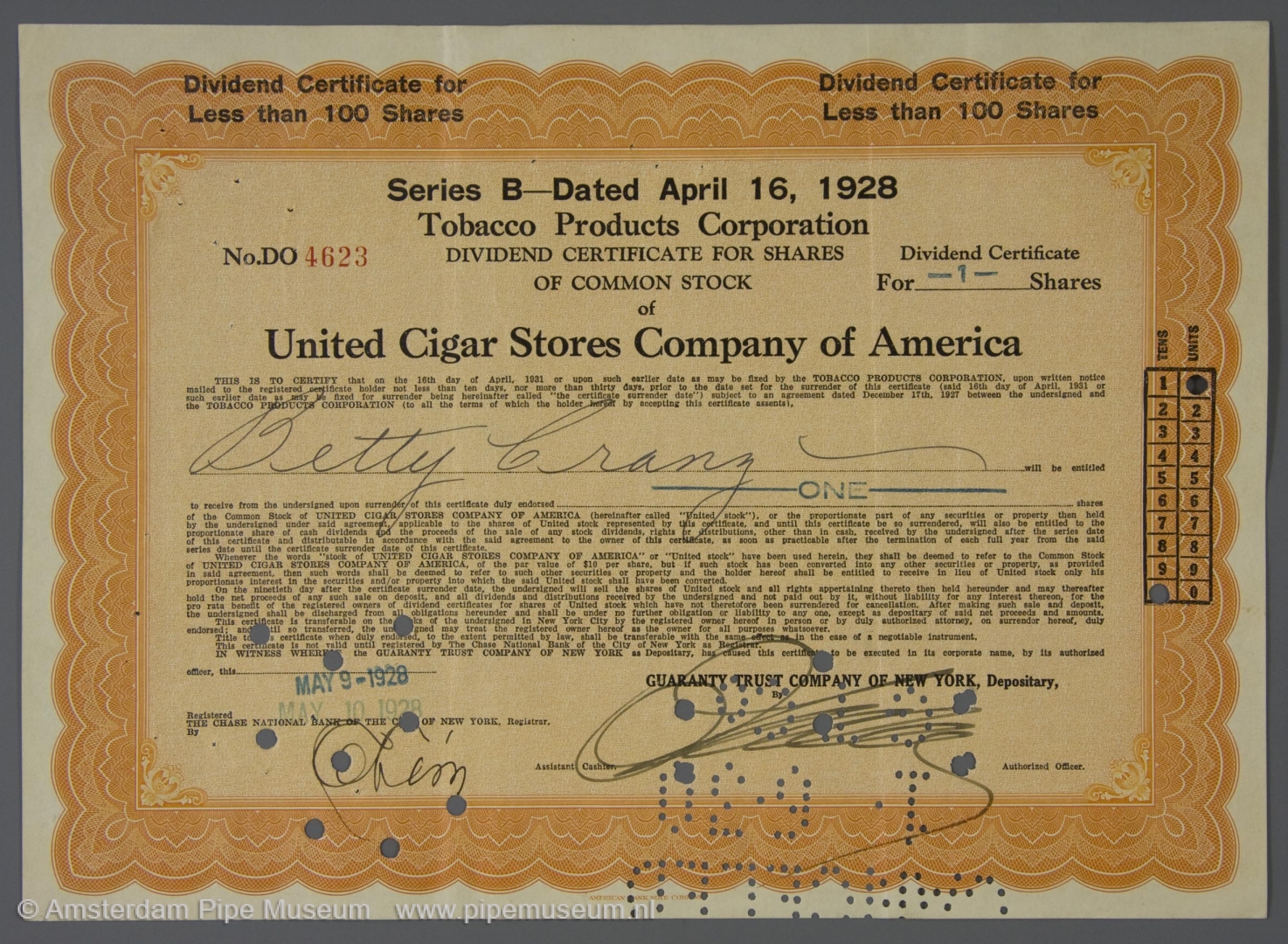

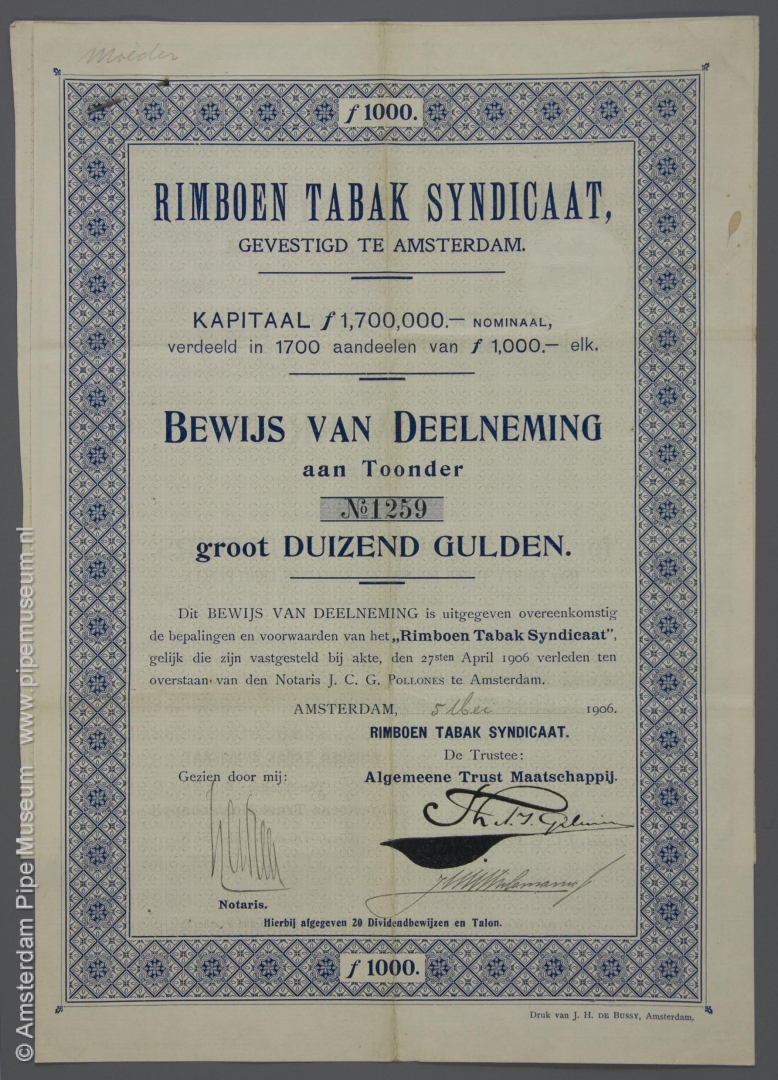

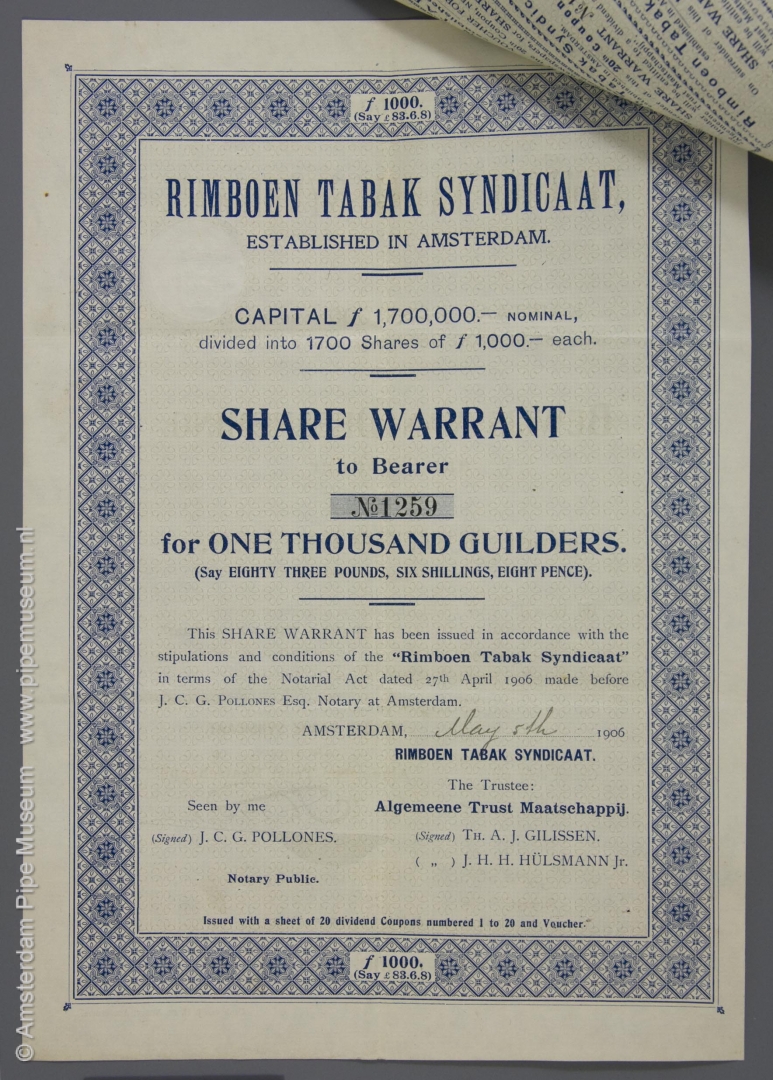

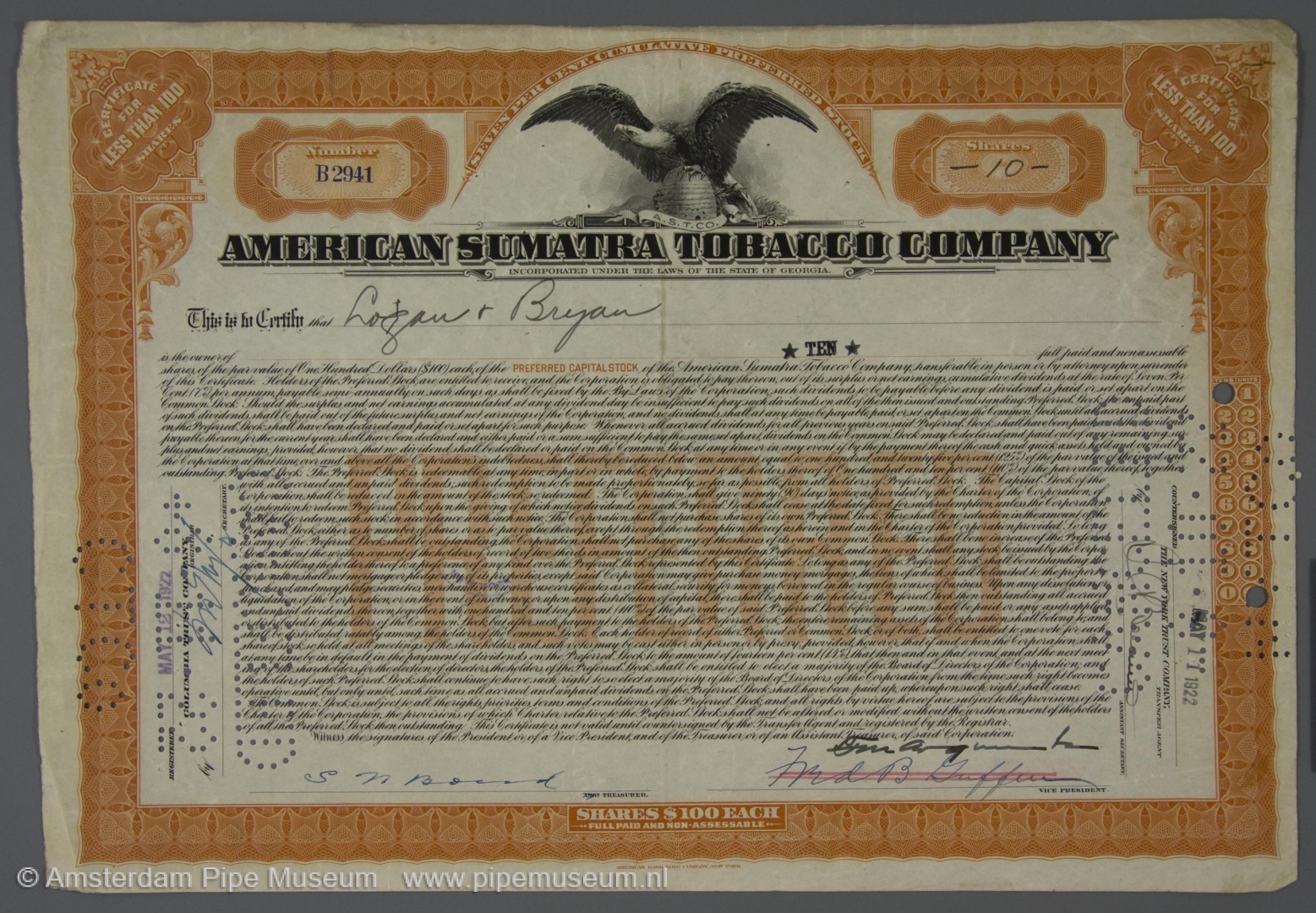

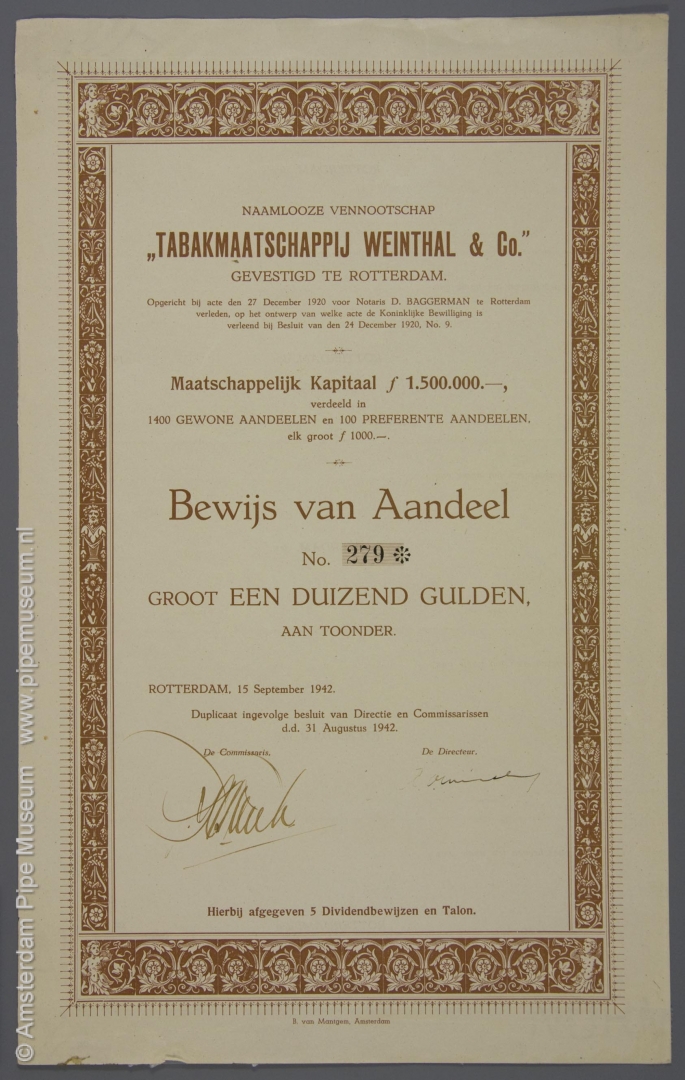

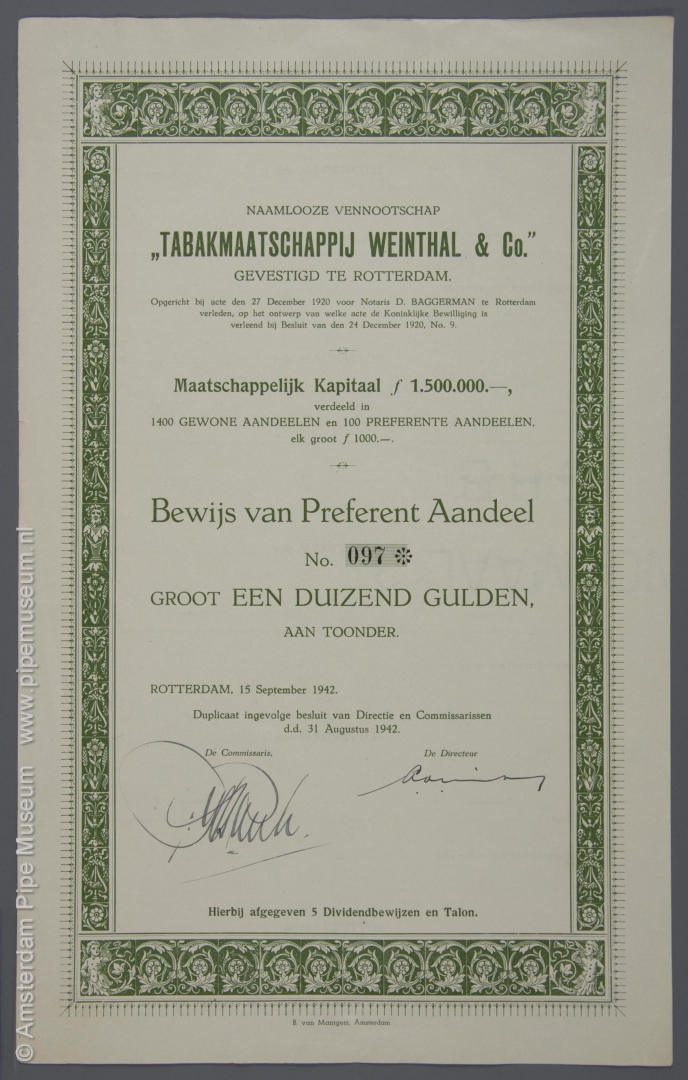

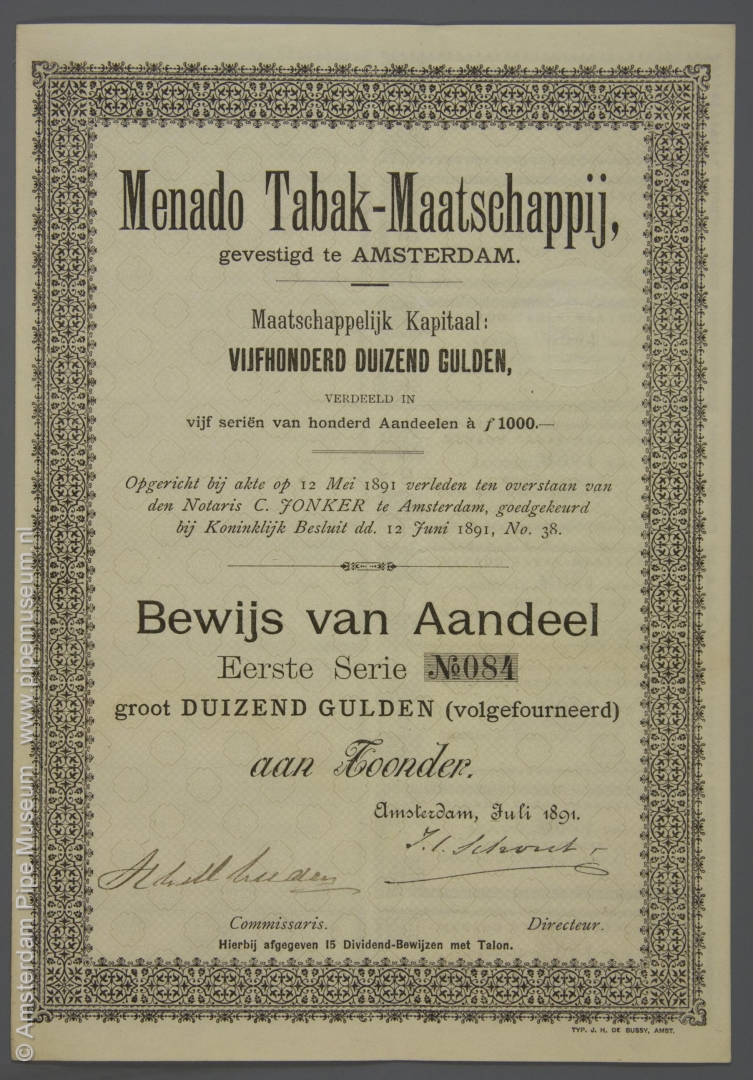

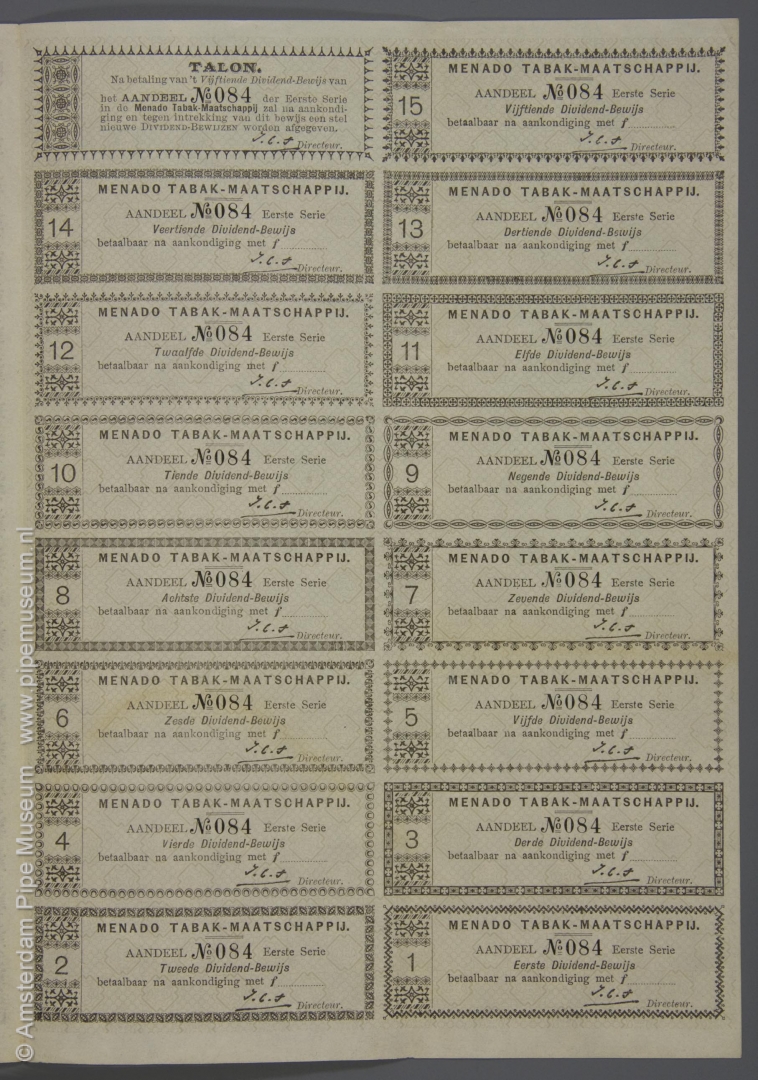

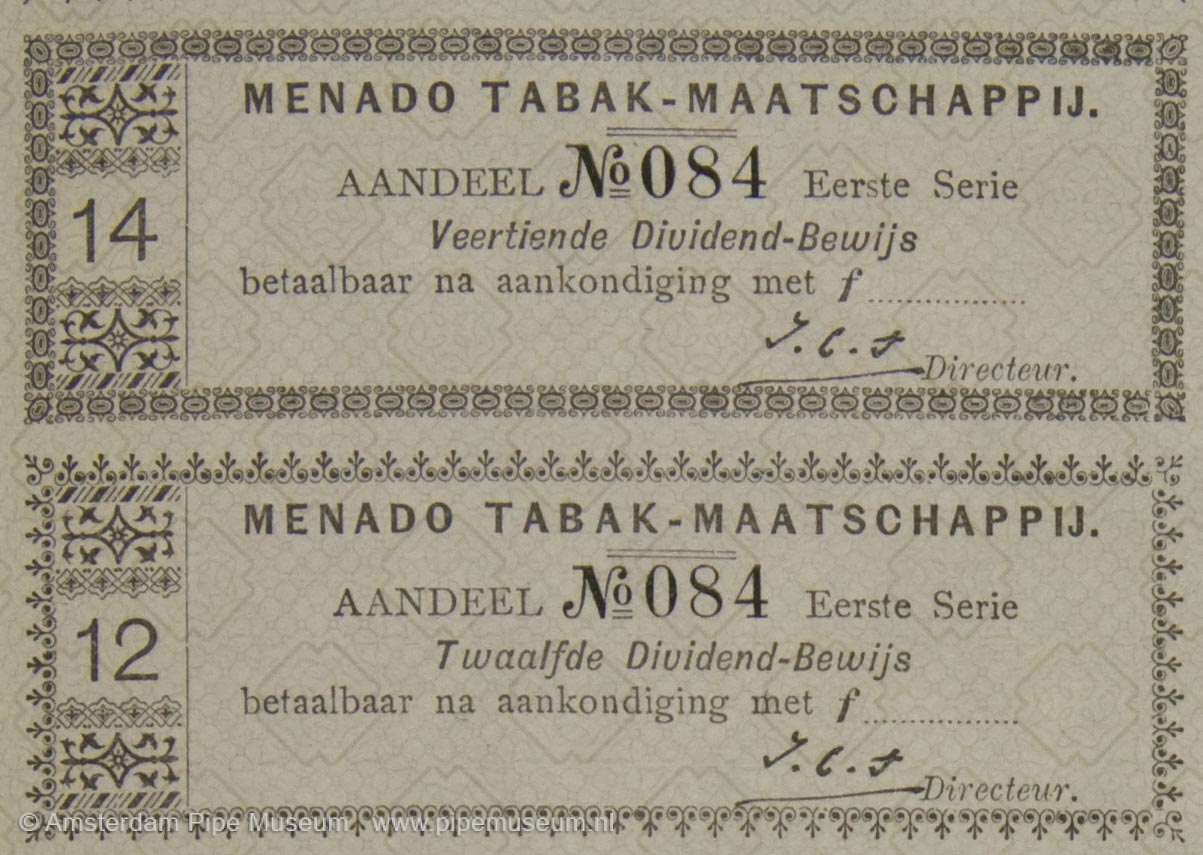

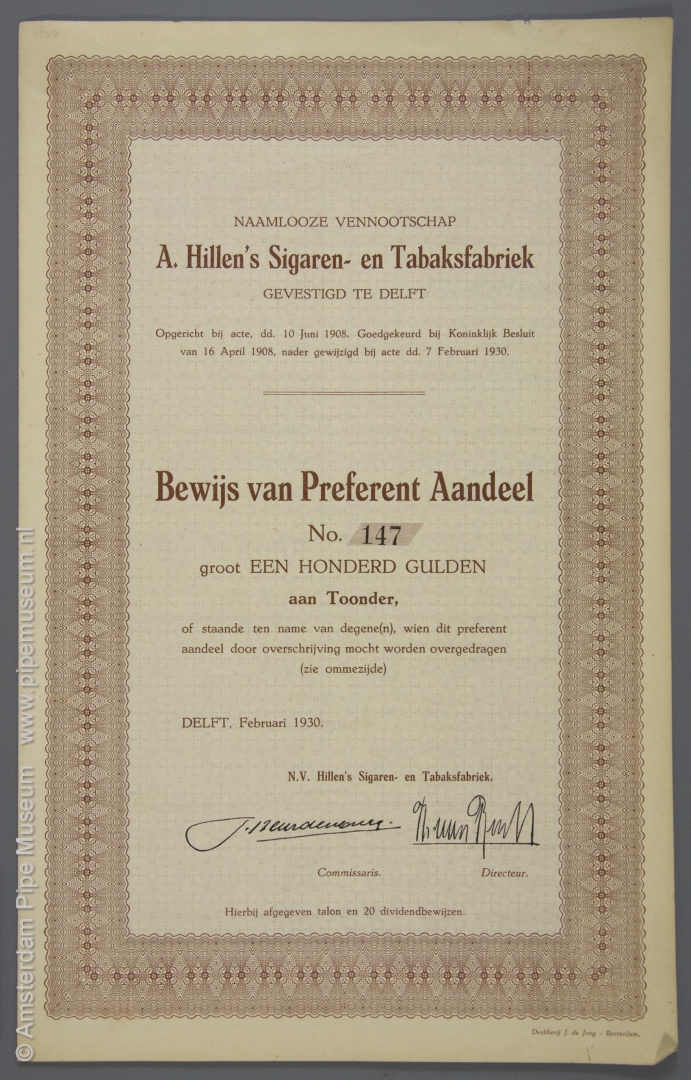

Until the mid-nineteenth century, tobacco factories were small businesses that processed tobacco on a limited scale. After 1850 these companies grow into real factories with dozens of workers. That is the time when capital is borrowed for investments with the issuance of shares or bonds as legal proof of participation for the investors.

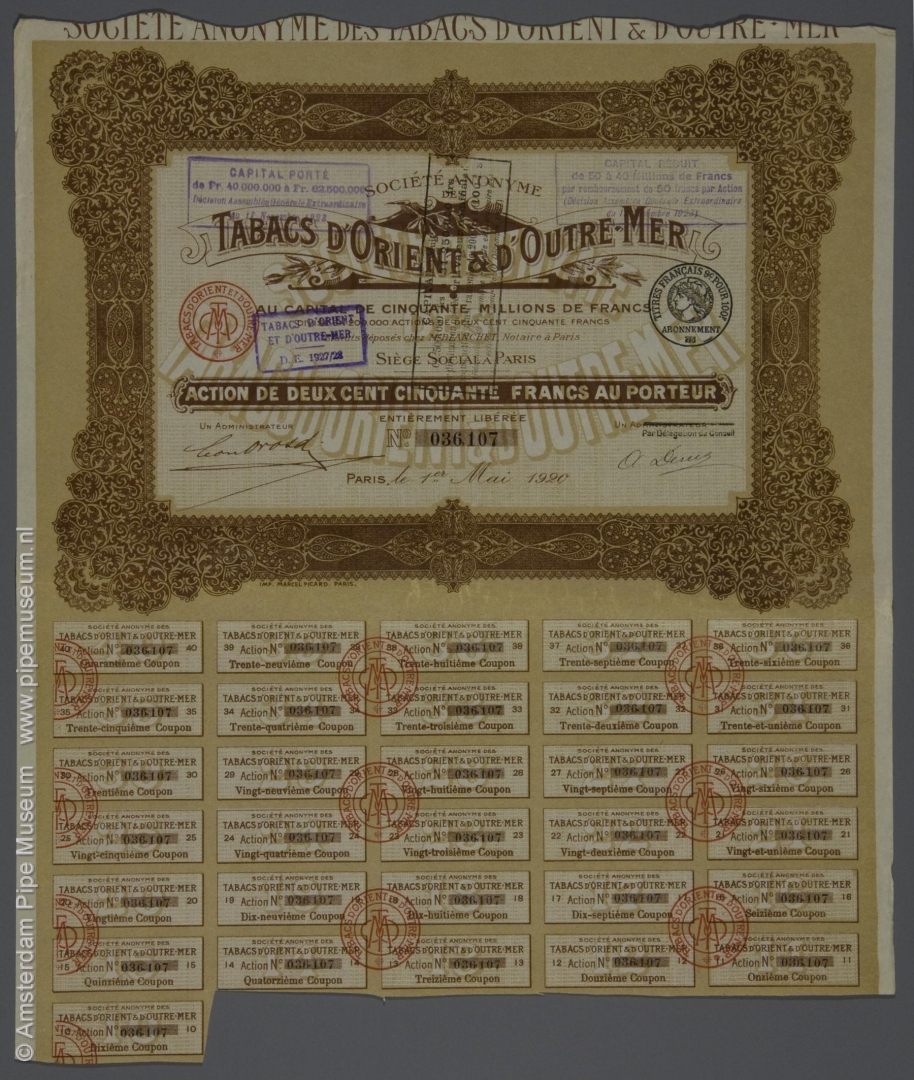

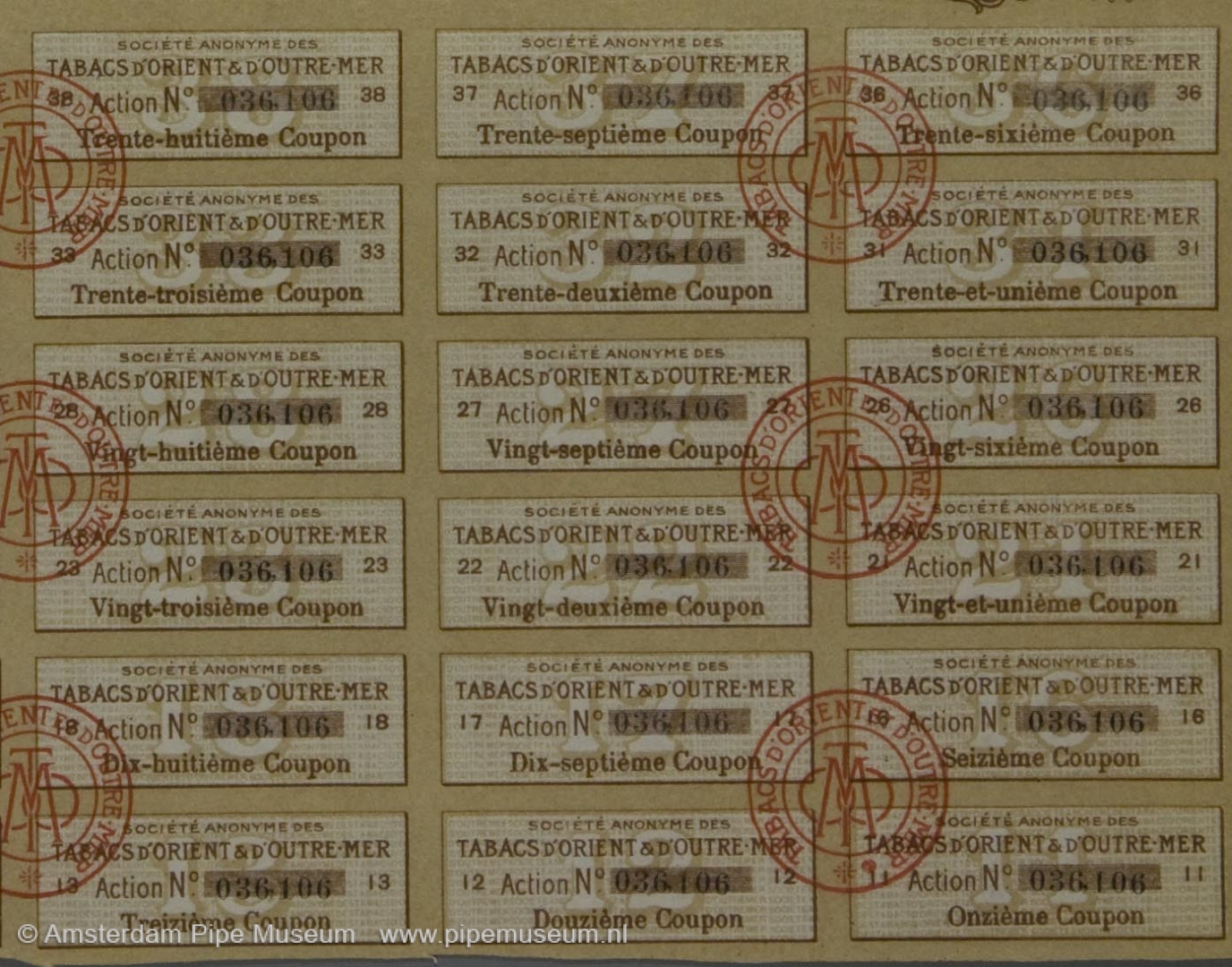

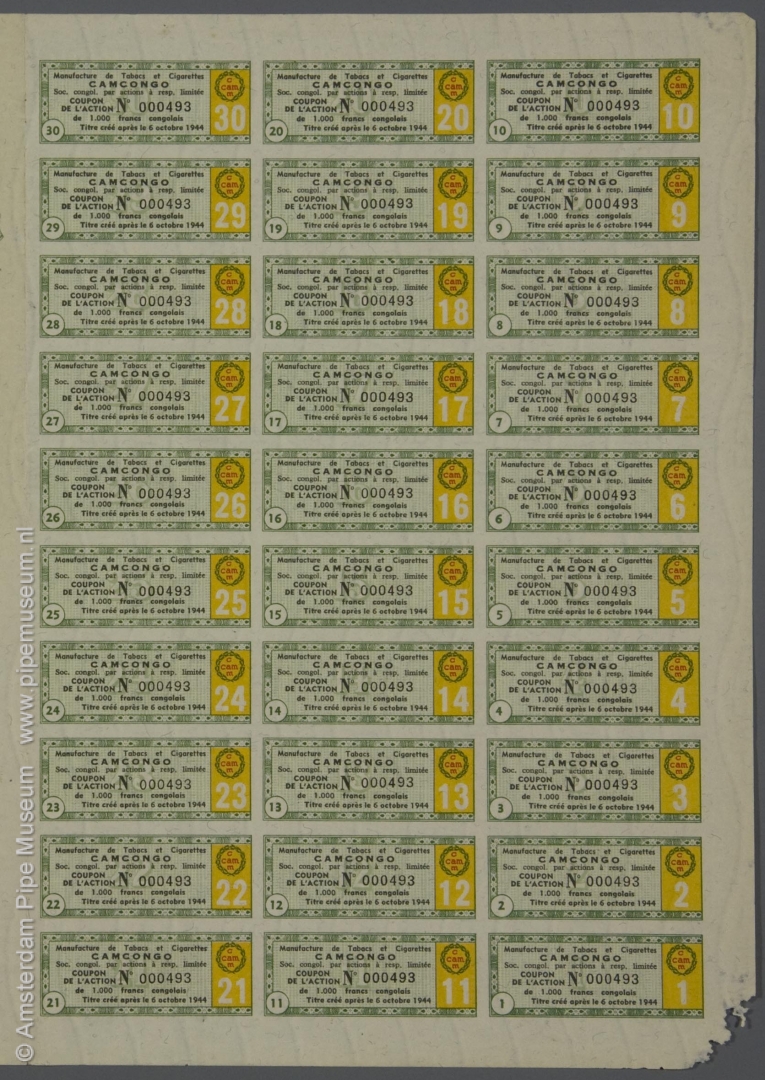

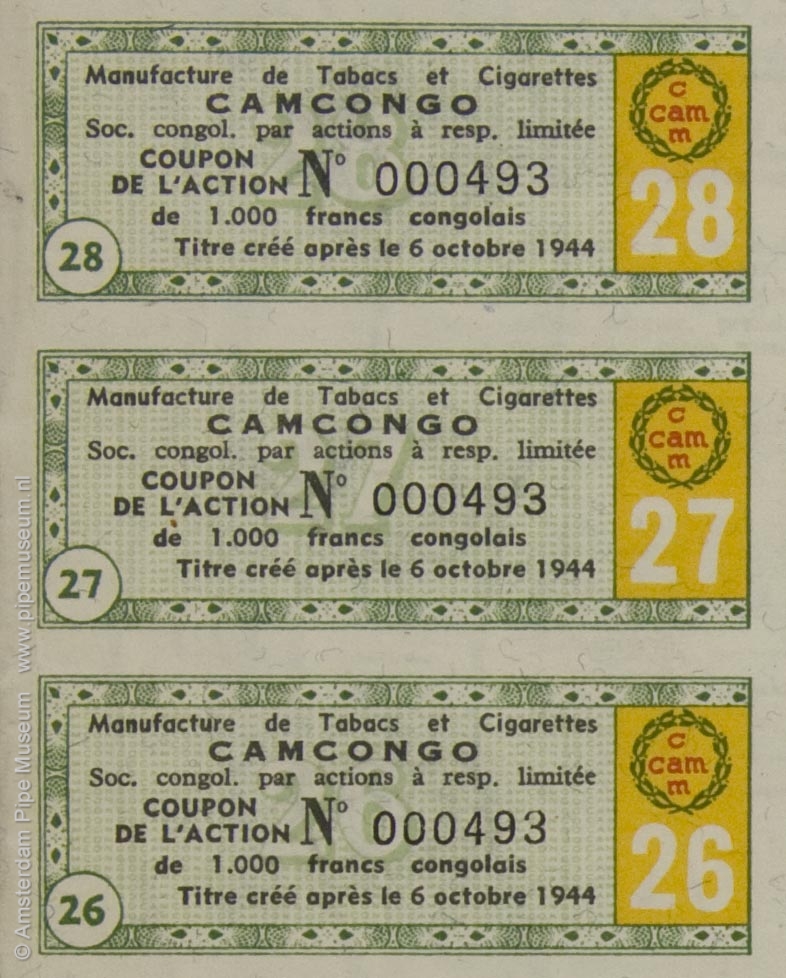

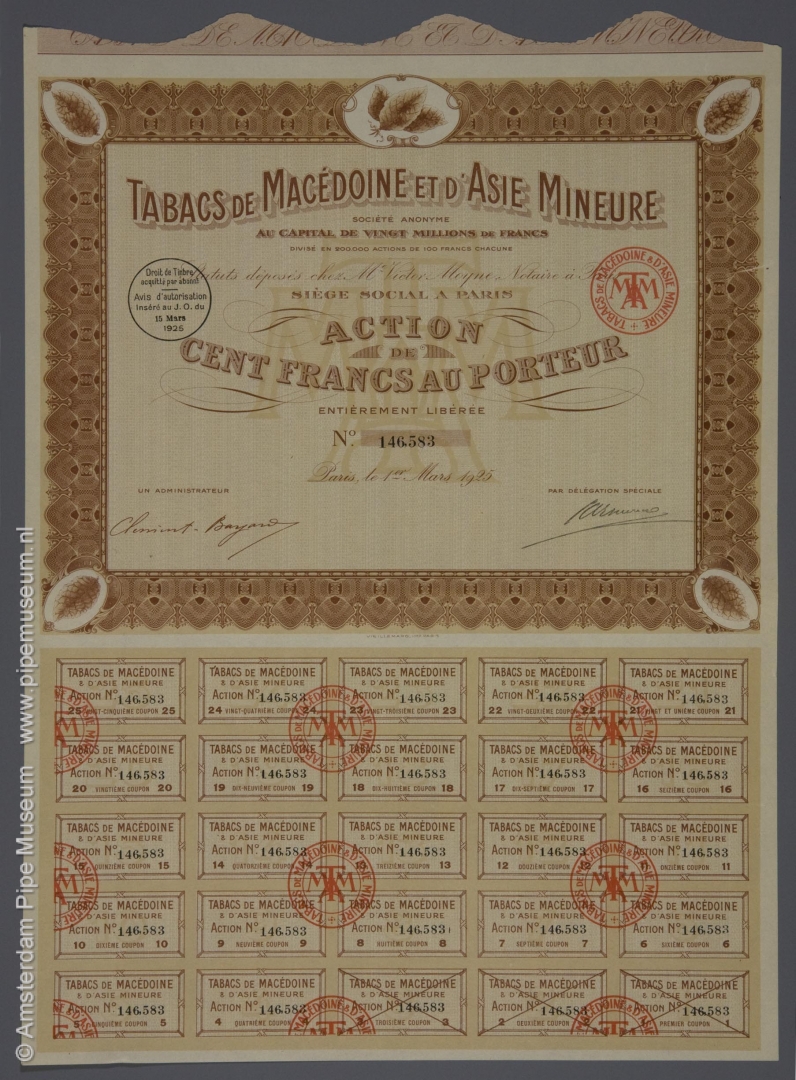

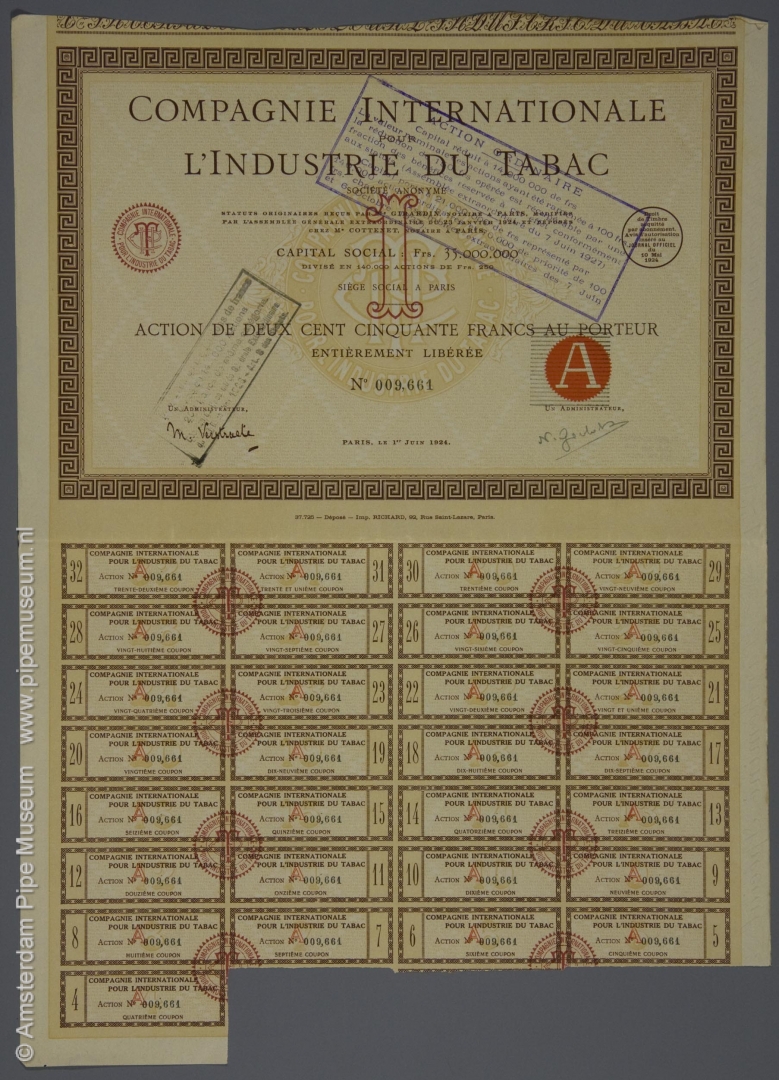

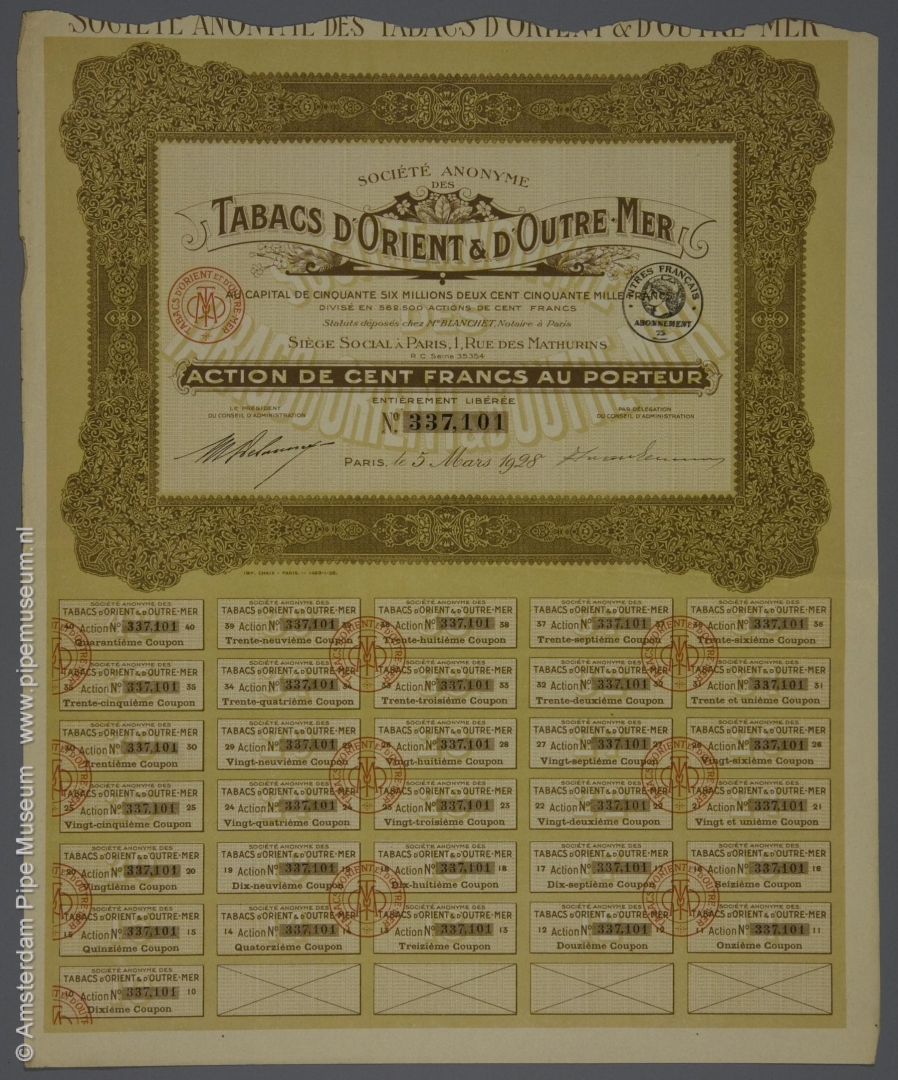

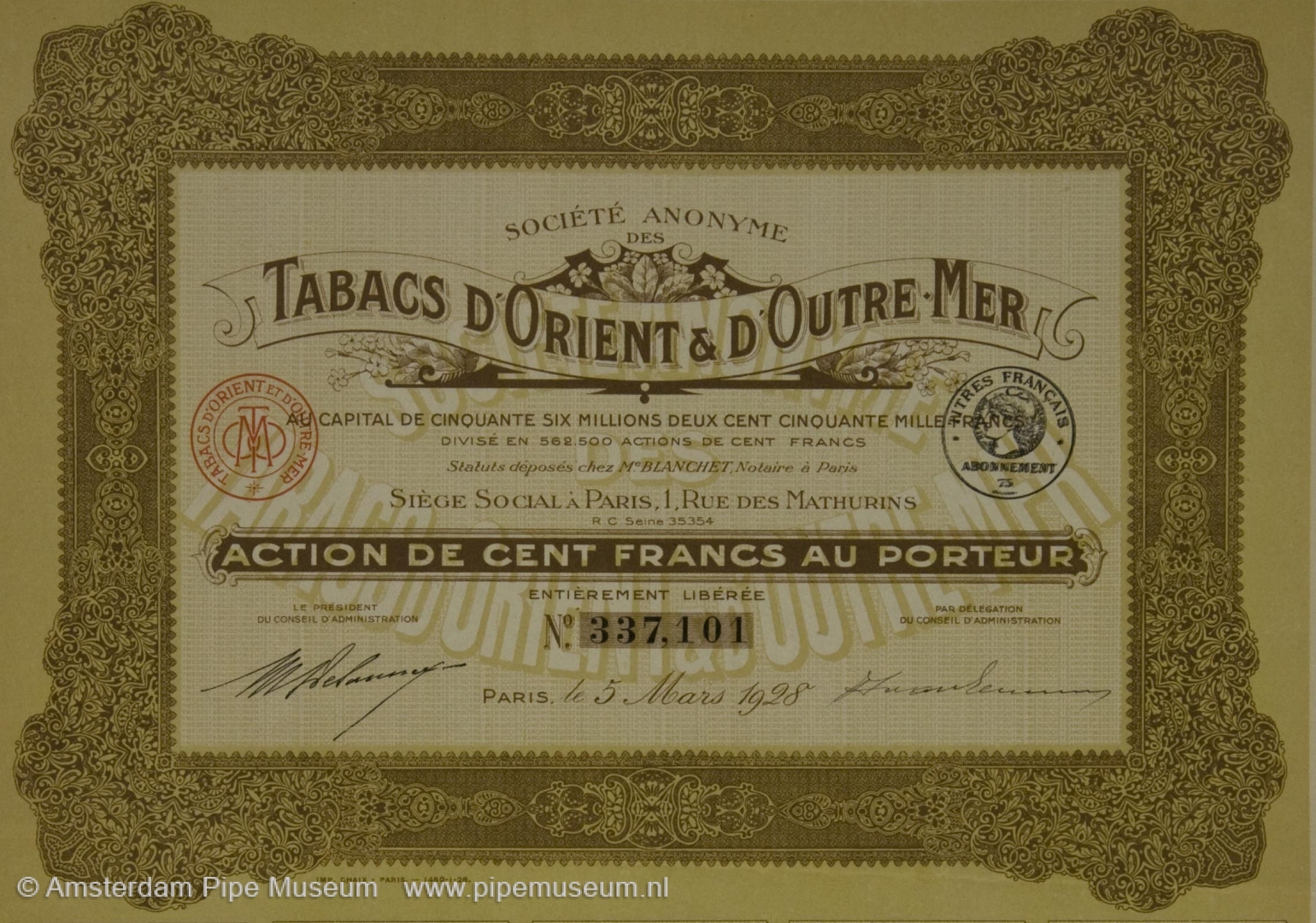

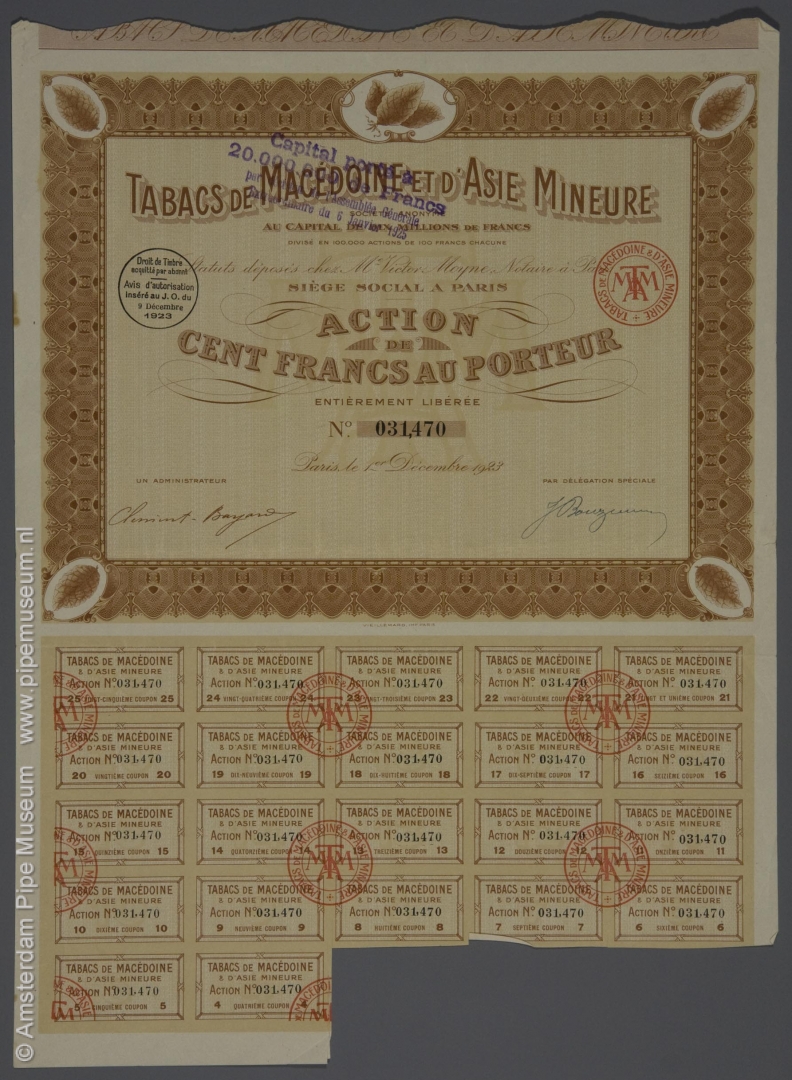

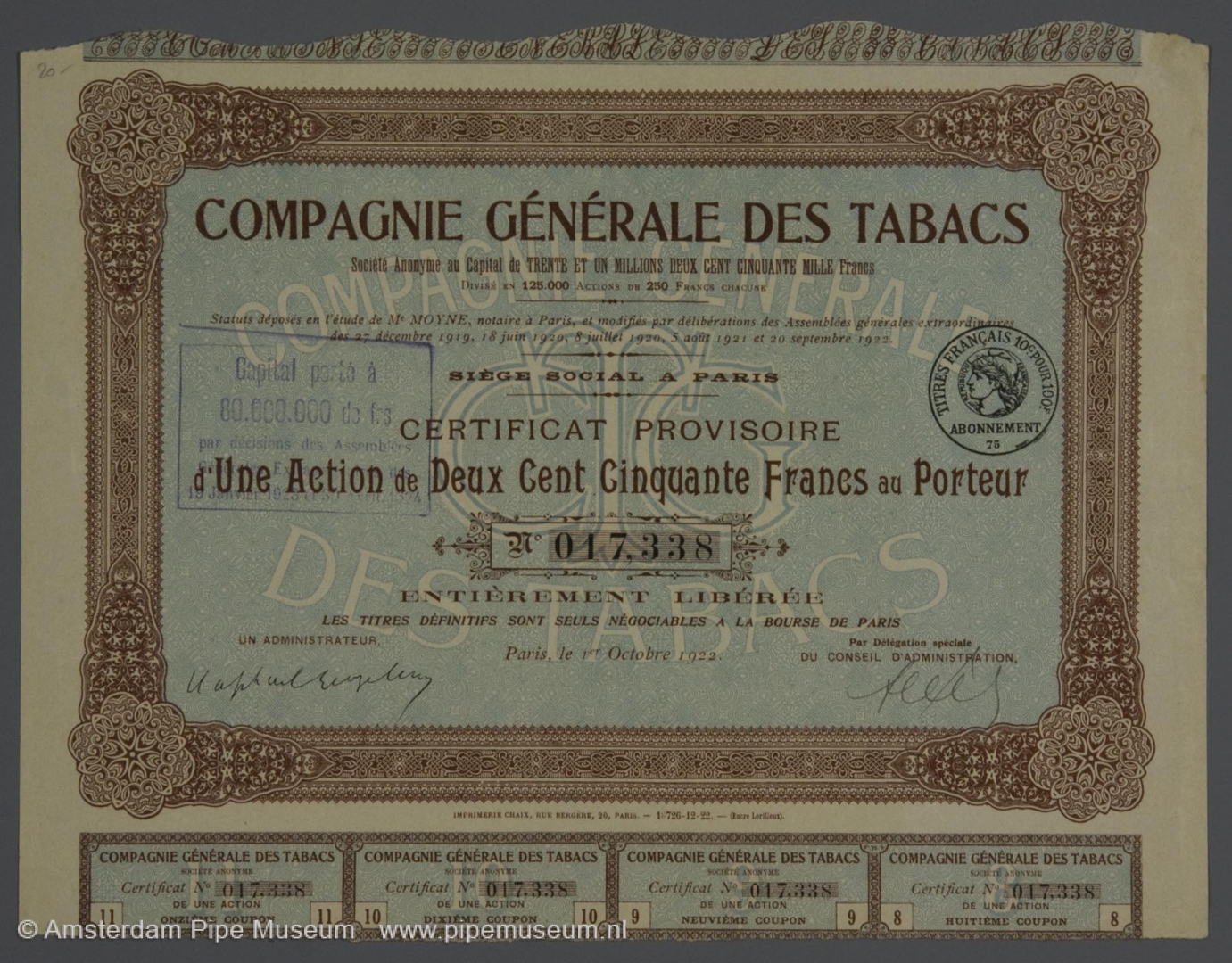

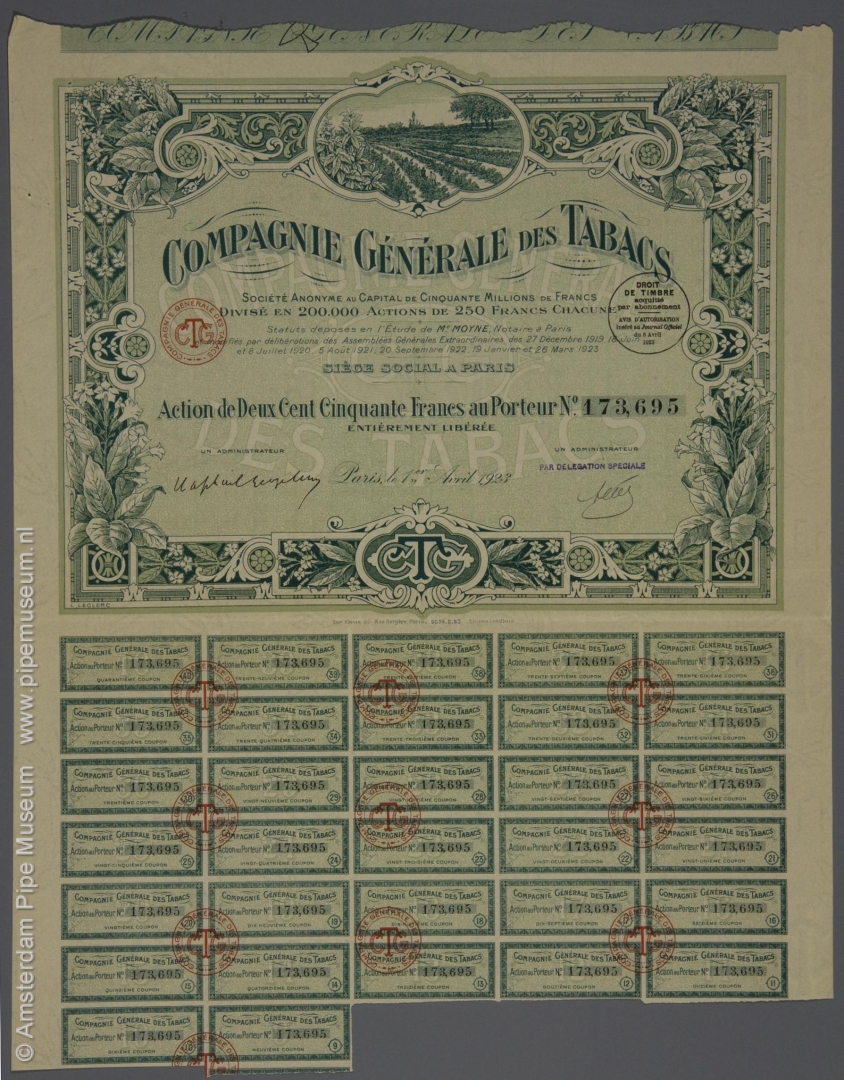

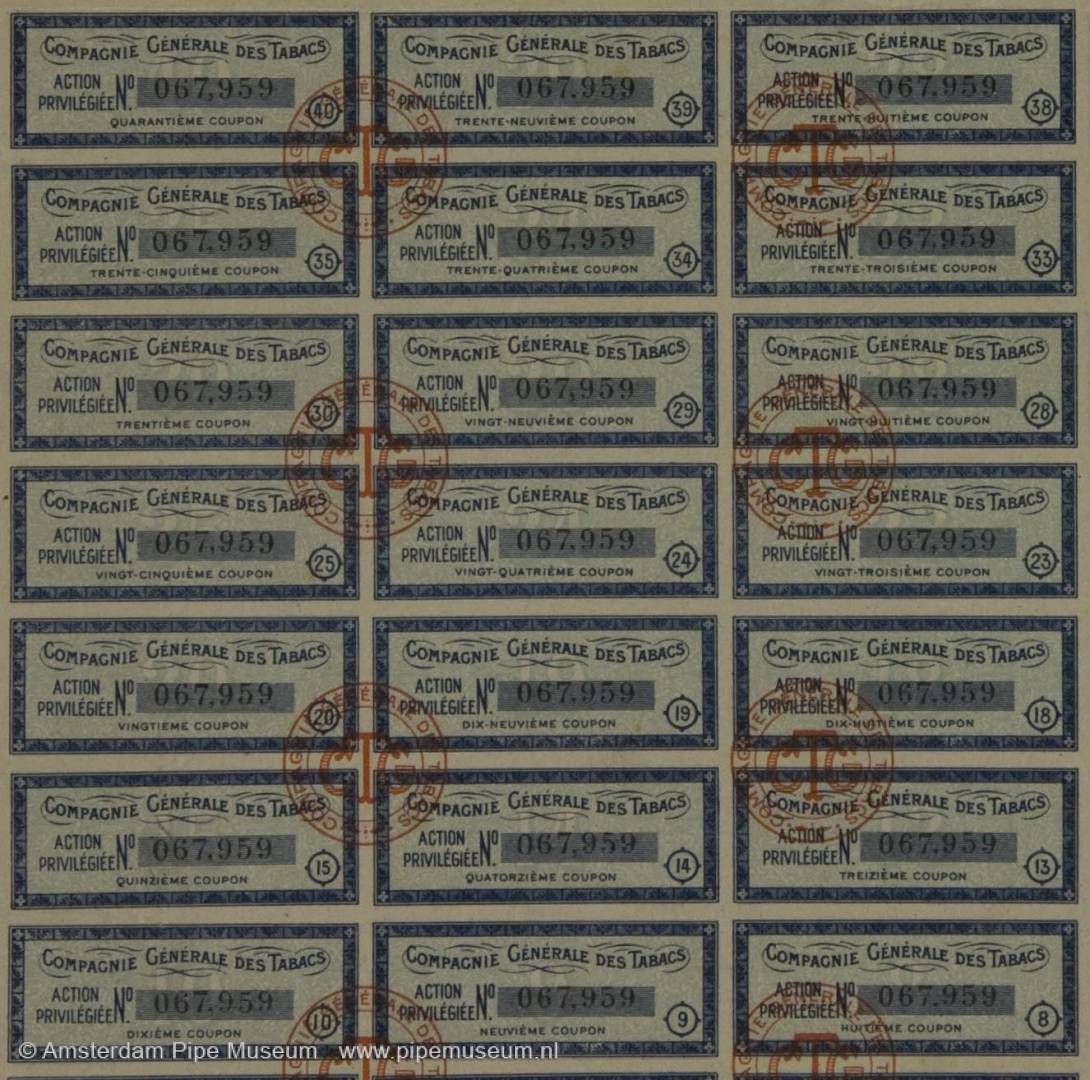

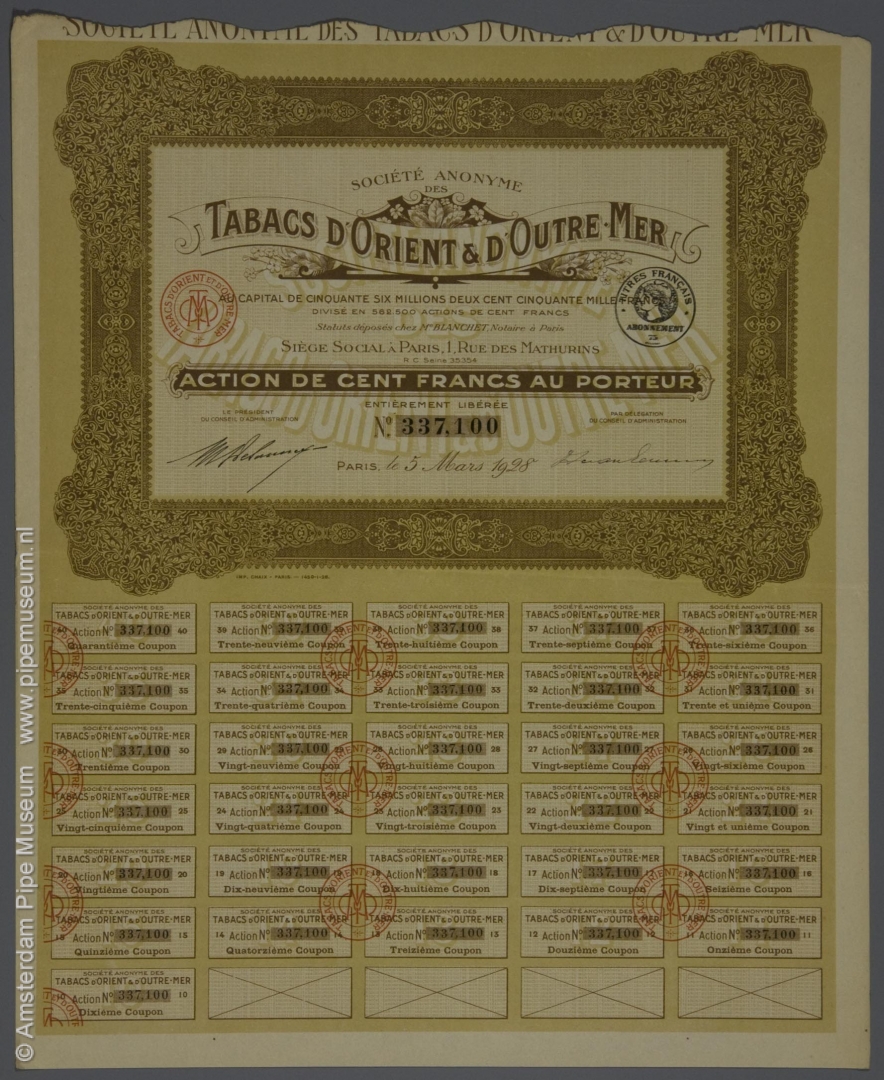

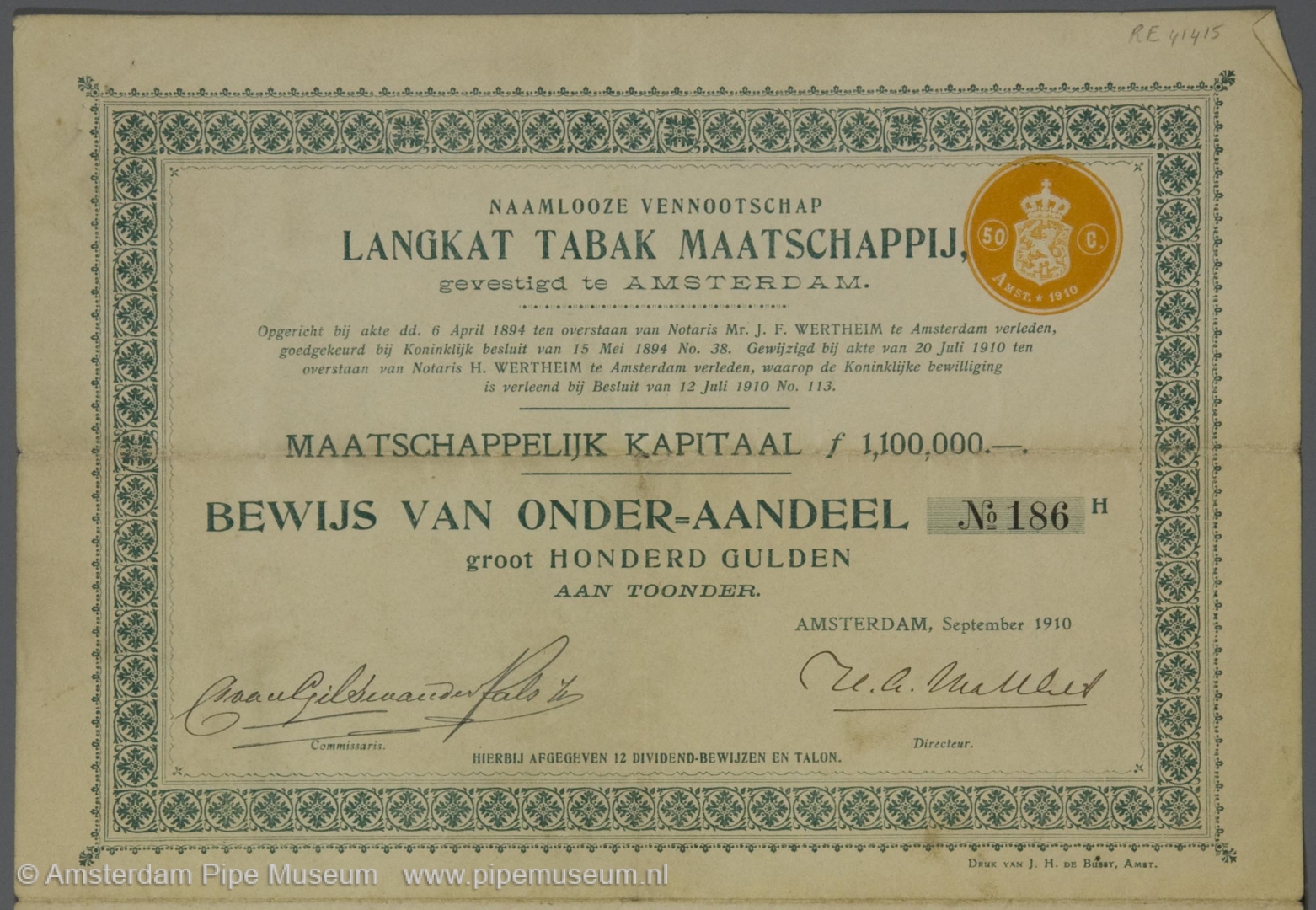

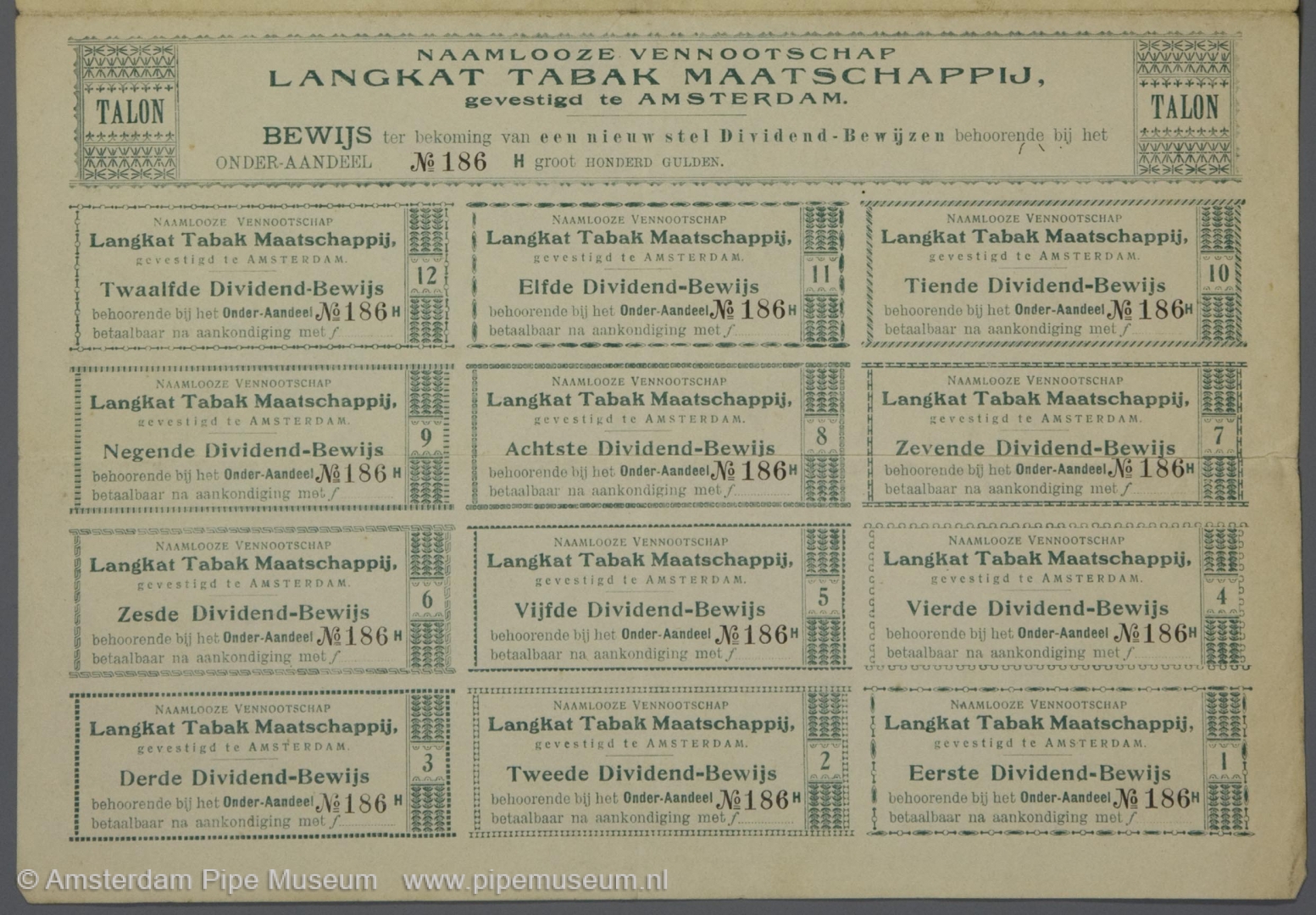

The larger plantations in the Dutch East Indies were companies with enormous capital. The Langkat Company, founded in 1897, borrowed more than a million guilders in shares of 100 guilders each. The French tobacco company did big business with 40 million francs domestically and 50 million for the overseas territories. The investor could also spend his money in plantations in, for example, Macedonia and Asia Minor and even countries such as Cameroon.

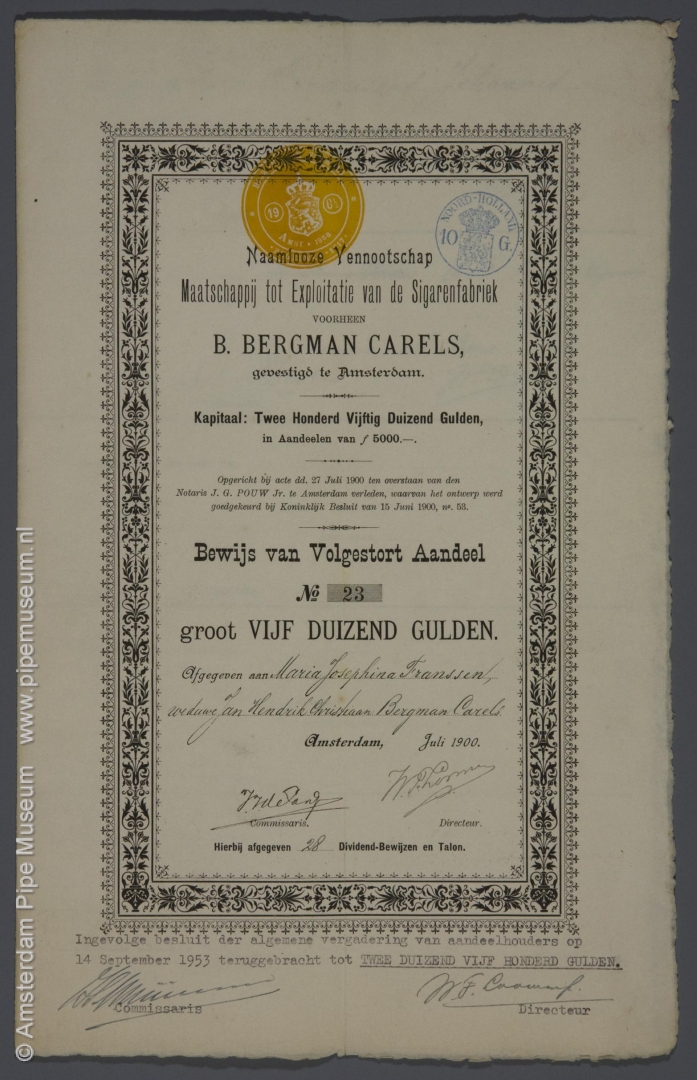

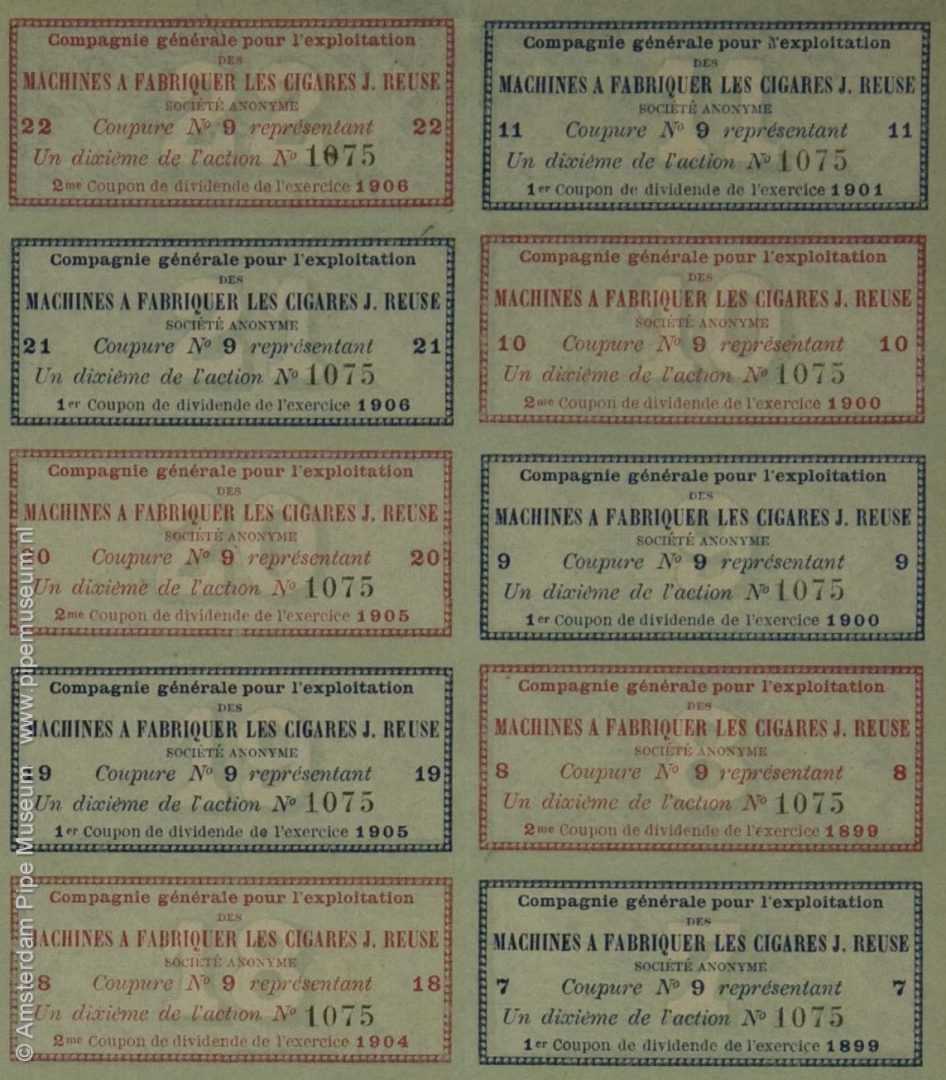

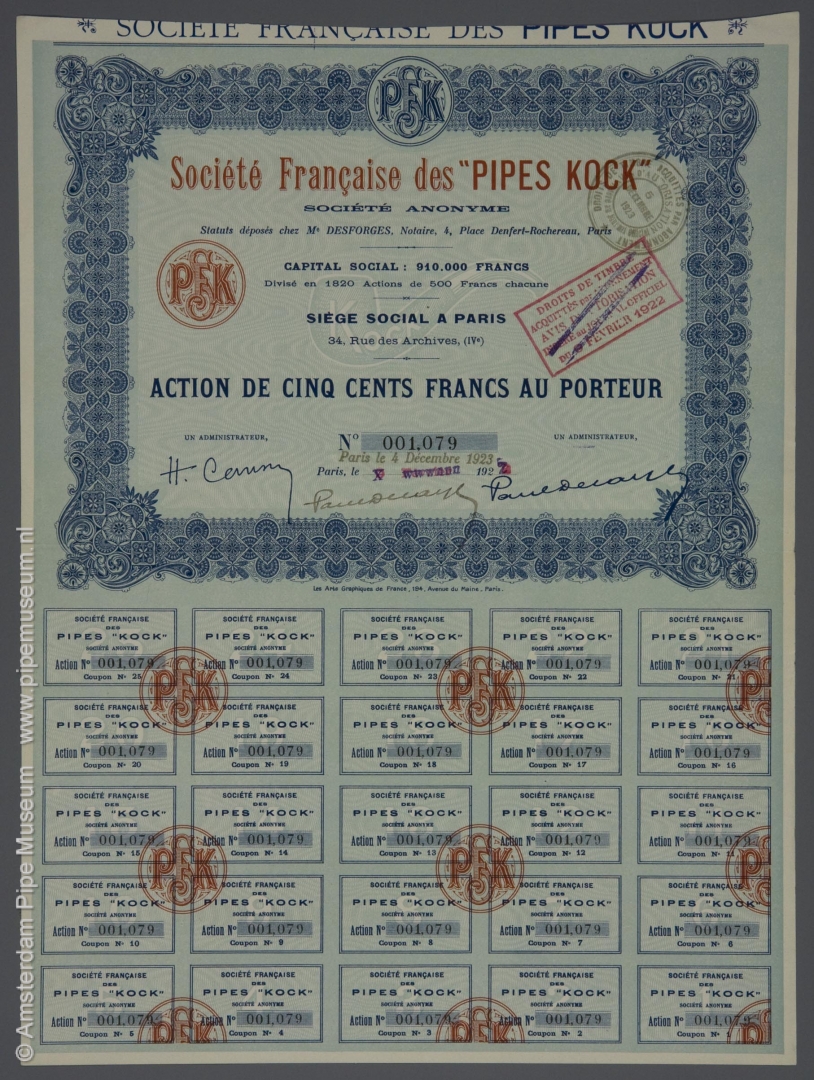

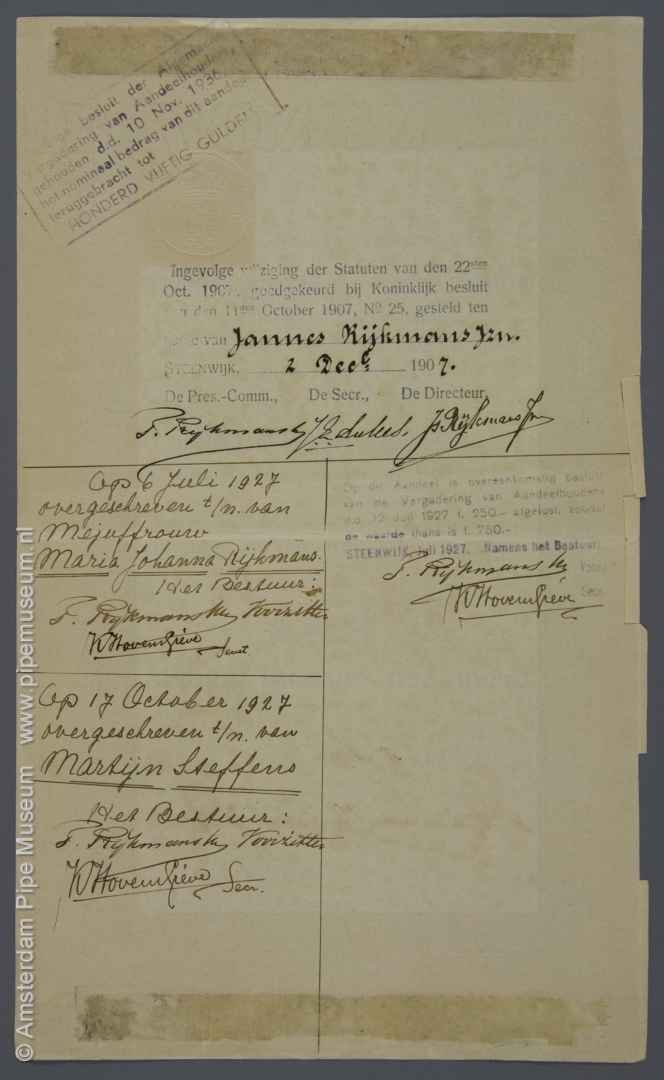

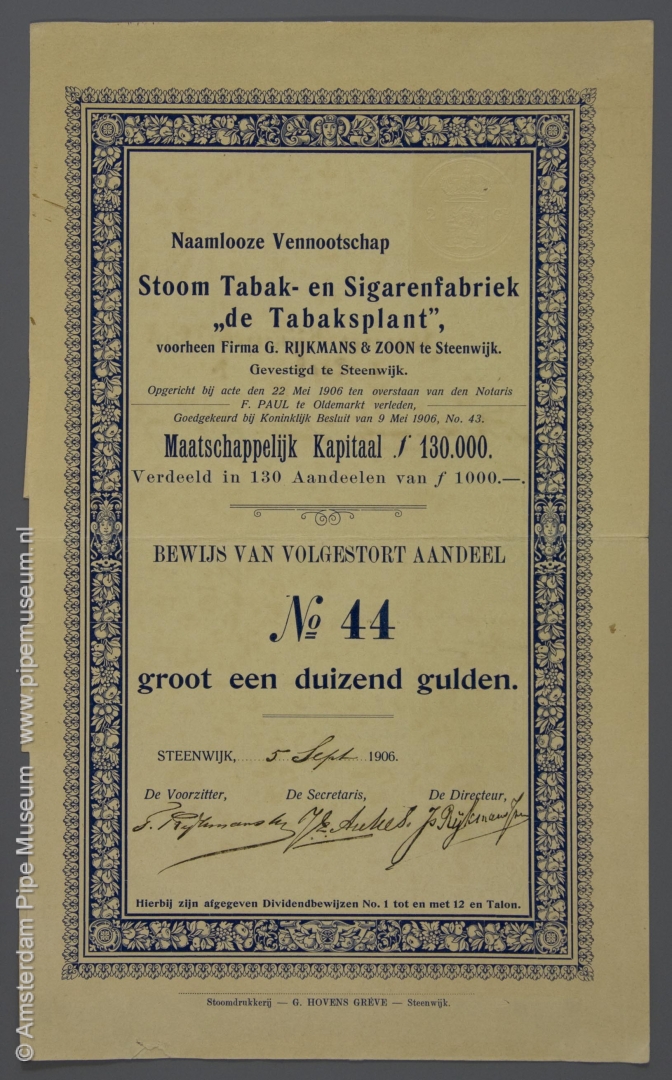

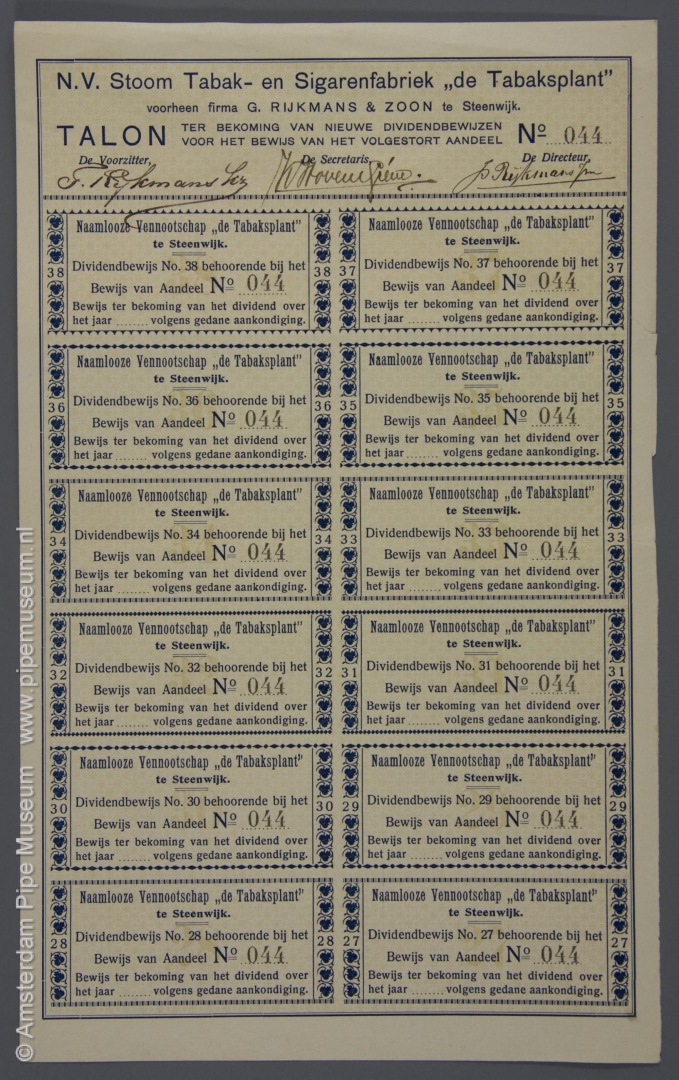

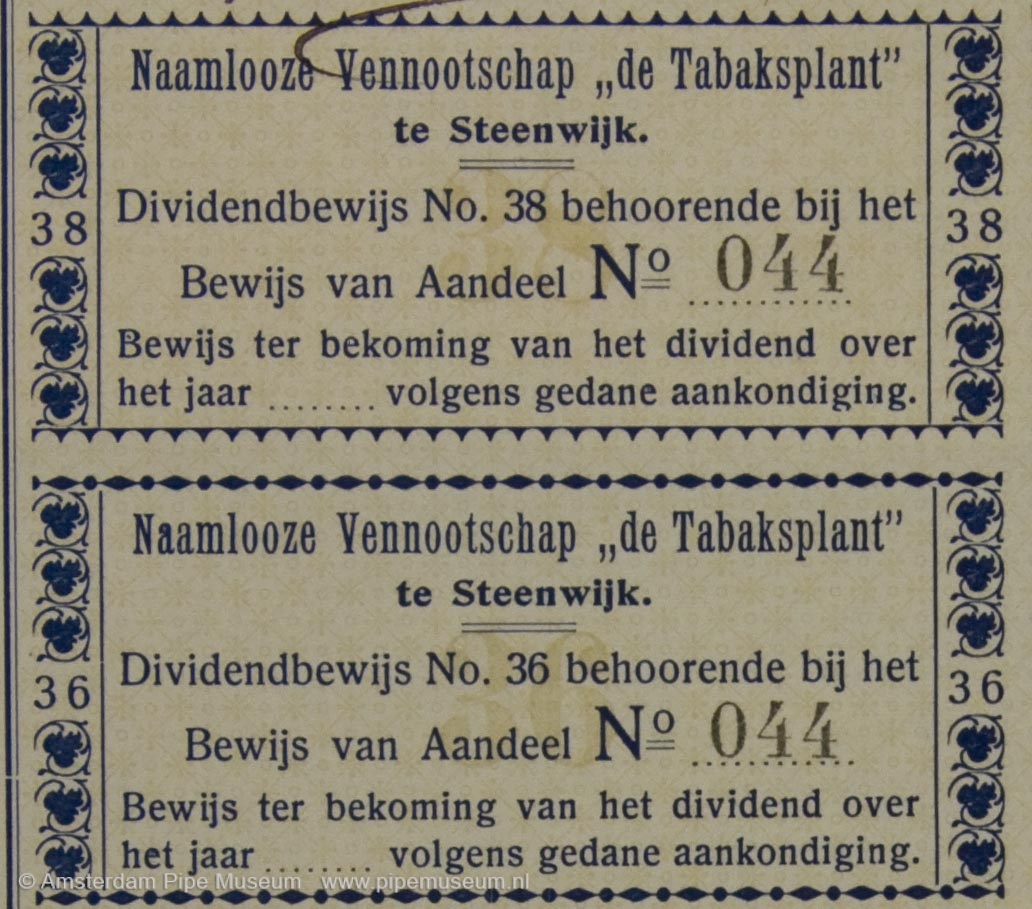

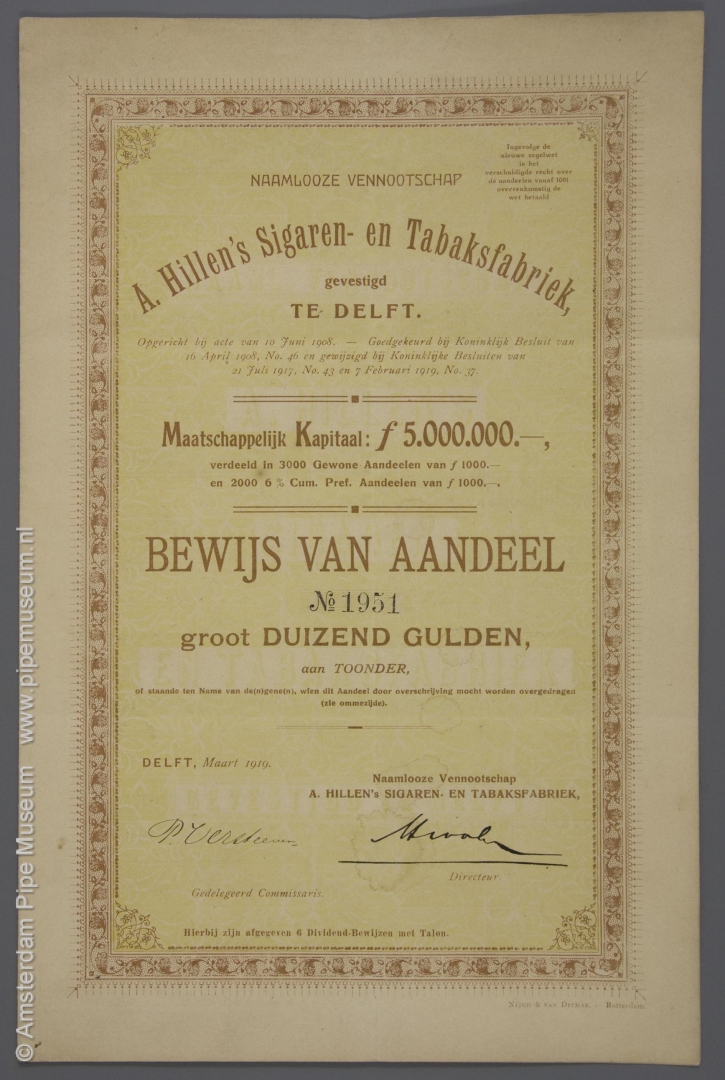

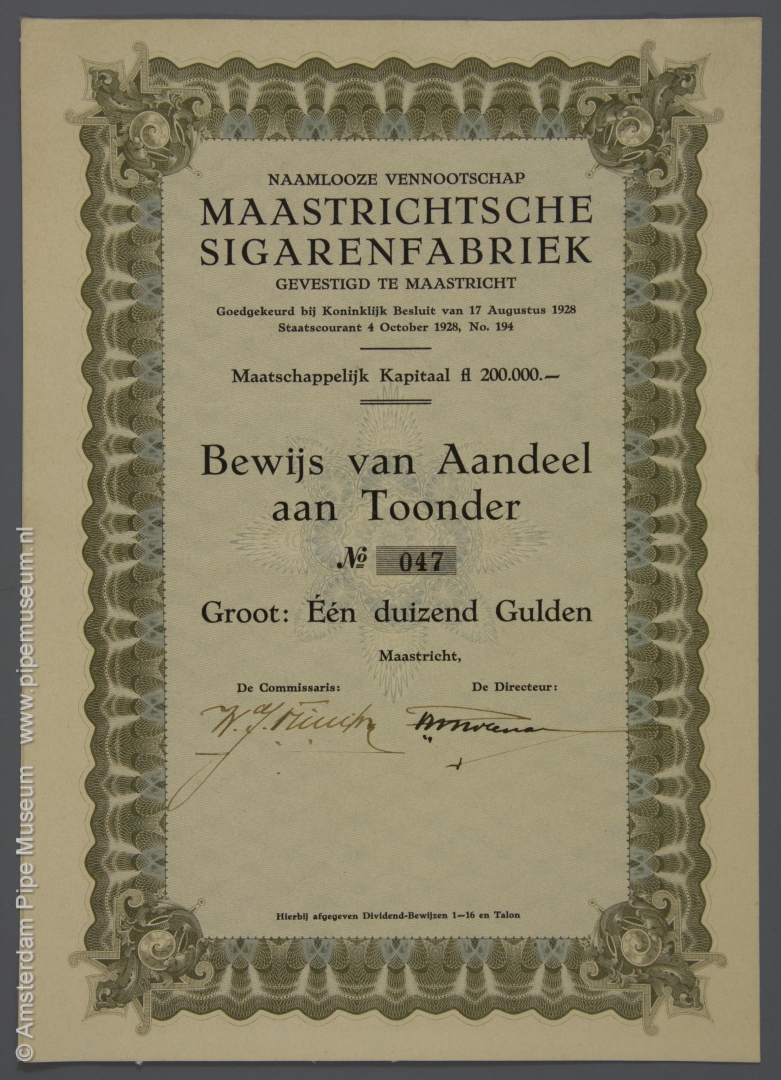

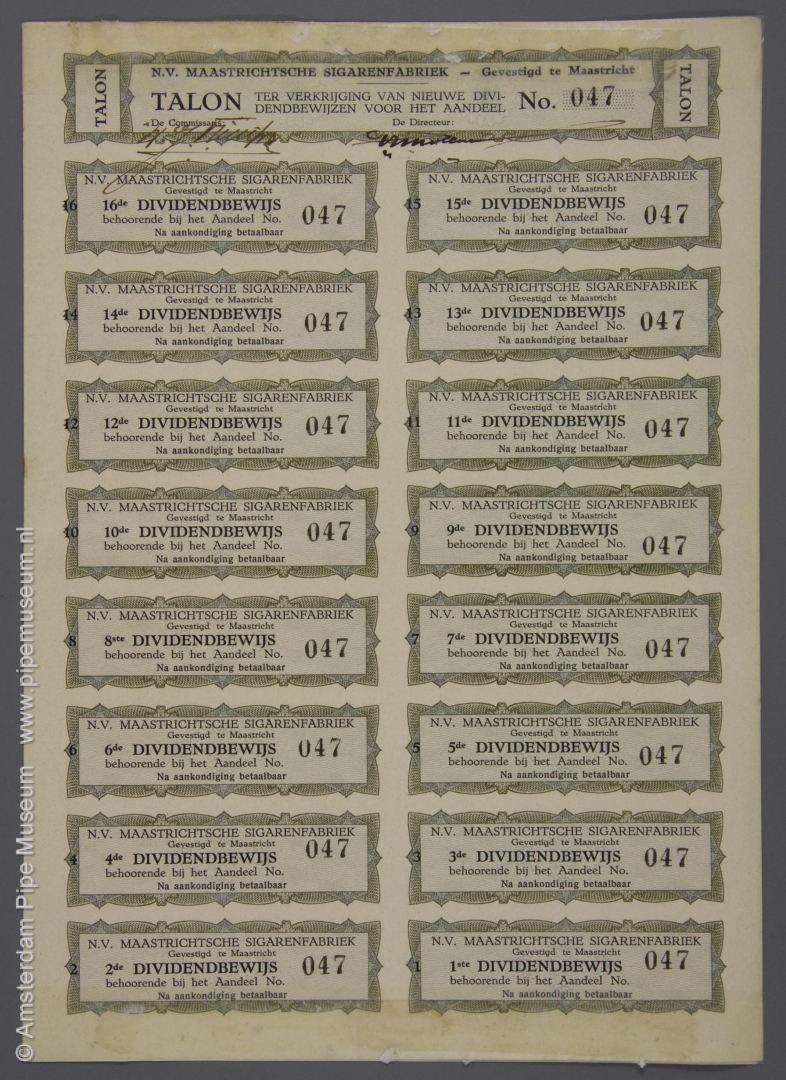

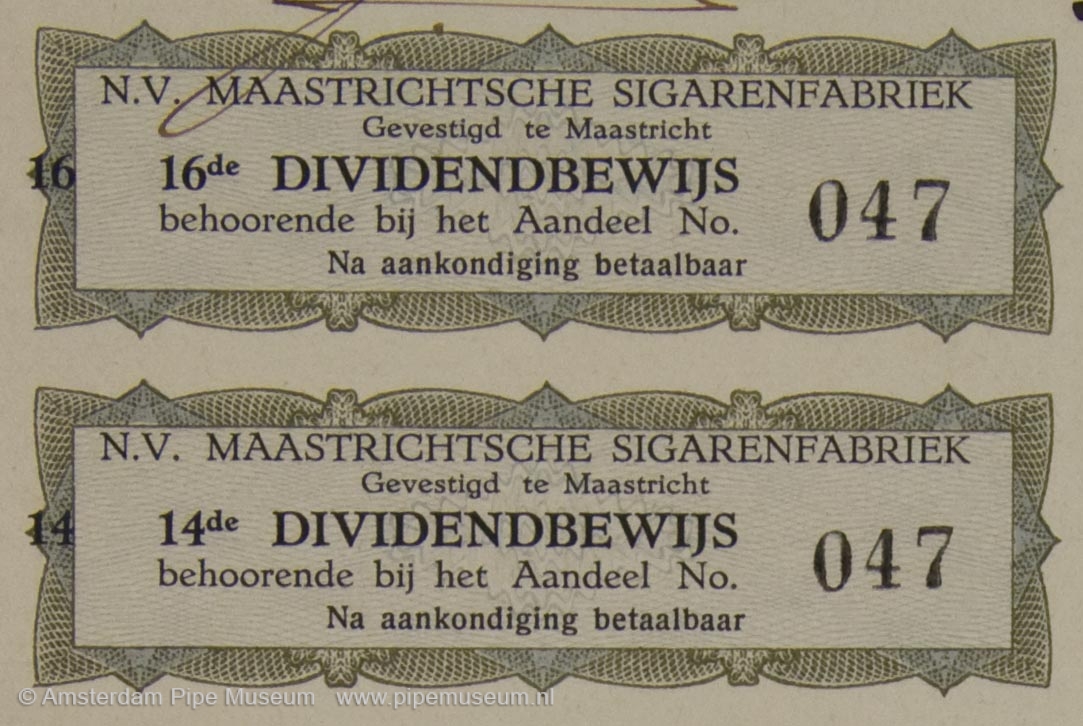

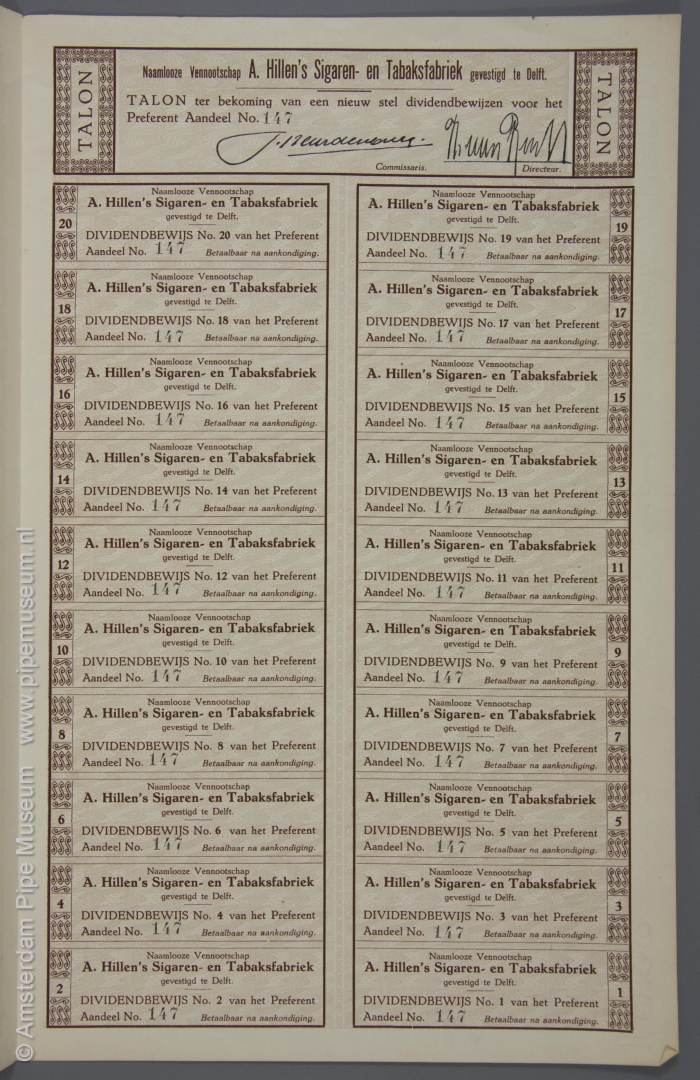

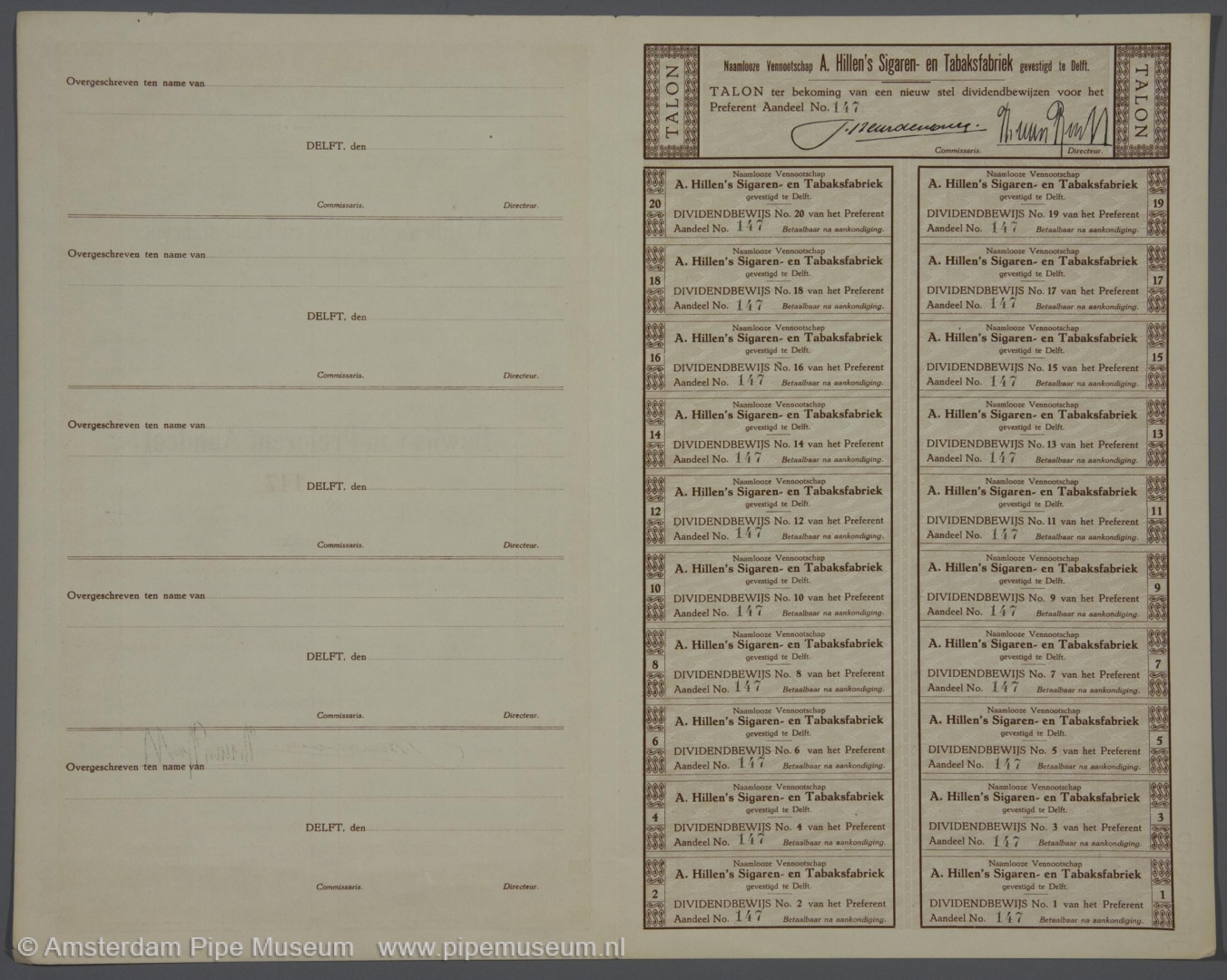

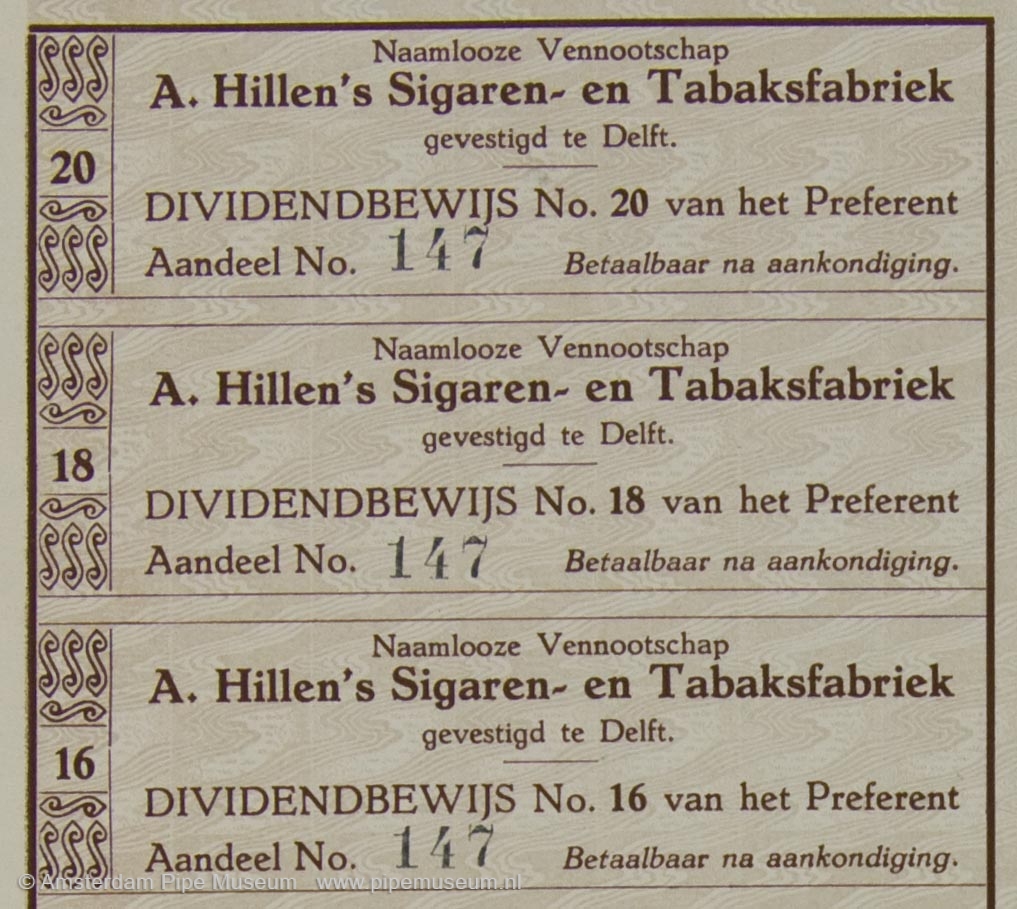

In addition to tobacco plantations and trading houses, larger cigar factories organized as limited company issued their own shares. A big name is Bergman Carels in Amsterdam. One share represented a nominal value of no less than 5,000 guilders. A small company like Stoom Tabak- en Sigarenfabriek de Tabaksplant in Steenwijk had a working capital of only 130,000 guilders.

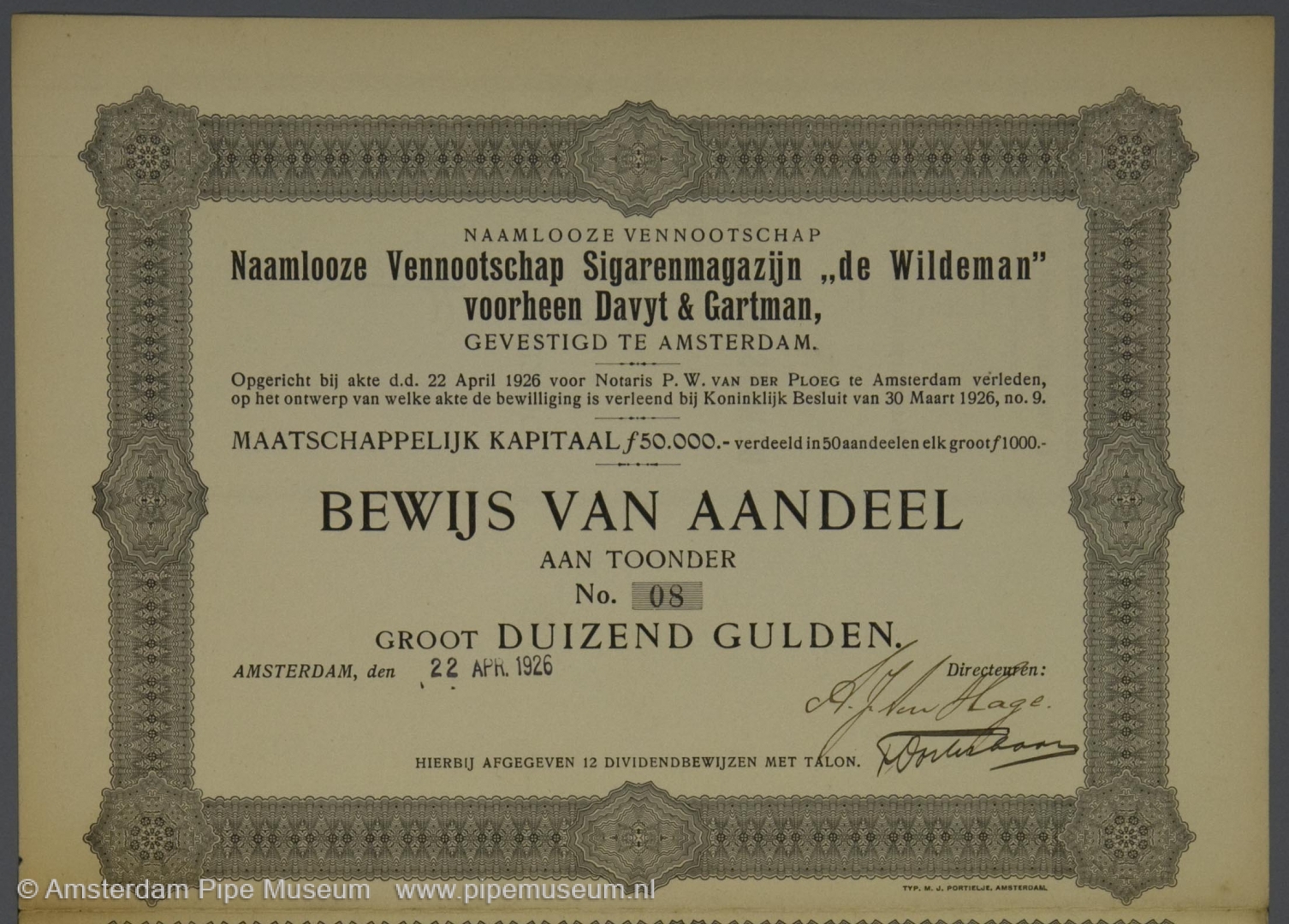

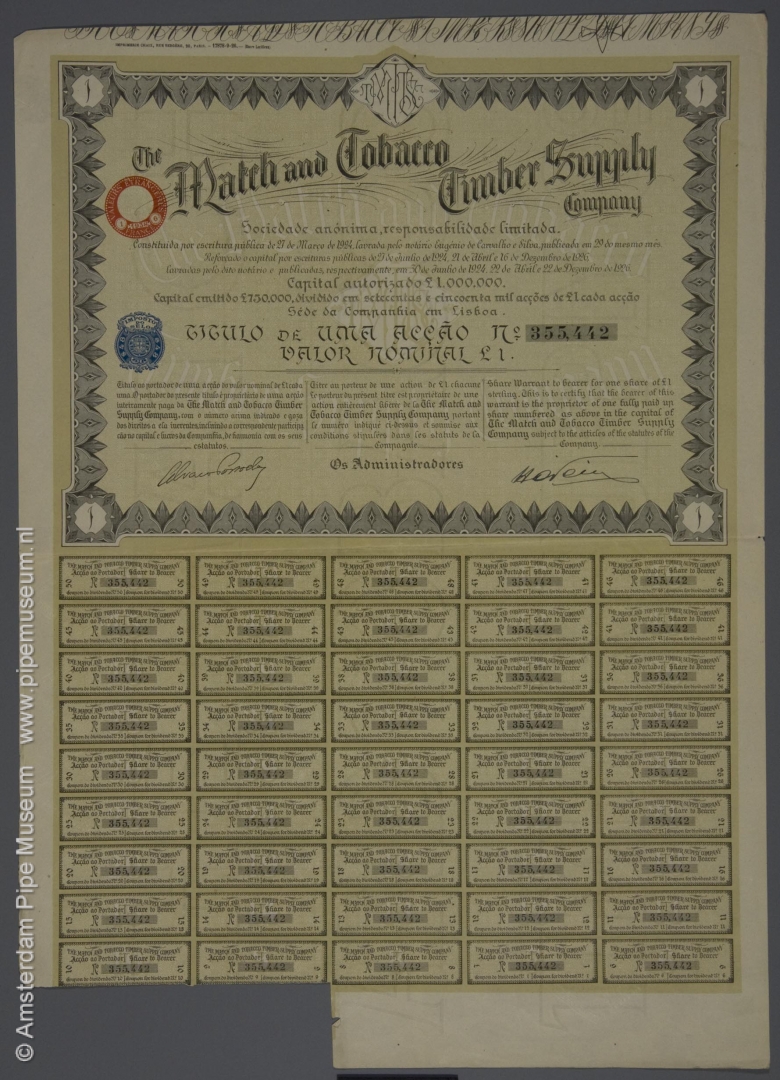

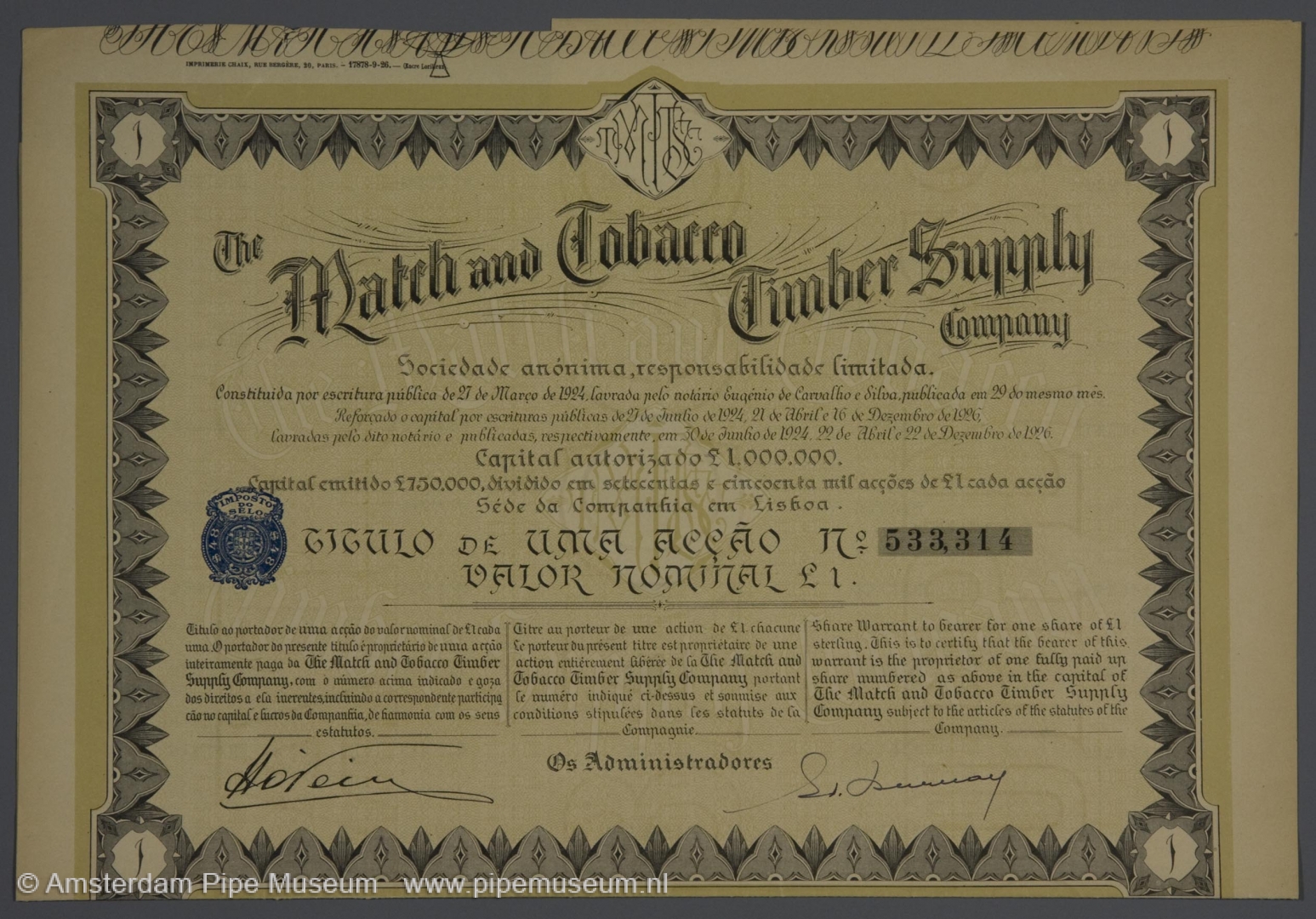

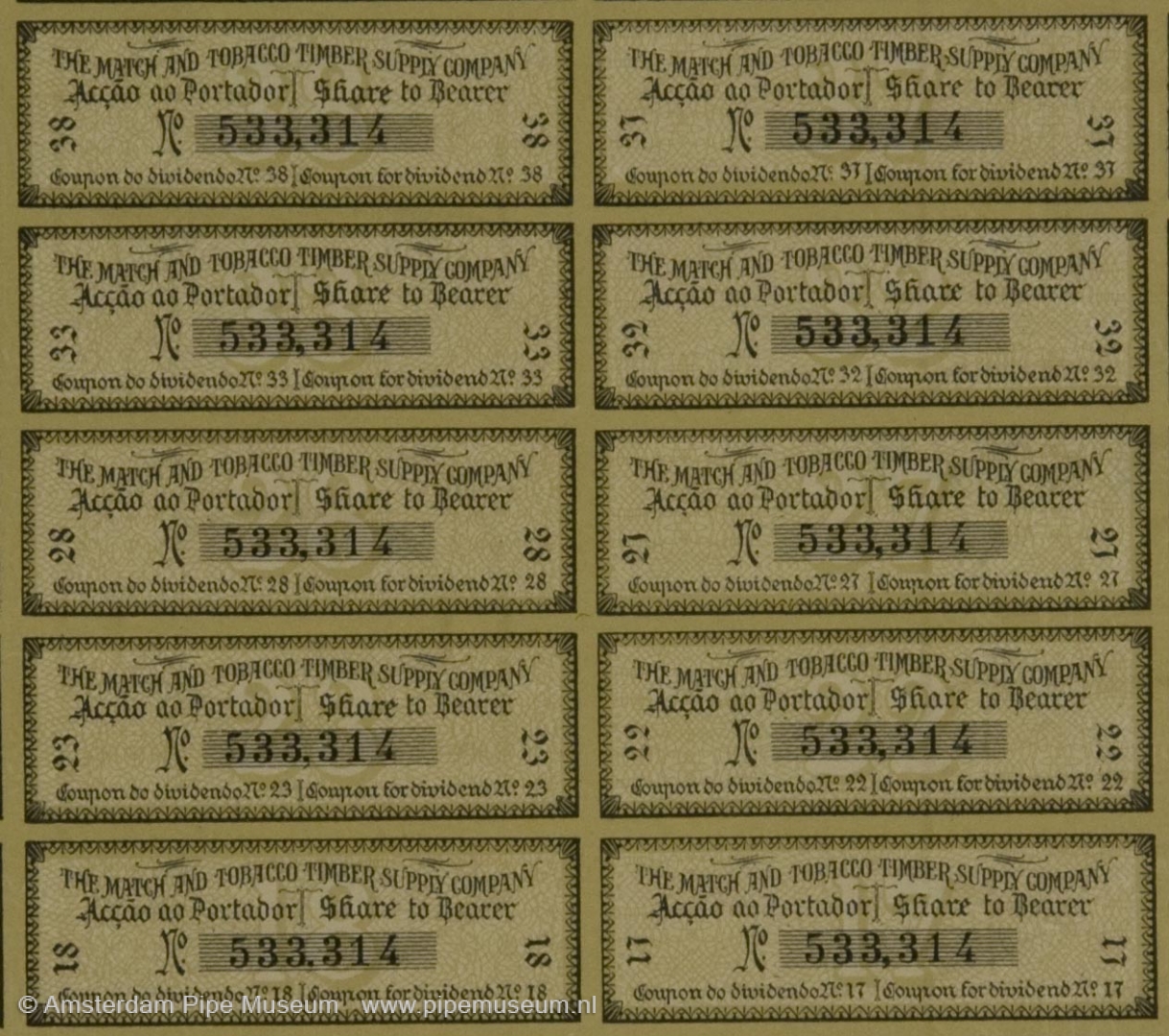

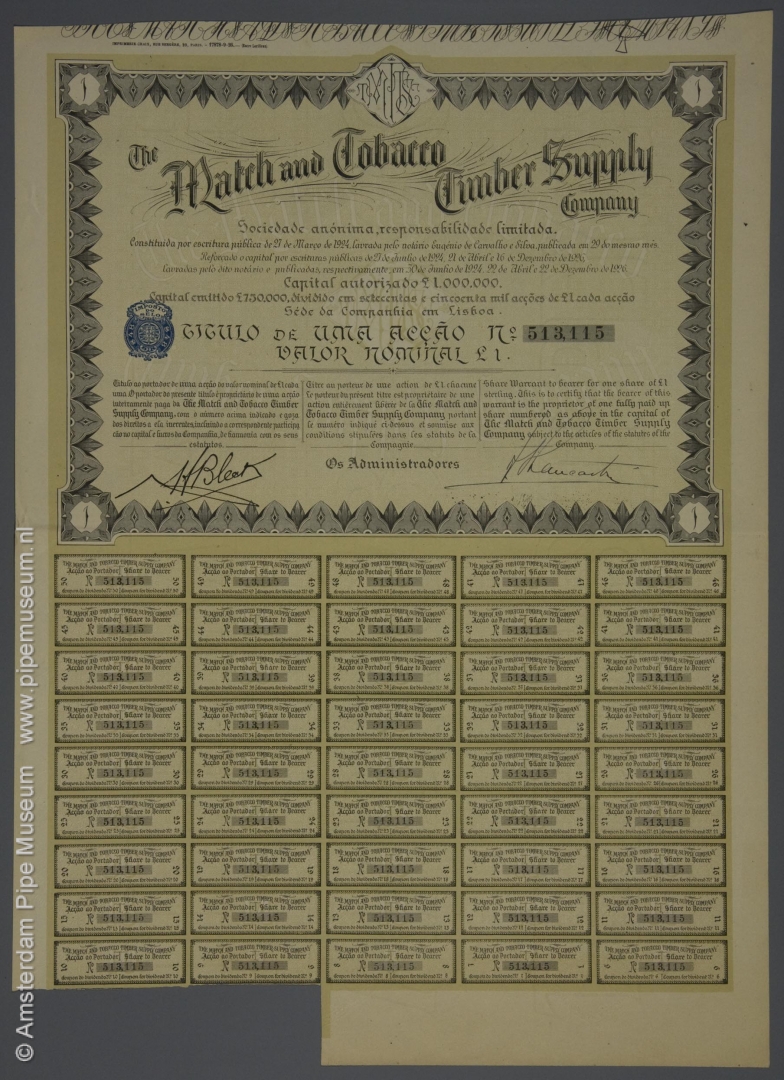

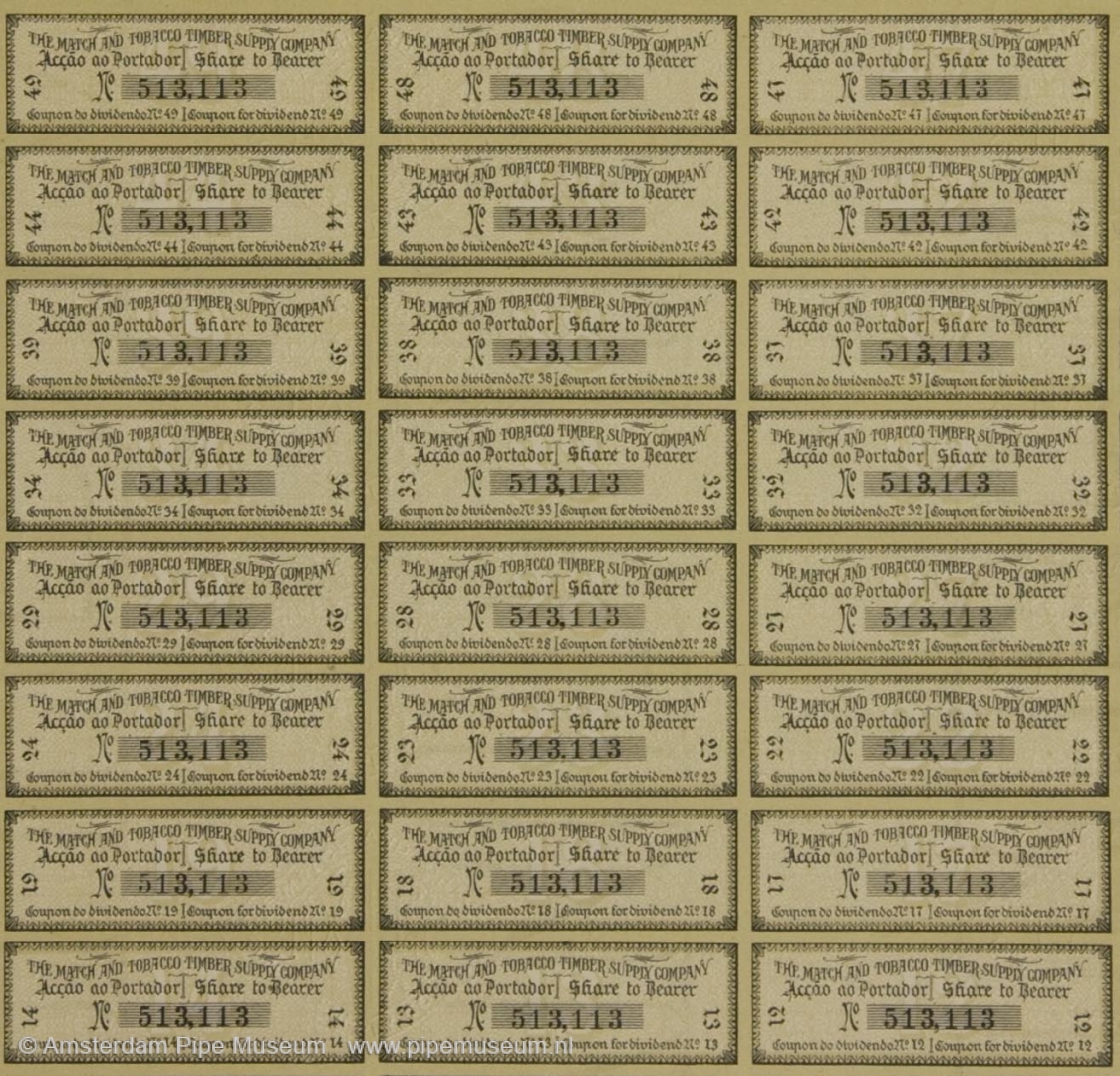

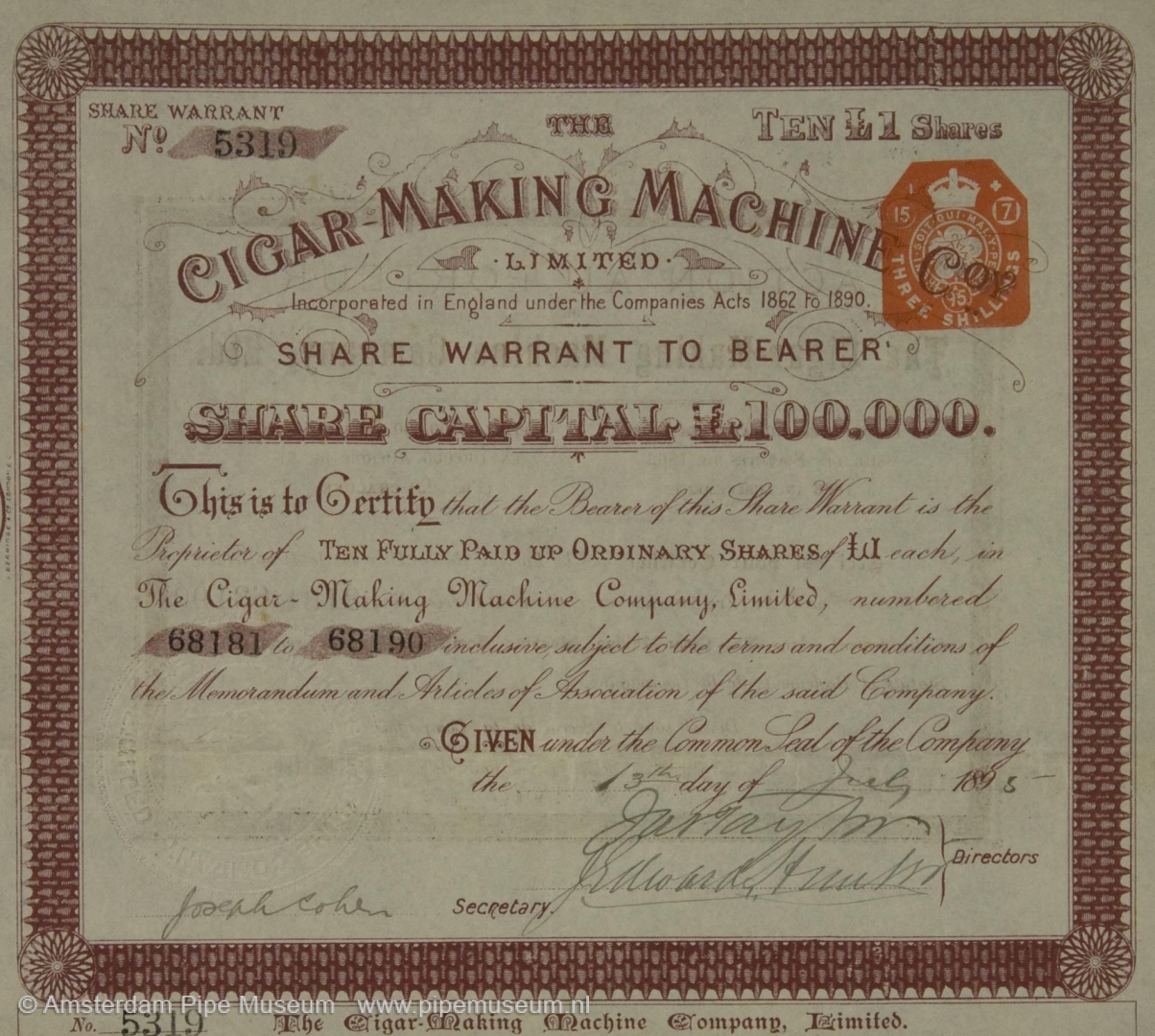

It is striking that a single store such as Davyt & Gartman in the Kalverstreet, Amsterdam issued shares. In 1926, this N.V. Sigarenmagazijn de Wildeman still represented a value of no less than 50,000 guilders, divided into fifty shares. Rare finds are the shares of a machine factory for production equipment for cigar factories or the company for match wood and wood for cigar boxes.

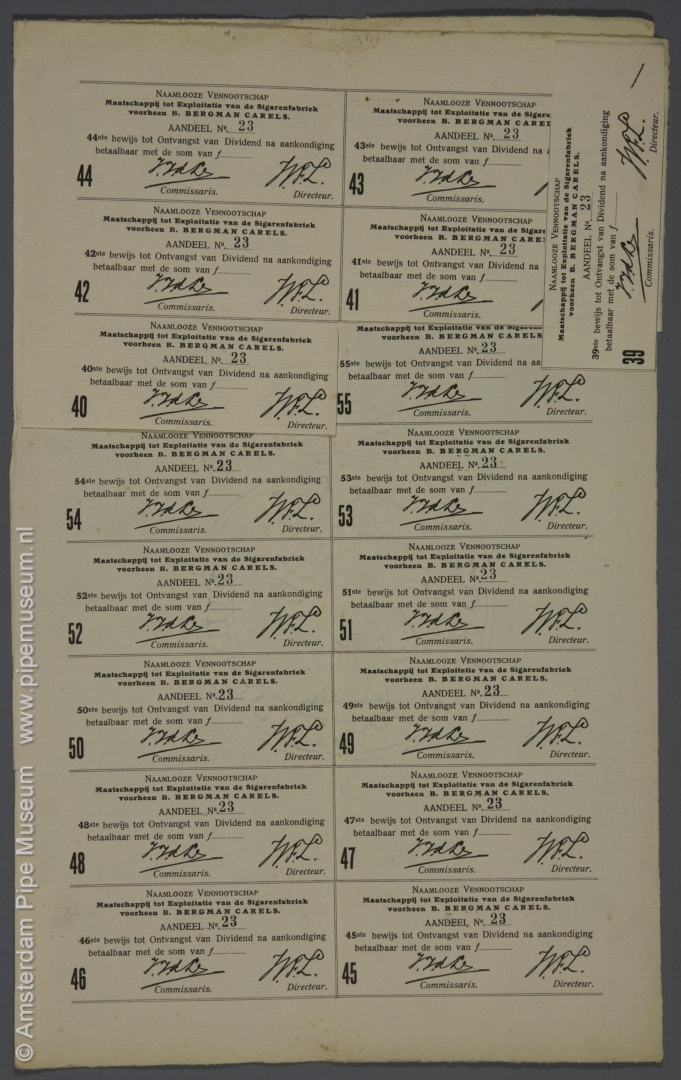

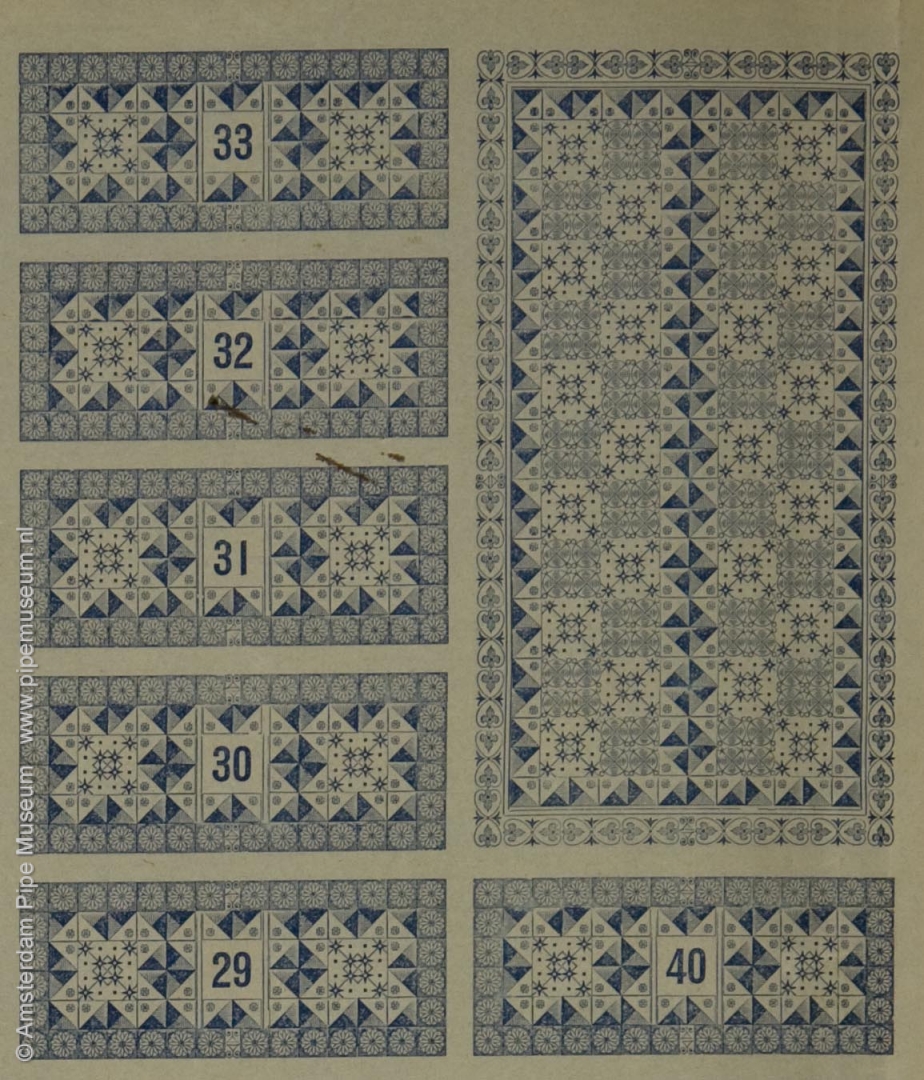

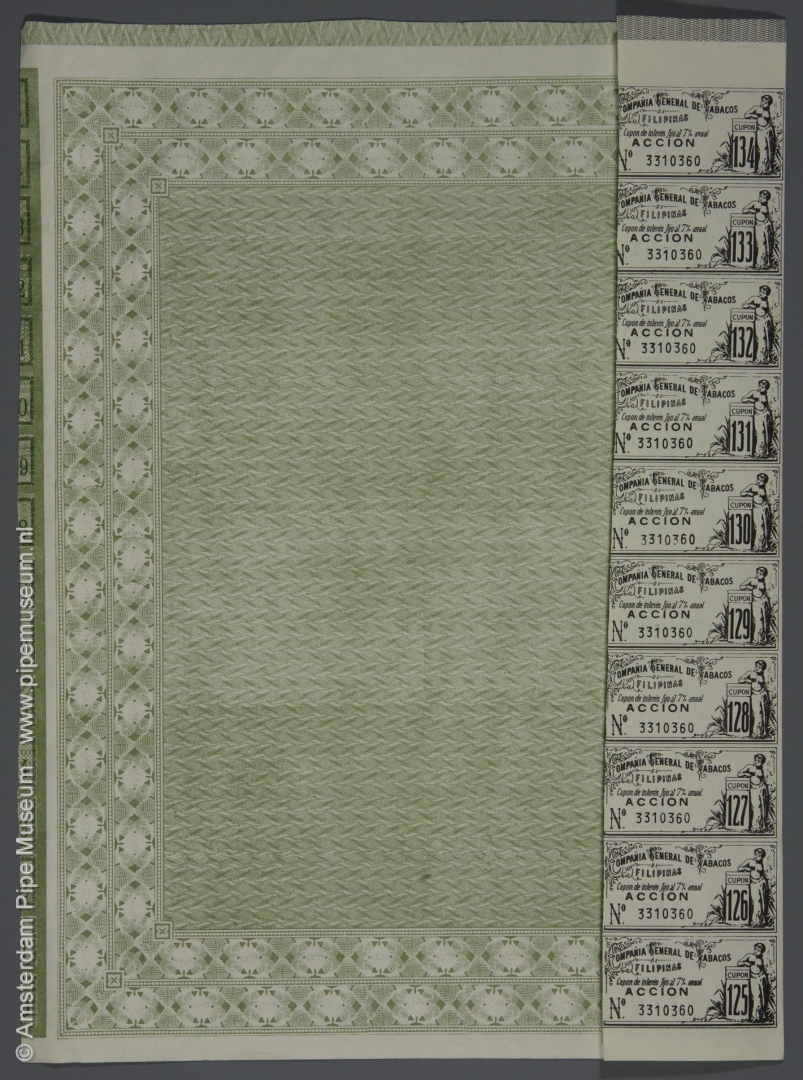

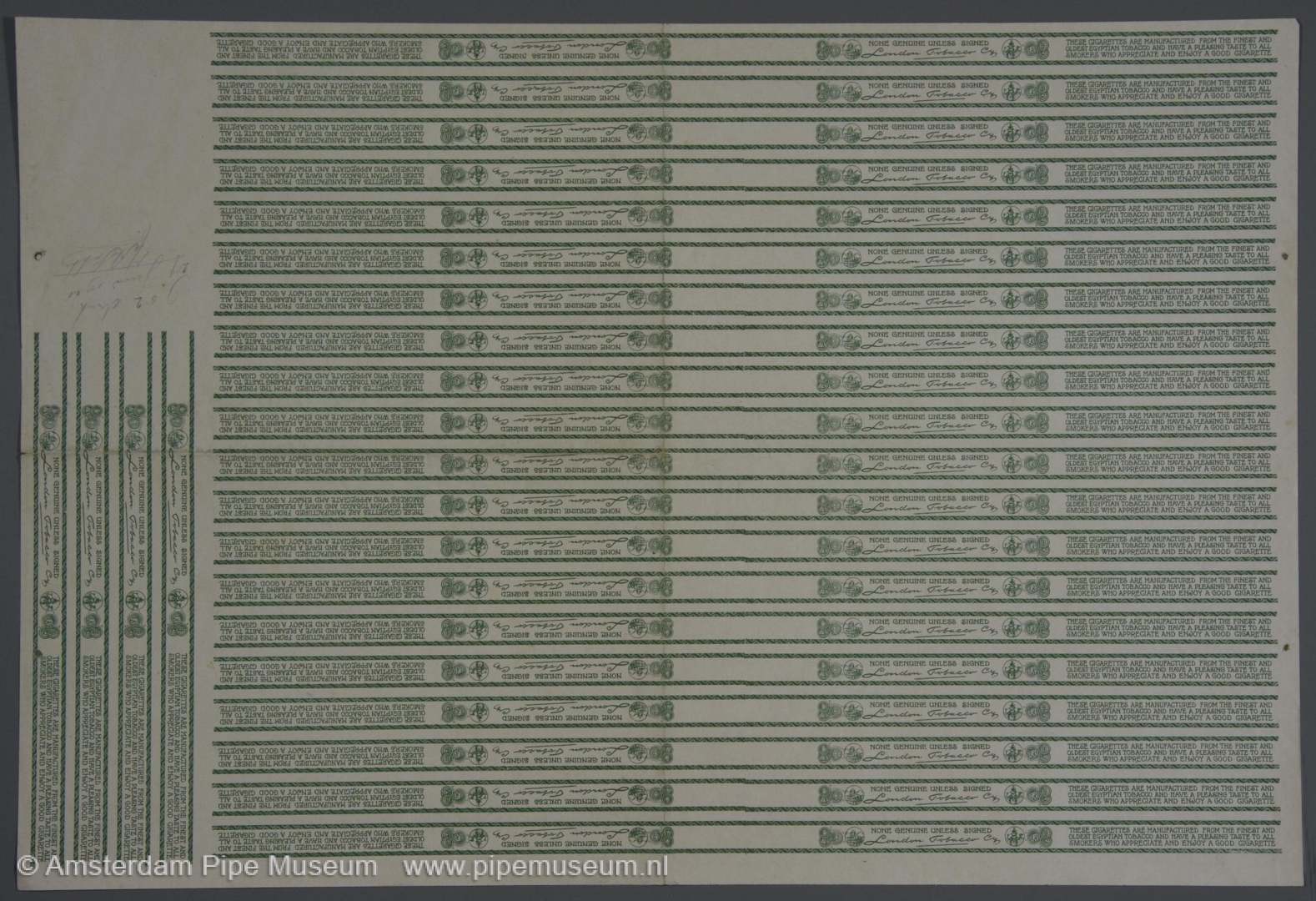

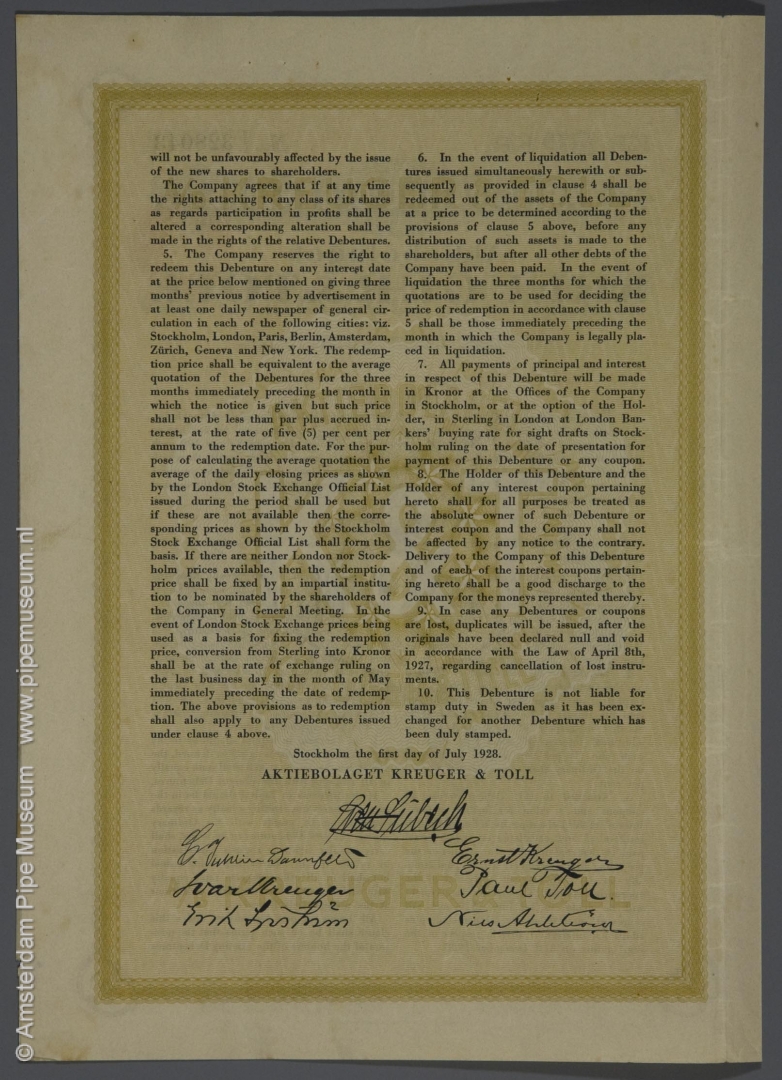

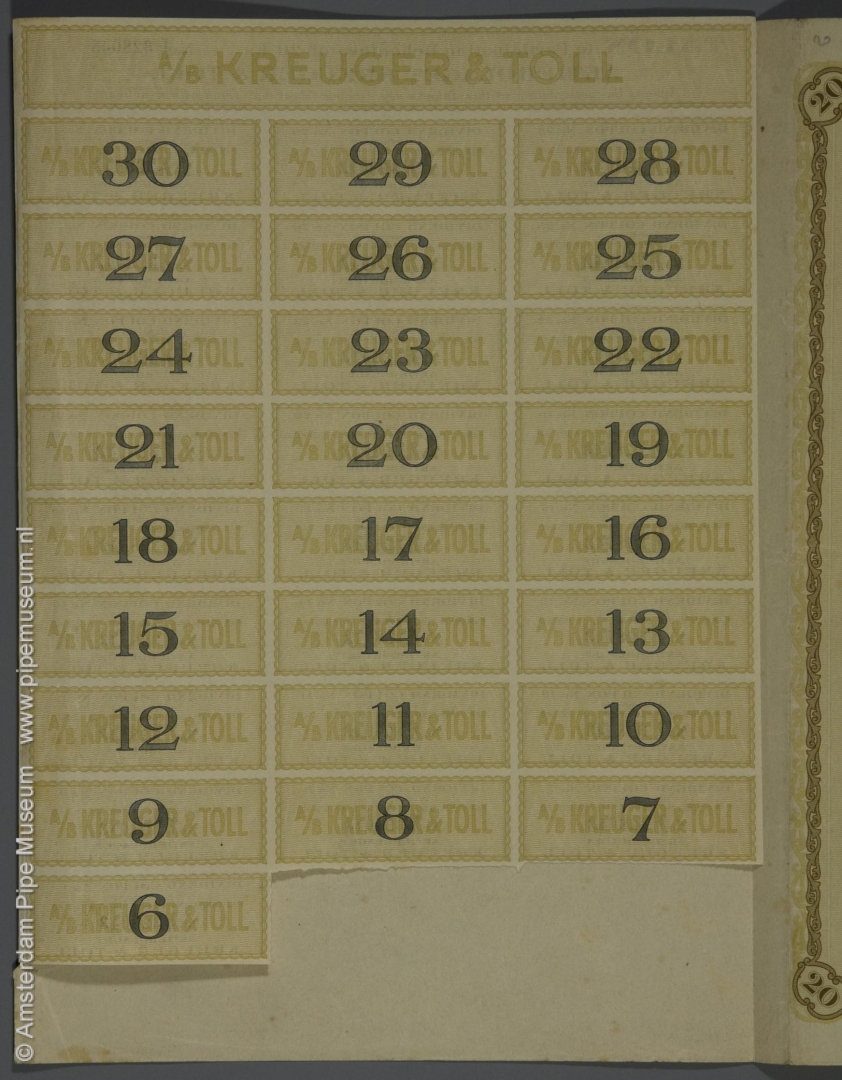

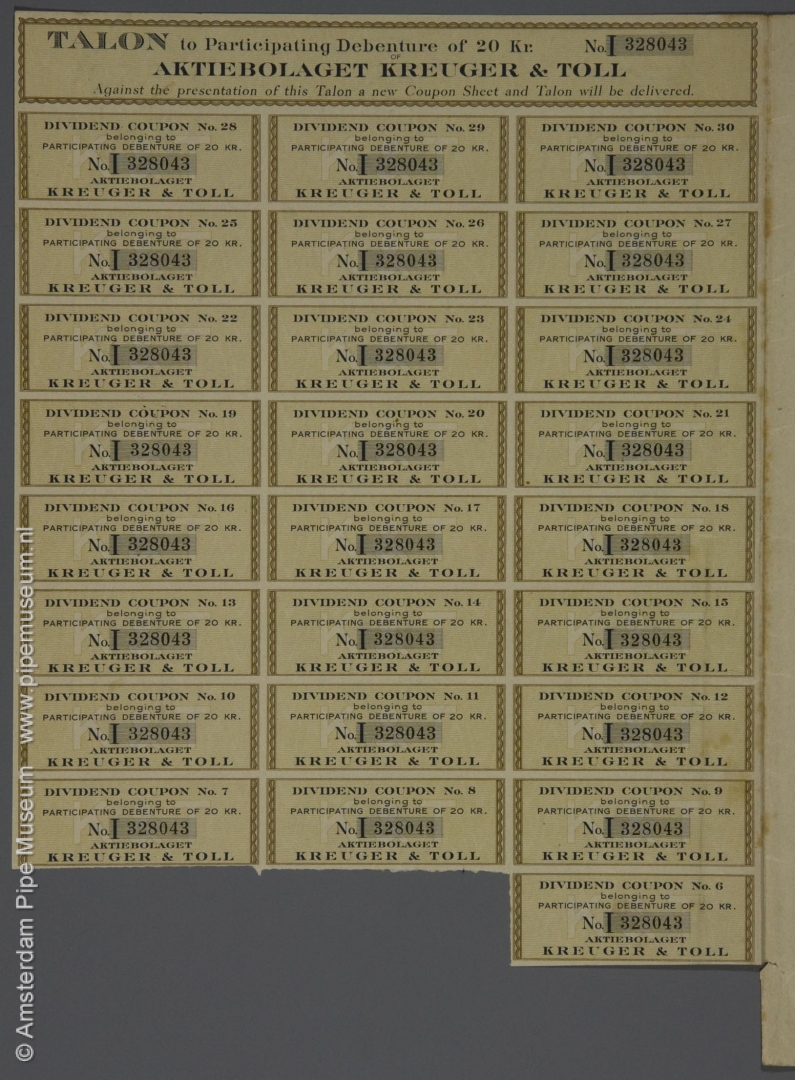

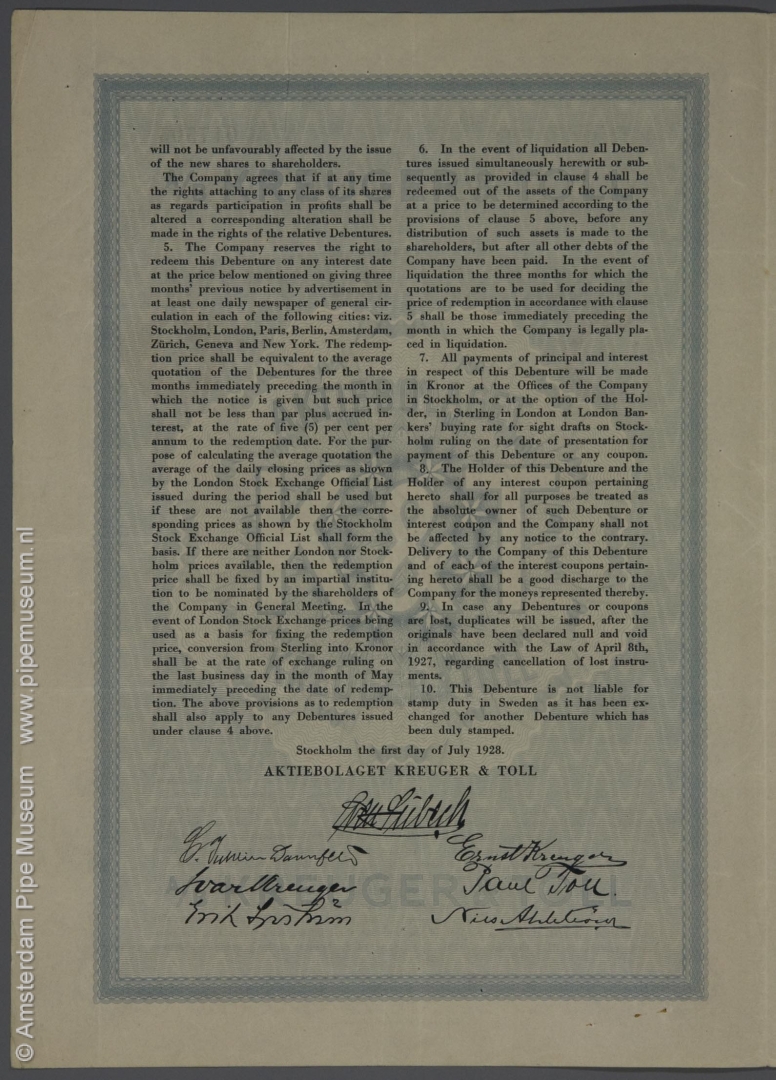

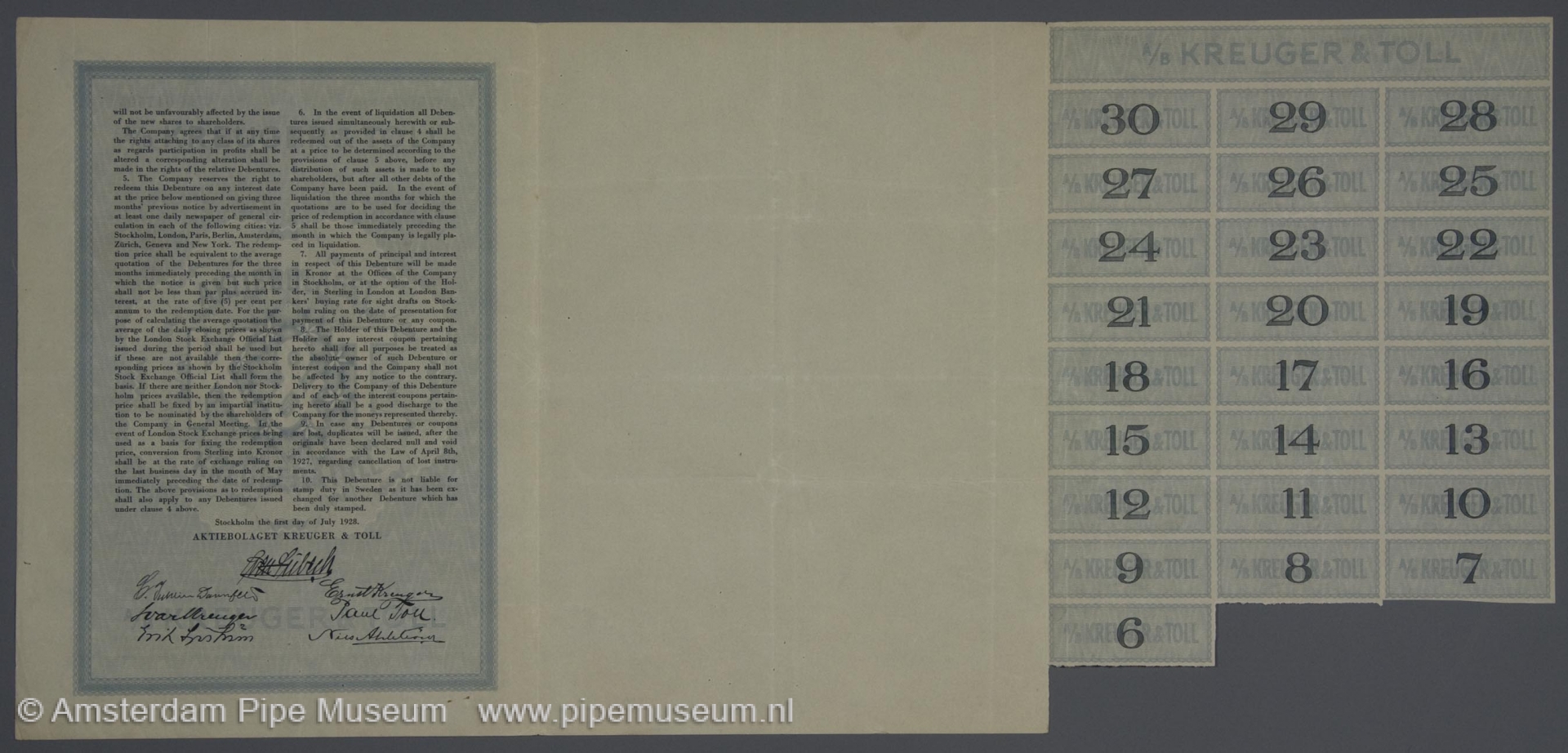

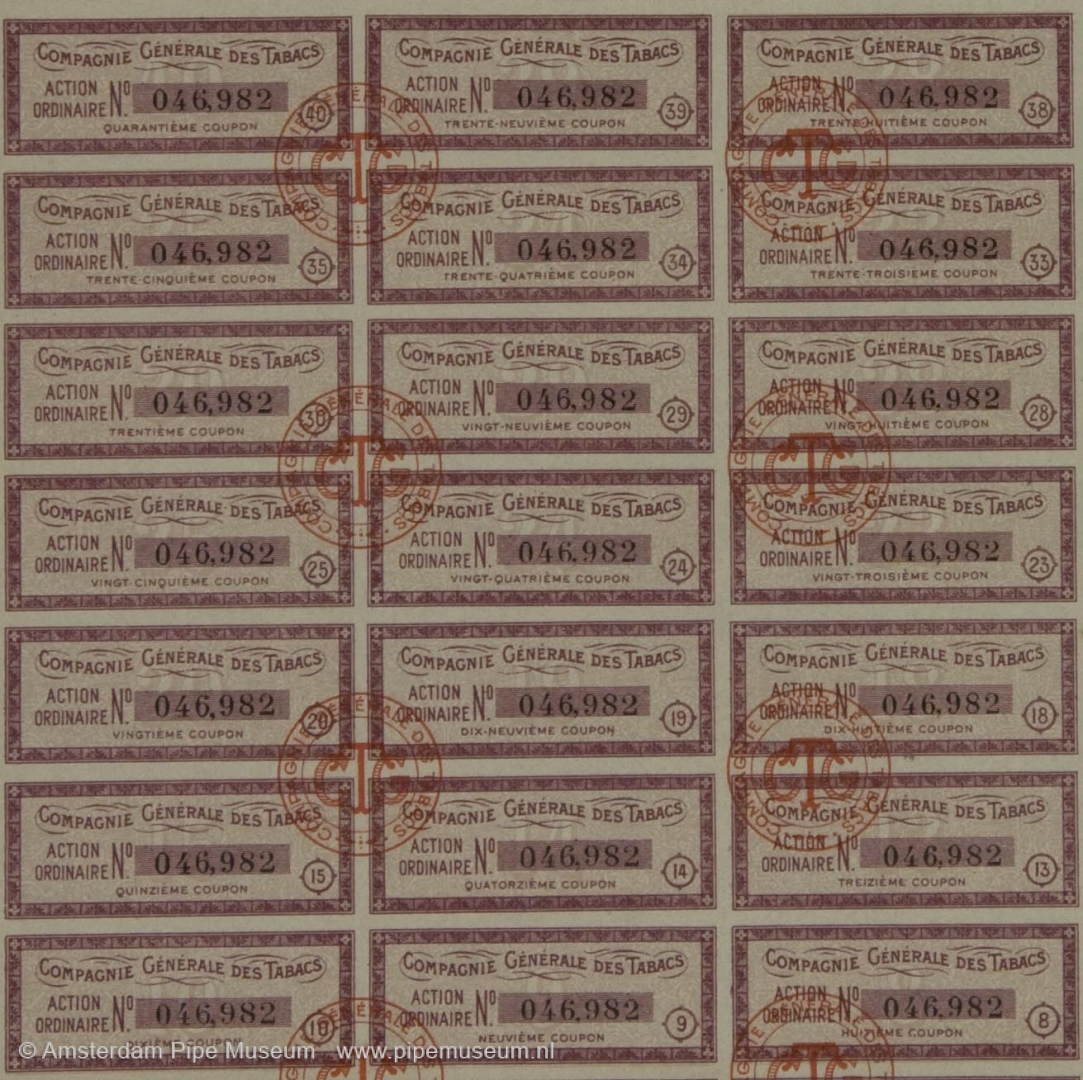

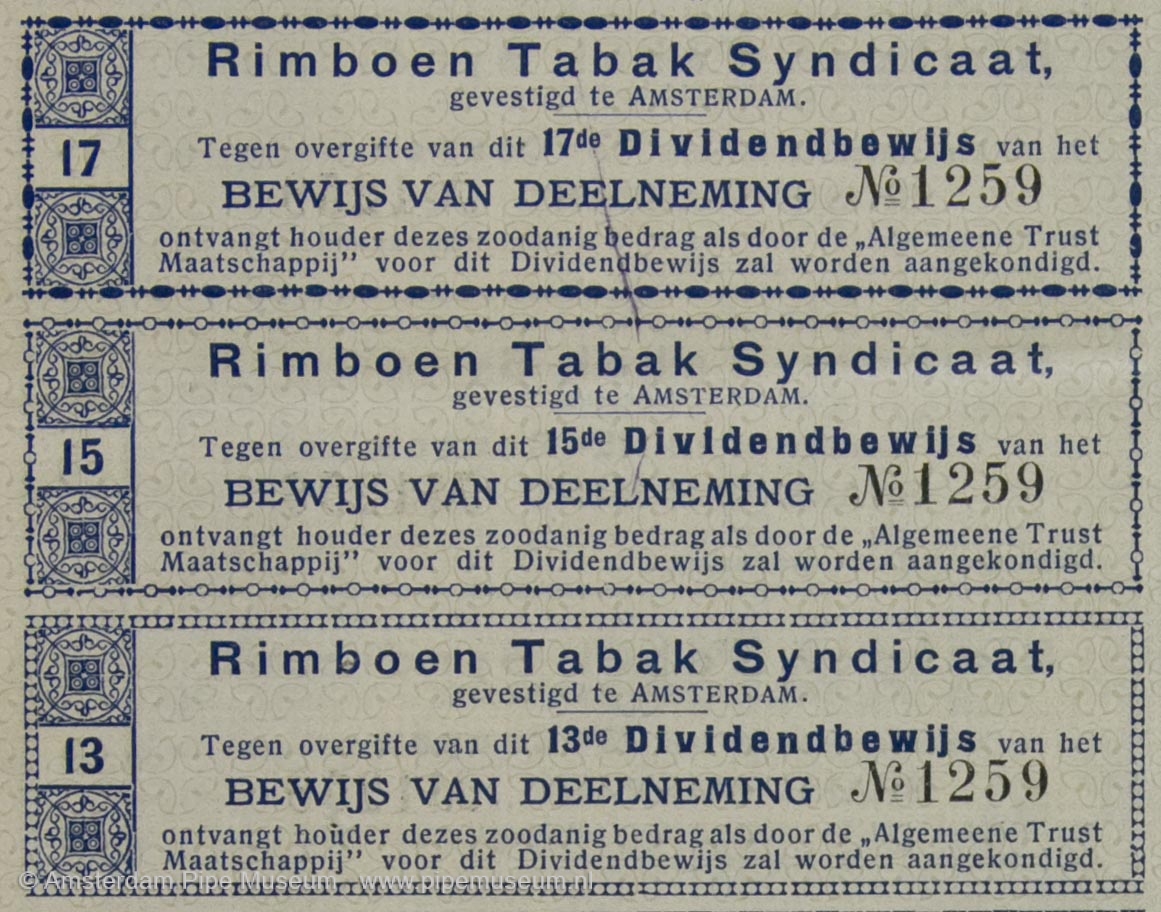

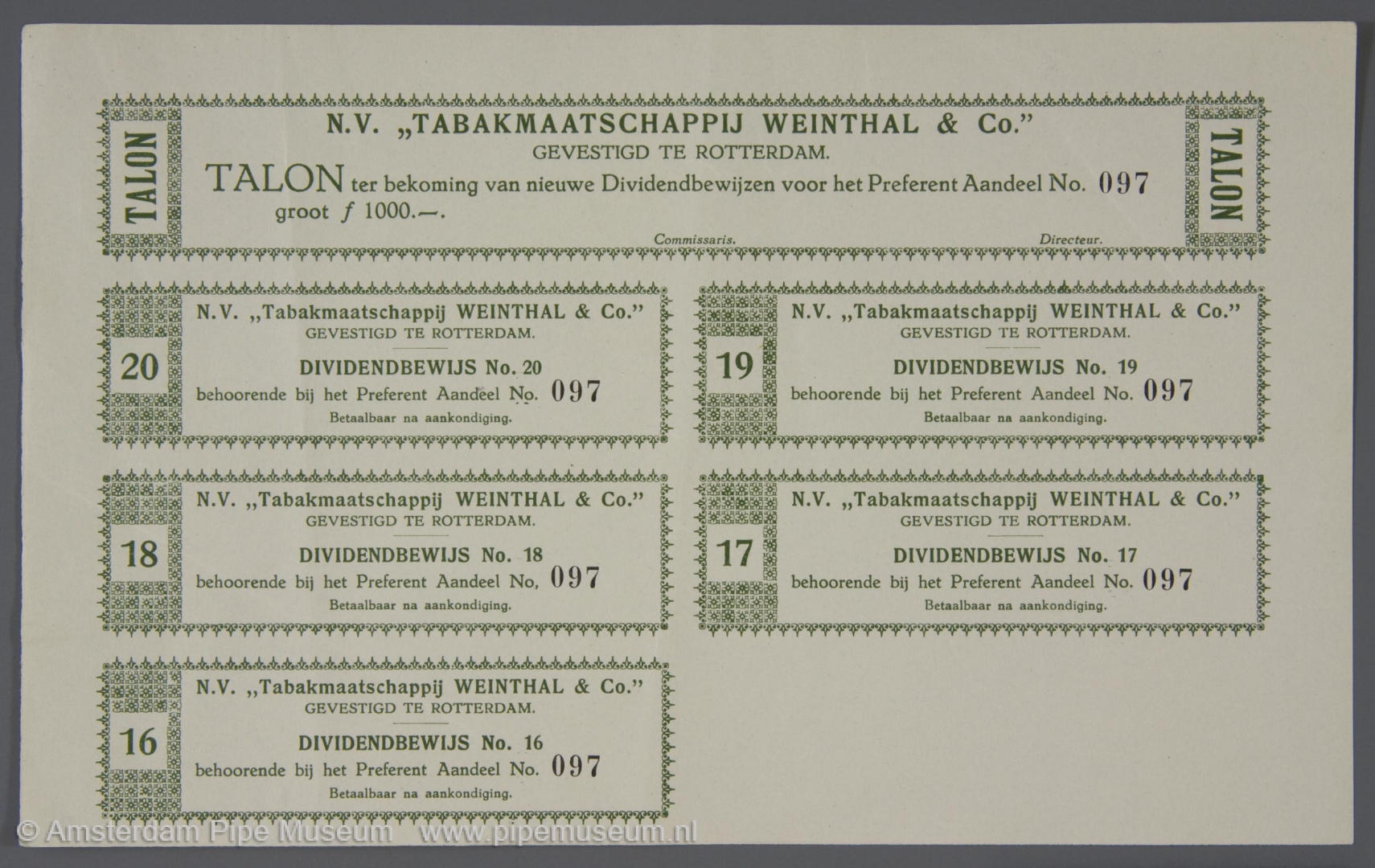

What all these securities have in common is the specific graphic design with the guilloche edges against counterfeiting. The fact that many coupons have not been collected indicates that not every investment yielded the desired result.